Housing affordability remains stretched amid higher interest rate environment

If the Fed starts rate cuts this year, as policymakers and market participants project, mortgage rates will continue to adjust, and pent-up housing demand could be unleashed.

- Advertisement -

As global central banks raised interest rates to tame inflation, home prices have cooled relative to the start of the hiking cycle. However, despite the sensitivity of the residential market to higher policy rates, prices are still above historical averages. Home prices in advanced economies, including most European Union countries, as well as Africa and the Middle East are 10 percent to 25 percent higher than pre-pandemic levels.

Rising interest rates have passed swiftly to residential mortgage markets, impeding affordability for current and prospective home buyers. Additionally, scarce home supply is limiting purchases in some regions. In all, housing affordability is more stretched amid still-elevated home prices and higher interest rates.

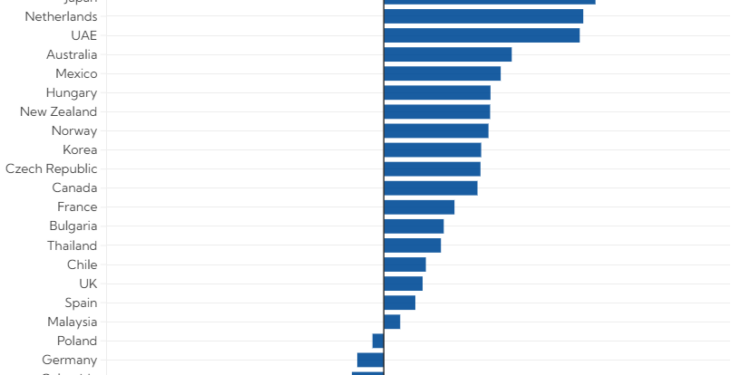

In the first half of 2023, mortgage rates in advanced economies climbed by more than 2 percentage points compared to the previous year. During this period, countries like Australia, Canada and New Zealand witnessed substantial declines in real house prices, likely due to a high share of adjustable-rate mortgages and home prices that have been stretched since before the pandemic. Comparatively, home prices have fallen more than 15 percent in some advanced economies while the drop in emerging economies was less significant. But, on net, real house prices will need to keep cooling from the 2021 and 2022 highs compared to reach pre-pandemic levels.

Higher borrowing costs are likely to see the largest impact on household debt service ratios—a measure of borrowers’ loan repayment ability—in countries where housing markets remain overvalued and average lifespans for mortgage loans are shorter, according to our latest Global Financial Stability Report.

Approvals and repayment

For instance, for some advanced economies such as Norway, Sweden, Denmark, and the Netherlands with pre-existing double-digit households’ debt service ratios, borrowers’ debt servicing costs could increase by up to 1.8 percentage points given the surge in interest rates. That would have consequences for loan approvals and borrower repayment capabilities. But borrowers are also less indebted, and underwriting standards have been strengthened since the global financial crisis, tempering the risk of a surge in loan defaults. This may have also limited instances of forced selling or foreclosures of homes, helping to support home prices.

In the United States, the Federal Reserve’s interest rate hikes brought big changes to the mortgage loan market, with the average rate on a 30-year fixed mortgage recently reaching a two-decade high of 7.8 percent. For prospective buyers, entry costs are putting homeownership further out of reach as the required down payments have also become a prohibitive factor because savings have shrunk since the pandemic.

Existing homeowners, deterred from purchasing new properties due to larger monthly mortgage payments, stay put causing a reduction in supply of existing homes. This phenomenon, known as “lock-in” effect, is particularly evident in the United States, where long-tenured fixed-rate mortgages are most popular. With average 30-year mortgage rates currently at 6.6 percent, around 3 percentage points above pandemic lows, mortgage originations remain 18 percent below last year’s levels while refinancing applications increased 8.5 percent over the year as mortgage rates continued to ease.

Rates and refinancing

The 30-year fixed-rate mortgages accounted for 90 percent of new US home loans at the end of last year, according to ICE Mortgage Technology. Almost two-fifths of all US mortgages were originated in 2020 or 2021, ICE data show, as the low interest rates during the pandemic allowed many Americans to refinance their home loans.

Higher interest rates also raise rental costs. Many people prefer to rent instead of buying given median house prices have been slow to adjust. In this context, the combination of higher rates and still-scarce housing supply creates a vicious circle that complicates central banks’ fight against inflation. US monthly home prices continued to rise in October compared with a year ago, with shelter contributing to one-third of the change of consumer prices in November.

If the Fed starts rate cuts this year, as policymakers and market participants project, mortgage rates will continue to adjust, and pent-up housing demand could be unleashed. A sudden increase, as the result of rapid rate cuts, could offset any improvements in housing supply, causing prices to rebound.

- Advertisement -