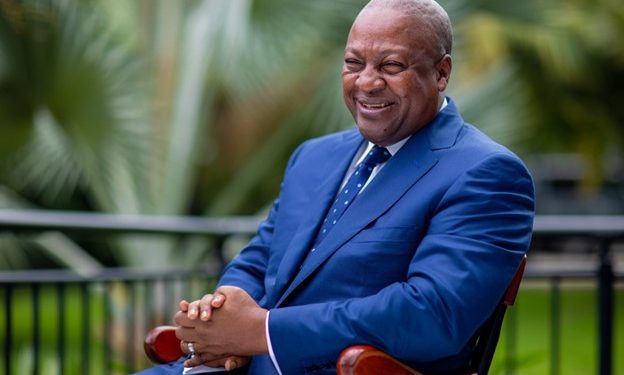

Mahama Highlights Infrastructure and Greenfield Investments as Key FDI Priorities for Ghana

These categories are of paramount importance, especially for African economies, due to the continent’s significant infrastructure deficit.

- Advertisement -

Former President John Mahama has stressed the importance of Foreign Direct Investment (FDI) for Ghana amidst the country’s current economic challenges.

With Ghana’s recent default on international debts and its temporary exclusion from international capital markets, Mr Mahama speaking at the inaugural Distinguished Speaker Series organized by the Consortium of Trade Associations on August 29, highlighted that increasing FDI inflows is crucial to maintaining robust GDP growth over the next four years.

- Advertisement -

The former president pointed out that Ghana’s immediate priorities lie in attracting FDI in two key areas: project finance, particularly for infrastructure development, and greenfield investments, which involve the establishment of new factories or businesses.

- Advertisement -

These categories are of paramount importance, especially for African economies, due to the continent’s significant infrastructure deficit.

“For Ghana, our immediate interests will be in FDI categories of project finance, particularly for infrastructure, and this is perhaps the most important for African economies due to the huge infrastructure deficit faced by the continent; and greenfield investments which involve the construction of new factories or businesses by investors from the ground up,” he remarked.

Speaking further, former president Mahama acknowledged that while Ghana cannot control external economic factors that impact FDI inflows, the country can address domestic issues that deter FDI. He identified several factors that key players in Ghana’s FDI space have noted as obstacles to investment.

The first is the proliferation of poorly coordinated and sometimes ill-conceived regulatory laws and policies, the second is the conflicting mandates of various regulatory agencies, which often lead to multiple agencies imposing overlapping requirements on businesses, creating a burdensome and confusing environment for investors.

- Advertisement -

Additionally, he highlighted the violation of contract sanctity and the protracted and inefficient processes for resolving business disputes as significant barriers to FDI. These issues, coupled with macroeconomic instability—evidenced by high inflation and an unstable currency—make it difficult for businesses to plan for the future.

Mr Mahama also criticized the punitive fiscal regime in Ghana, characterized by high tax rates and the frequent, haphazard introduction of new taxes without sufficient consideration of their impact on businesses and consumers.

Moreover, Mr Mahama pointed out that Ghana’s logistics network is weak, with inefficient infrastructure for transportation, storage, and distribution, as well as cumbersome processes at ports, all of which negatively impact FDI inflows.

“FDI inflows to Ghana are already low in comparison to other countries at similar stages of development, and FDI inflows have stagnated or declined in recent times, a situation which may partly explain the low growth of our economy over the last decade. In 2020, for example, global FDI declined by nearly 35 percent because of the COVID-19 pandemic. However, inflows to Ghana fell by 51 percent,” he added.

Ghana must address its domestic challenges to improve its competitiveness and attract more FDI which is essential for its economic growth and development.

Since 1990, foreign investors have injected approximately $47.2 billion into Ghana’s economy, making it a notable destination for FDI in the West African sub-region.

Source:norvanreports.com

- Advertisement -