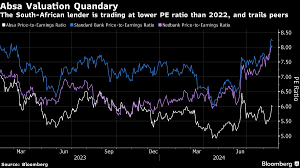

Absa Group Lags Peers as Leadership Turmoil Weighs on Stock

The JSE’s banking index has surged 19% year-to-date, with Capitec Bank Holdings Ltd. climbing 43% and Nedbank Group Ltd. rising 37%. In contrast, Absa only erased its year-to-date losses this week, posting a modest 0.8% gain in 2024.

- Advertisement -

Absa Group Ltd. is the worst-performing South African bank stock this year, lagging a strong rally in its peers as the lender struggles with leadership instability

The JSE’s banking index has surged 19% year-to-date, with Capitec Bank Holdings Ltd. climbing 43% and Nedbank Group Ltd. rising 37%. In contrast, Absa only erased its year-to-date losses this week, posting a modest 0.8% gain in 2024.

- Advertisement -

Earlier this week, Absa Charles Russon will become Absa’s sixth CEO in five years on Oct. 15, following Arrie Rautenbach’s decision to take early retirement. Russon will serve as interim CEO.

- Advertisement -

“We believe the frequent board and CEO changes, with multiple interim designations, have limited Absa’s ability to develop and implement a consistent strategy,” said Adrienne Damant, an analyst at Avior Capital Markets Pty Ltd. “Until Absa’s executive team stabilizes, we believe Absa will trade at a discount.”

- Advertisement -

While the bank’s share price has risen since Russon’s appointment was announced, skepticism remains about whether he can close the gap with Absa’s peers. Clawing back market share and managing bad loans will be key challenges. Absa’s credit loss ratio has exceeded the board-approved target range, whereas peers have managed credit stress more effectively, said Tasneem Samodien, a research analyst at Private Clients by Old Mutual Wealth.

“Competitors like Standard Bank and Nedbank have successfully communicated and achieved their goals to increase return on equity, whereas Absa’s performance has declined,” said Samodien. “Overall, the bank has many challenges that contribute to its lower valuation relative to peers, and we remain cautious about its outlook.”

Despite these challenges, Absa’s share price may still have room to rise. Avior has set a target price of 179 rand, 8.5% higher than Tuesday’s close of 164.85 rand. Avior maintains a sell rating on the lender, while six other analysts have a buy rating. The Bloomberg consensus 12-month target price is 190.72 rand.

Source:norvanreports.com

- Advertisement -