BoG Board members receive GH¢510k each as allowances while Bank records GH¢60.8billion loss

“The financial statements reported a total loss of GH¢60 billion, which has since become a matter of unfortunate politicisation. It is noteworthy that GH¢53.1 billion of those losses were a direct result of the government’s domestic debt restructuring exercise (phase 1 and II),”

- Advertisement -

Each of the 10 board members of the Bank of Ghana (BoG) took home GH¢510,000 in allowances last year despite presiding over a GH¢60 billion unprecedented loss.

This is according to the central bank’s 2022 audited annual report and financial statement which states that “fees and allowances paid to non-executive directors during the year amounted to GH¢5.10 million.”

This means in the year in which the central bank recorded its worse performance in recent history, each of its 10 board members received averagely GH¢42,500 each monthly, thus, GHC510,000.00 a year. That amount is 60.9% higher than they received in 2021.

In addition to the governor and his two deputies, the 10 board members make up the governing board of the bank.

The governing body of the BoG, as stipulated in the Bank of Ghana Act, 2002 (Act 612), is the Board of Directors. The Board is responsible for the formulation of policies necessary for the achievement of the objectives and functions of the Bank.

The Board provides strategic direction on the central bank’s operations and meets at least once every two months to consider matters within the above statutory responsibility and those referred to it.

But who were these board members?

The BoG released its full-year 2022 audited financial statements on July 28, 2023, and was widely criticised for the loss it incurred.

“The financial statements reported a total loss of GH¢60 billion, which has since become a matter of unfortunate politicisation. It is noteworthy that GH¢53.1 billion of those losses were a direct result of the government’s domestic debt restructuring exercise (phase 1 and II),” the BoG said in a statement to justify the loss.

