Ghana-IMF Bailout: 7 reasons why Ghana should have gone for a Fund programme a year ago

With its engagements with the IMF, government is seeking a Balance of Payment (BoP) support programme from the Bretton Wood Institution as part of a broader effort to quicken Ghana’s build back in the face of the challenges induced by the Covid pandemic and recently, the Russia-Ukraine war.

- Advertisement -

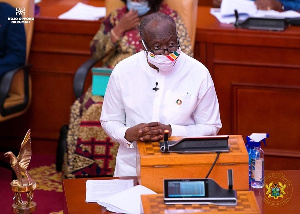

The Finance Minister, Ken Ofori-Atta, on President Akufo-Addo’s instructions has commenced engagements with the International Monetary Fund (IMF) to support an economic programme put together by the government.

With its engagements with the IMF, government is seeking a Balance of Payment (BoP) support programme from the Bretton Wood Institution as part of a broader effort to quicken Ghana’s build back in the face of the challenges induced by the Covid pandemic and recently, the Russia-Ukraine war.

- Advertisement -

Balance of Payment assistance takes the form of medium term loans that are conditional on the implementation of polices designed to address underlying economic problems.

- Advertisement -

The decision by the government and as contained in a press statement issued by the Ministry of Information on July 1, 2022, follows months of government’s insistence not to seek help from the Bretton Wood Institution despite the precarious state of the Ghanaian economy.

Unsustainable and ballooning public debt, increasing fiscal deficits, increasing portion of revenues being used for interest payments and compensation despite stagnant tax revenue, rapid depreciation of the value of the cedi, falling international reserves, among others are among the things that called for the need for the country to approach the IMF for a programme.

For former Deputy Minister for Finance, Cassiel Ato Forson, government should have approached the IMF for a Fund supported programme a year ago.

Taking to his Facebook page, the former Deputy Finance Minister, listed seven (7) reasons why the President should have taken this decision a year ago.

“This IMF Decision should have been taken 12 months ago for the following reasons:

- Our public debt was scary 12 months ago but is it NOW in a precarious state and we may default.

- Inflation was not in such a terrible state 12 months ago

- Monetary policy rate was NOT this high 12 months ago.

- Advertisement -

- Ghana’s credit rating was NOT in the junk range then.

- The balance of payment DEFICIT in Q1 2021 was about $430m, 12 months later it is about $1bn.

- Investor confidence was wavering 12 months ago but now it is at its lowest.

- Our fiscal framework though terrible 12 months ago, is NOW in a horrible state.

“Remember, the IMF DOES NOT lend to countries with UNSUSTAINABLE DEBT, that alone means a lot for Ghana

“The key difference between the 2015 IMF programme and the likely 2022 IMF programme will be our dangerous and unsustainable public debt situation, which was accumulated due to the NPP’s reckless borrowing for consumption!

“Fiscal consolidation alone won’t work for Ghana, we need more!,” he stated.

Ending his Facebook post, Mr Ato Forson noted engagements between government and the IMF is likely to be protracted possibly taking a year for both parties to come to an agreement on the programme and amount of funds to be made available to the country.

This, he asserts, is because of the bad state of the economy

- Advertisement -