World Gold Demand Tops $100 Billion as Western Investors Charge In

Purchases in the opaque over-the-counter market were becoming an increasingly important force for prices, according to John Reade, the council’s chief market strategist.

- Advertisement -

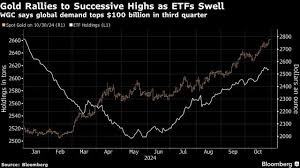

Global gold demand swelled about 5% in the third quarter, setting a record for the period and lifting consumption above $100 billion for the first time, according to the World Gold Council.

The increase — which saw volumes climb to 1,313 tons — was underpinned by stronger investment flows from the West, including more high-net-worth individuals, that helped offset waning appetite from Asia, the industry-funded group said in a report on Wednesday. Buying in bullion-backed exchange-traded funds flipped to gains in the quarter after prolonged outflows.

- Advertisement -

Gold has stormed higher this year, rallying by more than a third and setting successive records. The jump has been driven by robust central-bank buying and increased demand from wealthy investors, with recent gains aided by the Federal Reserve’s shift to cutting interest rates. Purchases in the opaque over-the-counter market were becoming an increasingly important force for prices, according to John Reade, the council’s chief market strategist.

- Advertisement -

“Demand has switched through the course of this year from predominantly emerging-market OTC buying — high-net-worth individuals — toward very much more Western OTC buying,” Reade said. OTC transactions are done through dealers or between buyers and sellers directly, without an exchange.

Gold — which set a record above $2,782 an ounce in Wednesday’s trading — has registered gains every month this year, apart from a minor pullback in January, and in June, when prices were flat. “The fact that corrections have been very shallow and short is a keen indication of FOMO buying,” Reade said in an interview, referring to investors’ so-called fear of missing out.

- Advertisement -

As the rate-cutting cycle gets underway, the WGC expects to see increased allocation to bullion, with geopolitical uncertainty — particularly surrounding next week’s tight US presidential election — adding to reasons why investors are seeking to hold the haven asset.

Investment flows were key to the metal’s 13% gain in the third quarter, with total demand for ETFs, bars and coins reaching the strongest levels since Russia’s invasion of Ukraine in 2022. Central-bank purchases continued — with Poland, Hungary and India among the top buyers — even as the pace of official activity slowed. Jewelry demand fell as record prices hurt consumption.

Looking ahead, fiscal concerns — especially about swelling levels of government debt in the US — may become more pronounced as a driver, according to Reade.

There are concerns, including from the International Monetary Fund, “saying the deficit’s too big and really needs to be sorted out,” Reade said. “That’s the primary attraction from the OTC community to increase their gold holdings.”

Source:norvanreports.com

- Advertisement -