Are countries ready to manage revenues from transition minerals?

There are also lessons in Mongolia’s management of mineral revenues. The country has repeatedly postponed implementation of its fiscal rules and has teetered from one macroeconomic crisis to the next. Despite massive copper, coal, iron and gold revenue windfalls, the government neither saved in its Fiscal Stability Fund nor paid down its public debt during the boom years.

The global supply of minerals that are essential to cleaner energy production, transmission, and storage technologies—minerals such as lithium, cobalt, nickel, copper, rare earths and graphite—will help determine how fast the world can transition to a low-carbon future. But are countries rich in these minerals prepared to manage the revenues they earn from mining them?

Countries expecting significant transition mineral revenues must prepare

- Advertisement -

Managing extractives revenues well is key to benefiting from them. According to one estimate from GIZ and Econias Consulting, resource-rich countries as a group could stand to gain a total of $100 billion to $500 billion in additional government revenues by 2040. While unpredictable changes in technology and markets make the scale of revenues uncertain and therefore risky for countries to count on, countries must still prepare to manage revenues.

- Advertisement -

According to The Economist, Australia, Chile, China, Democratic Republic of the Congo, Indonesia and Peru stand to gain the most from transition minerals. This aligns with the GIZ/Econias analysis, which suggests that the same countries (plus Russia) will have the highest sales of energy transition minerals under the IEA’s Stated Policies (STEPS) energy transition scenario. In another group of countries and territories, the “transition minerals” mentioned above already play an important role relative to the size of economies (or are likely to do so as the energy transition progresses); these include Cuba, New Caledonia, Mongolia and Zambia.

