Kenya Struggles to Stabilize Public Finances After Tax Protests

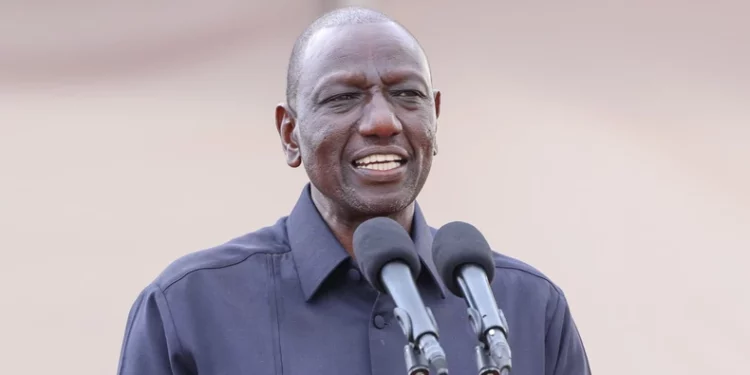

The revision comes after deadly anti-government protests forced President William Ruto’s administration to withdraw contentious tax measures that would have raised about $2.7 billion shillings of revenue for the East African economy.

- Advertisement -

Kenya widened its estimated budget gap by 28% just two months into the fiscal year as the finance ministry struggles to stabilize its strained public finances, Treasury Secretary John Mbadi said.

The National Treasury forecasts a budget deficit of 767 billion shillings ($5.95 billion) in the year through June 2025, Mbadi told the government’s accounting officers at an event in the capital, Nairobi, on Monday that marked the start of the budget-preparation process.

- Advertisement -

The revision comes after deadly anti-government protests forced President William Ruto’s administration to withdraw contentious tax measures that would have raised about $2.7 billion shillings of revenue for the East African economy.

- Advertisement -

“The government is operating under a constrained fiscal environment,” said Mbadi, who took over as head of the Treasury last month after Ruto reorganized his cabinet to include members of the opposition. “We are barely managing the 2024-25 budget.”

Kenya’s government has been under pressure to shore up tax collection and slash borrowing under a $3.6 billion funding program first agreed with the International Monetary Fund in 2021 to address the nation’s debt vulnerabilities.

It has since updated its budget-deficit forecast several times. Initially, the Treasury said the shortfall would narrow to 3.3% of gross domestic product, and made a number of subsequent changes before finally raising the projection to 4.3% of GDP on Monday.

- Advertisement -

Fiscal Strain

Kenya’s public finances are under strain because revenue collection has underperformed, debt and loan repayments are piling up, while pending bills and expenditure carryovers from the previous fiscal year are exerting pressure on limited resources, Mbadi said.

He warned there’s a risk that Kenya’s regional administrations may “grind to a halt” after the central government failed to remit any funding to the nation’s 47 counties so far this fiscal year.

Adding to the strain on the fiscus, Kenyan courts are holding hearings on the legality of a different set of taxes that places another $1.7 billion of tax income in jeopardy.

The government is refining some of the less contentious tax measures it was forced to abandon and will reintroduce them, Mbadi said last month.

The three major credit-rating companies lowered their assessment of Kenya’s debt deeper into junk territory this year because of the government’s dwindling capacity to raise revenue.

Source:norvanreports.com

- Advertisement -