GCB Capital Research highlights hurdles in MoU talks with OCC for Ghana’s $600m second tranche

With the clock ticking, the government of Ghana finds itself racing against time to secure an agreement that not only unlocks the second disbursement under the IMF program but also addresses crucial economic imperatives.

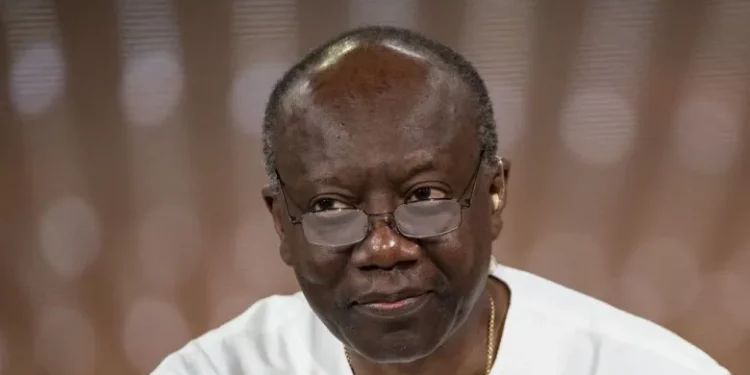

As Ghana aims to swiftly finalize the Memorandum of Understanding (MOU) with Official Creditors, the Finance Minister faces a tight deadline to complete the first review of the country’s 3-year program at the IMF Board level.

According to GCB Capital Research, two prominent issues emerge as significant hurdles in reaching an agreement.

- Advertisement -

First, is the determination of the “cut-off date” for eligible debts, and second, is the complex “comparability of treatment” clause within the Common Framework.

- Advertisement -

Ghana needs to reach a restructuring deal with its official creditors to secure the International Monetary Fund executive board’s approval for the next $600 million payout from the $3 billion rescue loan.

Official creditors, who hold about $5.4 billion of Ghana’s $20 billion external debt that is being restructured, were considering dates in March 2020 and December 2022 as possible cut-off dates.

While Dec. 31, 2022 is close to when Ghana defaulted, March 24, 2020 was being considered as a cut-off date because that was when the G20 introduced its debt service suspension initiative (DSSI) to help the world’s poorest countries cope with the fallout of the COVID-19 crisis.

- Advertisement -

While Ghana expresses willingness to accept any proposed cut-off date, contention looms over the suggested 30% to 40% haircut for commercial creditors.

Commercial creditors are anticipated to resist the proposed principal haircut, potentially jeopardizing the smooth progress of the debt negotiation.

Compromises on the part of the Government could also risk falling short of the ambitious targets outlined in the IMF programme.

The urgency to establish clear parameters for external debt treatment is paramount, as it directly impacts macroeconomic stability, fiscal and debt sustainability, and market access.

With the clock ticking, the government of Ghana finds itself racing against time to secure an agreement that not only unlocks the second disbursement under the IMF program but also addresses crucial economic imperatives.

Source:norvanreports

- Advertisement -