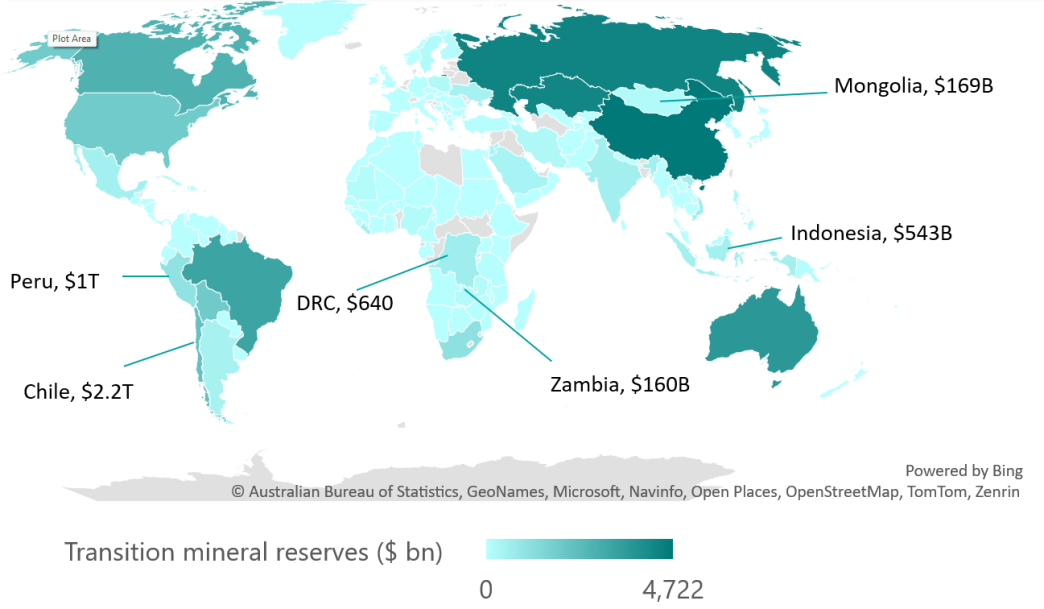

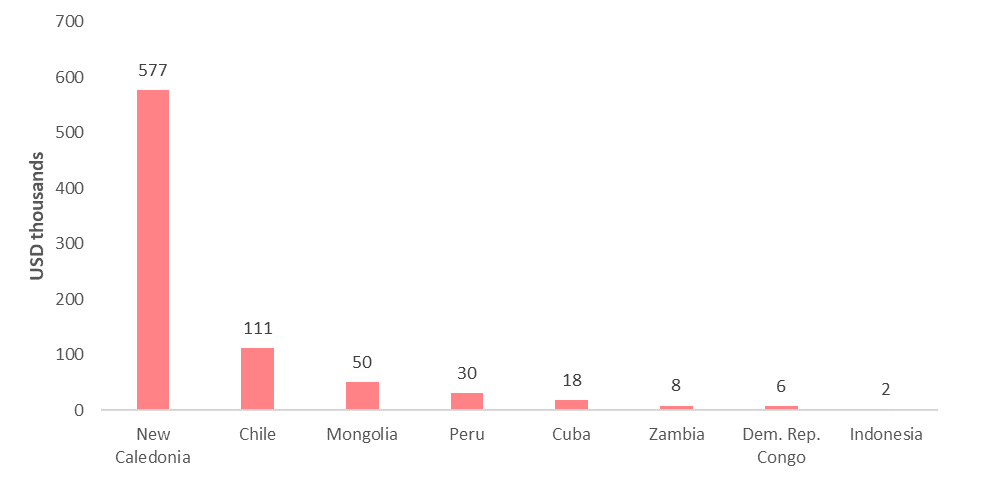

While Australia and China have large, diversified economies, in most of the other countries listed, transition minerals could provide a sizeable share of government revenue. Figures 1 and 2 below set out the value of transition minerals in selected countries, in aggregate and per capita. On average, governments tend to collect tax revenues equal to around 16 percent of the value of mineral sales revenues. So, the value of reserves gives an idea of what these reserves could mean for countries, in terms of public revenues, if the reserves were ultimately extracted.

In this post we focus on the countries and territories where transition minerals could provide a sizeable share of government revenue, and the challenges that they may face in managing transition mineral revenues based on their current track records of mining revenue management.

Figure 1. Estimated value of transition mineral reserves, selected countries

Source: S&P Capital IQ Pro. Figures are based on most recent available data on 20 September 2023. In this figure, we include reserves of antimony, bauxite, chromite, cobalt, copper, graphite, iron ore, lanthanides, lead, lithium, manganese, molybdenum, nickel, niobium, phosphate, platinum scandium, silver, tantalum, tin, titanium, tungsten, vanadium, yttrium, zinc and zircon. We are restricted in the minerals which we can include by the data available via S&P.

Figure 2. Estimated transition mineral reserves value per capita, selected countries, USD thousands

Source: S&P Capital IQ Pro. Figures are based on most recent available data on 20 September 2023. Includes the same minerals as figure 1.

Transition mineral revenues may be short-lived and volatile

Some of these countries or territories with smaller absolute levels of reserves—such as Cuba or New Caledonia—might only experience a decade or two of a mineral boom. Production in others may last longer, though it is unclear how long high demand for some transition minerals will last, given advances in technology. It will therefore be crucial for producers to take full advantage of their respective windfalls.

- Advertisement -

Nauru, an island nation in the South Pacific, provides a cautionary tale. Once a phosphate giant—with a GDP per capita of USD 39,000 (2023 dollars) in 1973—today Nauru is one of the world’s poorest countries. Much of the phosphate income was consumed rather than invested. Luxury goods were imported, and it was common for residents to go on shopping sprees abroad. Government hiring and salaries increased dramatically. At its peak, the Nauru Phosphate Royalties Trust had a balance of USD 1.3 billion, but eventually lost all of its assets to the state’s creditors. As the resource neared depletion in the early 1990s, Nauru began to borrow heavily to finance its fiscal deficit. The education system collapsed in the early 2000s when schools largely closed due to lack of funding; half of the schools never reopened.

