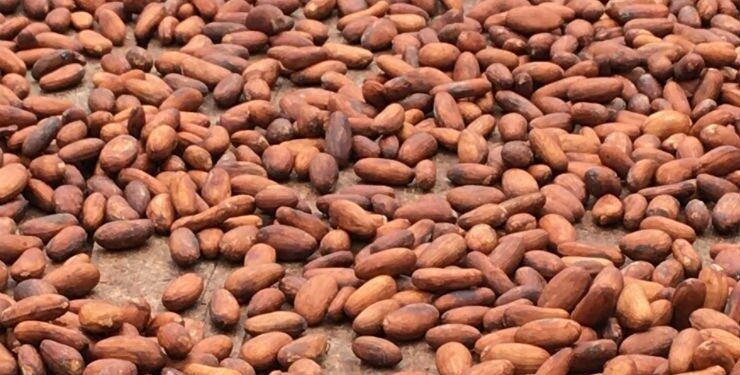

Ghana and Cote d’Ivoire look to reshape the world’s cocoa industry as Africa holds more than 75% of global production

“While the alliance has yielded positive outcomes, ongoing challenges such as global competition and the need for plantation renewal necessitate continued focus and adaptation to secure the future of cocoa production in both nations,” he said.

- Advertisement -

Ghana and Cote d’Ivoire, the world’s leading cocoa producers and age-old rivals, are collaborating to tackle challenges in the cocoa industry. According to an expert, the alliance could revitalize the sector in Africa.

Bonface Orucho, bird story agency

- Advertisement -

Ghanaian cocoa supply chain expert and co-founder, Gazali Halidu, believes a new alliance between Africa’s two biggest cocoa producers “holds the potential to transform the cocoa sector.”

- Advertisement -

“It has the potential to address revenue imbalances, support farmer livelihoods, and promote sustainable practices,” Halidu shared in an interview with bird story agency.

The alliance between Cote d’Ivoire and Ghana, the world’s top two producers of cocoa, comes as a sharp decline in production volumes and a deterioration of producer prices hits the market.

The countries recently commissioned the Cote d’Ivore-Ghana Cocoa Initiative (CGCI) Secretariat building in Accra as the two countries to explore a collaborative approach to address cocoa challenges.

“We are, through this cooperation, creating the opportunity to revolutionize the cocoa supply chain for the delivery of greater value to our economies,” explained Ghanaian President Akuffo-Addo during a commissioning event on April 17.

According to the International Cocoa Organization, the neighbouring countries produce up to 60% of the world’s cocoa and, together with Nigeria and Cameroon, more than 75% of the world’s annual cocoa crop.

However, the sector faces headwinds characterised by a sharp drop in volumes in the past decade and a slump in prices.

<script src=”https://bird.africanofilter.org/hits/counter.js” id=”bird-counter” data-counter=”https://bird.africanofilter.org/hits/story?id=1694&slug=ghana-and-cote-d-ivoire-look-to-reshape-the-world-s-cocoa-industry-africa-holds-more-than-75-of-global-production” type=”text/javascript” async=”async”></script>

According to the International Cocoa Organization’s March 2024 report, cocoa shipments at Ivorian and Ghanaian ports have dropped by 28% and 35%, respectively, compared to the previous year.

- Advertisement -

Projections paint a bleak picture for the future. The Ghana Cocoa Board’s (COCOBOD) 2024 production outlook shows that the country’s 2023–2024 harvest will reach a maximum of 425,000 metric tons, a 22-year low.

In Cote d’Ivoire, the cocoa authority recently forecast a 33% decrease in the mid-crop cocoa harvest, expecting a yield of 400,000 metric tonnes compared to last year’s 600,000 metric tonnes. This mid-crop season, kicking off in April represents the smaller of the two annual harvests.

According to Halidu, attracting younger workers to cocoa cultivation is essential as the cocoa sector faces labour shortages due to an ageing farmer population in both countries.

“Addressing this involves attracting younger workers into cocoa cultivation, which could also help mitigate the high unemployment rates in both countries.”

Halidu believes the alliance between the nations, born in 2018 with the signing of the Abidjan Declaration, holds the key to change.

A key measure is the “decent income differential” (DID), which adds US$400 per ton to premium cocoa prices. This move is integral to their broader strategy of setting a minimum floor price of US$2,600 per ton, ensuring fair compensation for cocoa and compelling chocolate companies to meet these standards to access their markets.

“This approach has not only held firm but also strengthened over time, enhancing the preference for beans from Côte d’Ivoire and Ghana over those from other producers like Cameroon and Nigeria,” Halidu explains.

Also, sustainability concerns have been addressed in the new alliance, especially after the EU, one of the largest markets for African coffee, passed the Sustainable Cocoa Initiative in 2020, aiming for the economic, social, and environmental sustainability of cocoa production and trade.

The Cocoa Initiative’s management body has initiated certification bodies, cooperatives, bean buyers, and other key stakeholders in both countries, matching the EU’s initiative. However, continued adaptation of the West African cocoa industry to the changing global environment is essential, according to Halidu.

“While the alliance has yielded positive outcomes, ongoing challenges such as global competition and the need for plantation renewal necessitate continued focus and adaptation to secure the future of cocoa production in both nations,” he said.

bird story agency

- Advertisement -