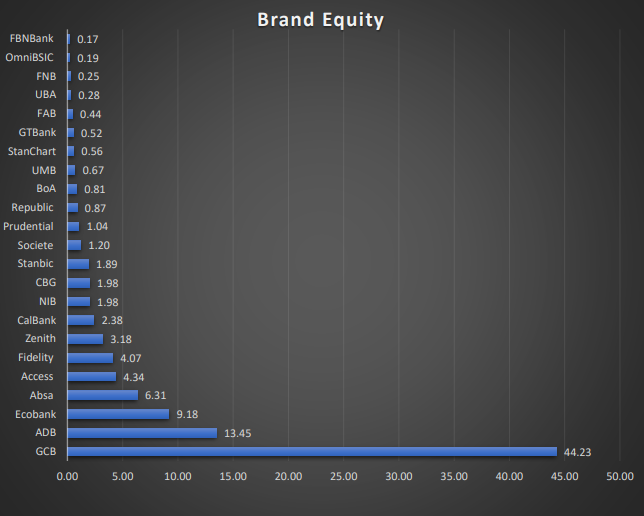

Banking Brand Health: GCB leads peers in brand equity metric

The bank, per Global InfoAnalytics Q2 2022 Banking Sector Brand Health Check report recorded a brand equity score of 44.23%.

- Advertisement -

GCB has been adjudged the bank with the highest brand equity in Ghana by research firm, Global InfoAnalytics.

GCB became the third bank in the country to clinch the top spot in Q3 2021 after Fidelity Bank and Ecobank in the first and second quarters respectively.

- Advertisement -

Since then, GCB has dominated and led its peers in the key brand metric.

- Advertisement -

The bank, per Global InfoAnalytics Q2 2022 Banking Sector Brand Health Check report recorded a brand equity score of 44.23%.

In second, third and fourth places are ADB, Ecobank and Absa Bank with brand equity scores of 13.45%, 9.18% and 6.31% respectively.

Banks with the least brand equity per the report are FBN Bank, Omnibsic, and FNB Bank with scores of 0.17%, 0.19% and 0.25% respectively.

According to Global InfoAnalytics, brand equity describes the level of sway a brand name has in the minds of consumers.

It asserts that organizations establish brand equity by creating positive experiences that entice consumers to continue purchasing from them over competitors who make similar products.

- Advertisement -

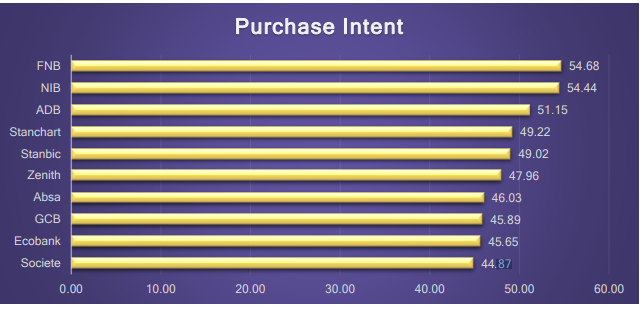

Meanwhile, First National Bank Ghana, despite having one of the lowest brand equity scores, was adjudged as the bank with the highest purchase intent score for the first half of 2022.

According to the Q2 2022 Banking Sector Brand Health Report by Global InfoAnalytics, First National Bank for the review year recorded the highest average purchase intent score of 54.68%.

National Investment Bank [NIB] came second with an average purchase intent score of 54.44%, Agricultural Development Bank [ADB] with average purchase intent score of 51.15% and then Standard Chartered Bank with 50% purchase intent score.

According to Global InfoAnalytics, the annual performance score shows GCB, Ecobank and Societe Generale with the lowest purchase intent scores of 45.89%, 45.65% and 44.87% respectively.

The purchase intent metric as measured and explained by Global InfoAnalytics shows how likely customers are to go from knowing a brand to buying products or services of the brand, and also indicates the probability that a consumer will buy a product or service in the future.

The Banking Sector Brand Health Report seeks to highlight how the various banks are performing on Key Brand Metrics (KBM) and provide insights that help the banks assess how they can track their performance against competitors.

The key brand metrics assessed are; Brand Recall, Purchase Intent, Brand Visibility, Net Promoter Score (NPS), Brand Equity and Brand Satisfaction.

Source: norvanreports.com

- Advertisement -