Mining revenues also tend to be volatile. Conflict and natural disaster can halt production at a moment’s notice, costs of production can change from year to year, and the most important revenue determinants—prices—fluctuate unpredictably. If mineral revenues represent a significant portion of overall fiscal revenues, as is already the case in Chile, the DRC and Mongolia, volatility can negatively affect public spending decisions. Governments tend to spend on prestige items (e.g., airports, stadiums) in good times, and make harmful cuts to public services or indebt themselves in lean times. Thus, governments should smooth public spending, either through debt management or by saving in peak revenue years and drawing down on savings during tough times. Some transition minerals can have particularly volatile revenues, making it all the more important for authorities to save or invest them. For instance, over the last five years, cobalt prices were over 60 percent more volatile than those of copper. (Authors’ analysis based on S&P Capital IQ Pro. Period covered is 20 September 2018 to 19 September 2023. The measure of volatility used is the coefficient of variation.)

Countries can manage such short- and long-term booms and busts by setting clear rules for how much the government can increase spending year-on-year and by setting limits on the non-mineral fiscal deficit. In practice, this implies controlling public debt or saving some money in a special fund, though only in higher-income and lower debt environments. Escape clauses—like in Peru’s Fiscal Prudence and Transparency Law—can allow governments to increase spending in times of crisis. Countries where such minerals play a significant role should use revenues to diversify their economies so that they don’t suffer declines after the resources run out (as happened in Nauru) or demand declines.

Investing resource revenues back into transition mineral extraction, as Ghana has recently proposed, may not achieve diversification, unless it can provide a springboard to the development of other economic sectors. These principles apply equally to the management of revenues from non-transition minerals; but many of the countries about to experience transition mineral revenue booms have little experience or success in managing significant resource revenues and are therefore at greater risk of mismanaging their windfalls.

Many countries must bolster their systems for managing mineral revenues

Historically, Chile has managed its resource windfalls relatively well, thanks to a counter-cyclical fiscal rule for managing revenues from copper that enjoys multiparty and popular support. The rule reduces the impact of mineral price volatility on the economy, keeps public debt levels low, and generates some fiscal savings for the future. It also allows for adjustments depending on economic circumstances which can help avoid such rules being abandoned in economically difficult times. There is currently a discussion as to how to manage the country’s revenues from lithium.

Copper and gold mine in Chile’s Region del Maule • Jose Luis Stephens via Shutterstock

Unfortunately, some countries’ mineral revenue management does not meet the standard set by Chile. For example, in NRGI’s 2021 Resource Governance Index, revenue management was rated as “good” in only 3 of 13 national mining sectors assessed.

For example, the DRC’s mineral revenues—USD 1.4 billion in 2021, or 29 percent of government revenues—are largely channeled to government salaries and politically-motivated projects. A recent IMF assessment of the public investment management system concluded that, “[P]ublic investment management in the DRC suffers from weaknesses all along the project cycle, both on paper…and in practice.” The DRC has no fiscal rules to manage volatility and no holistic medium-term costed national development plan to guide public spending. At the subnational level, significant amounts of revenue go to subnational governments that have neither the technical nor the financial capacity to effectively manage these revenues.

DRC’s neighbor, Zambia, also faces challenges with critical minerals. Although it has had some success in marketing itself as a source of critical minerals, the country faces another debt crisis. Despite being heavily dependent on volatile copper revenues, authorities have never implemented a counter-cyclical fiscal rule to manage boom-bust cycles nor increased public spending sustainably. Instead, the government has made a series of medium-term commitments, most recently to run a primary fiscal surplus of 3.2 percent by 2024 to be enforced by an IMF program.

There are also lessons in Mongolia’s management of mineral revenues. The country has repeatedly postponed implementation of its fiscal rules and has teetered from one macroeconomic crisis to the next. Despite massive copper, coal, iron and gold revenue windfalls, the government neither saved in its Fiscal Stability Fund nor paid down its public debt during the boom years. Today, the country is at high risk of debt distress, giving the government little room to expand investment in public services or provide support during future crises.

Increased interest in transition minerals in other countries raises concerns about whether governments are prepared to benefit from these minerals and manage the resulting revenues. Several of the countries where exploration or production is ongoing lack some, or any, of the elements of an effective extractives revenue management framework. Yet good practices from Botswana, Chile, Peru and other countries that have done better in managing mining revenues provide inspiration upon which countries can draw.

- Advertisement -