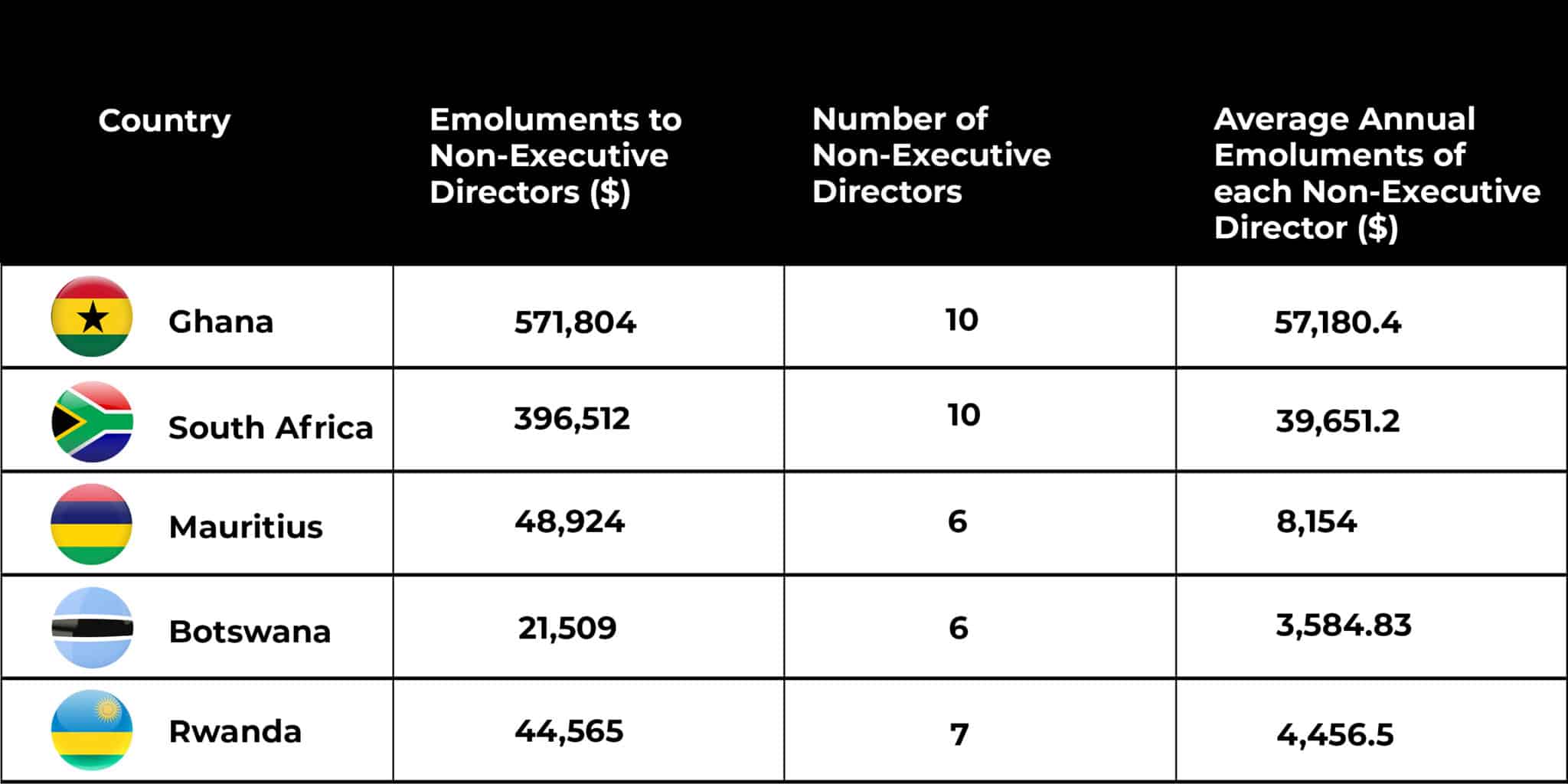

Ghana’s emoluments for the central bank’s non-executive directors are among the highest paid on the continent. On average, they are paid better than their peers in South Africa, Botswana, Mauritius, and Rwanda.

Annual emoluments received by non-executive board members in Ghana, South Africa, Mauritius, Botswana, and Rwanda in 2022:

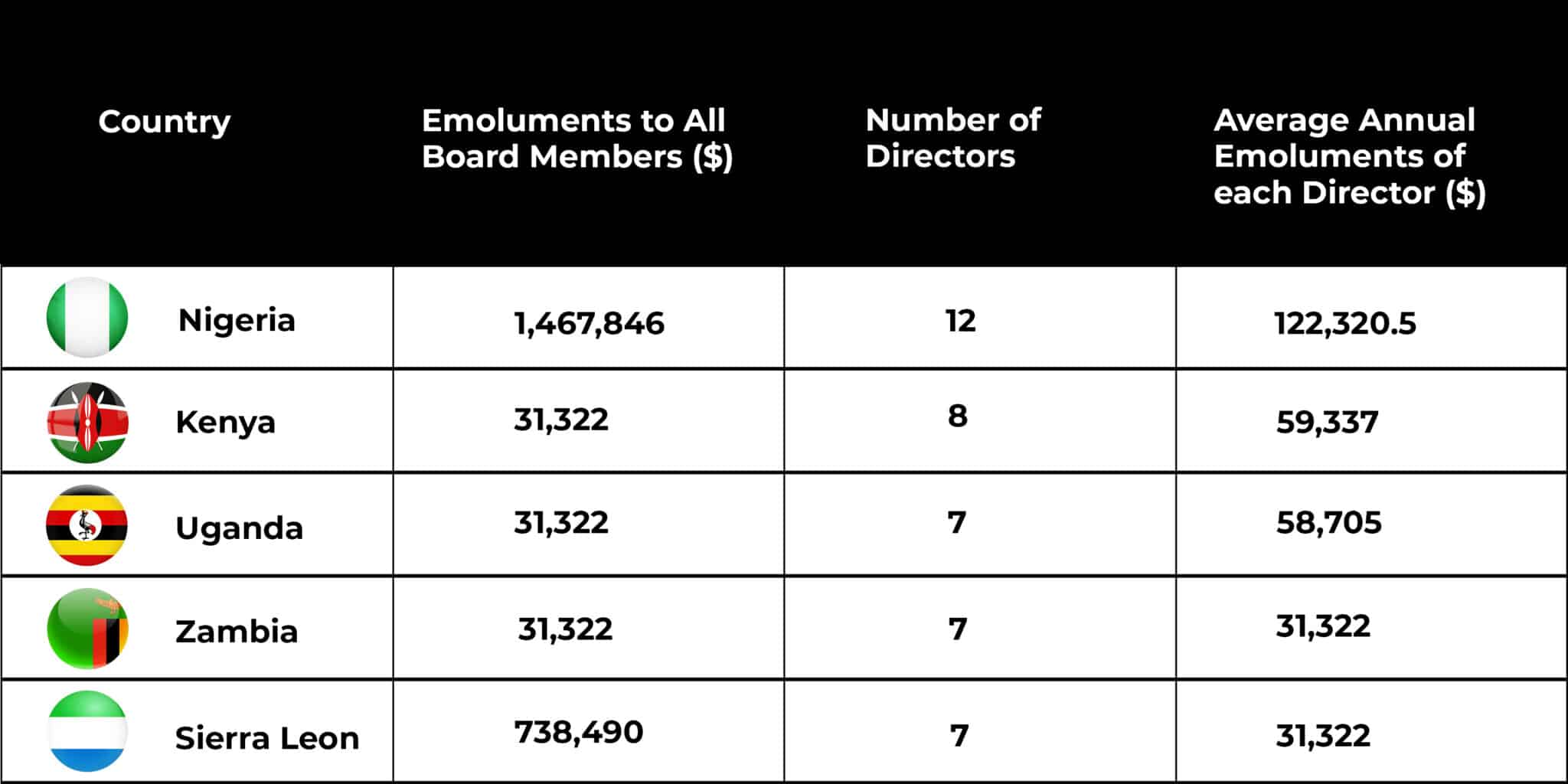

In Kenya, Uganda, and Zambia where the remunerations of the executive directors are lumped together with the non-executive directors, Ghana’s figures are still competitive. Nigeria and Sierra Leone, however, paid their central bank directors much higher.

Emoluments received by all Board Members of the Central Banks of Nigeria, Kenya, Uganda, Zambia, and Sierra Leon in 2022

Before the central bank started highlighting the exact amount it paid its non-executive board members in 2020, the emoluments paid to non-executive directors and executive directors were usually lumped together in the annual reports. This made it difficult to find the exact amount non-executive directors were paid before 2020.

However, the 2020 annual report stated that the exact amount paid to the board of directors in 2019 was GH¢1.96 million.

The emoluments of the non-executive directors have continually increased since 2019. In 2020, their fees and allowances were increased by GH¢670,000. The following year, when the country was still in the jaw of the COVID-19 pandemic, the emoluments of the BoG decision-makers increased from GH¢2.63 million to GH¢3.17 million.

This amount jumped to GH¢5.10 million in 2022—the year the bank recorded substantial losses.

In that same year, BoG’s key management, which includes the Governor, his two deputies, and the bank’s top-level management received GH¢16.79 million as short-term employee benefits. These benefits have seen close to a quadruple increase since 2017, when the key management received GH¢4.49 million.

At the time the managers of the central bank were consistently increasing their fees and allowances, especially in 2021, Finance Minister, Ken Ofori-Atta, pleaded with Ghanaians to sacrifice and burden share to resuscitate the economy.

“I think in the end, the issue of sharing the burden is one we’ve had some very serious discussions with the Ministry of Information about, really creating a national conversation on that. So that everybody has the true numbers, everybody understands the impact of COVID,” Mr Ofori-Atta said at a press conference in May 2021.

Salary cuts

In April 2022, the government announced a 30% salary cut for all its top appointees as part of austerity measures to deal with the country’s financial difficulties.

There were also restrictions on foreign travels, except pre-approved critical statutory ones, a 50% reduction in expenditure on all meetings and conferences, and a 50% cut on fuel coupon allocations.

When President Nana Akufo-Addo addressed the nation on the state of the economy in October, he reiterated that decision:

“We have decided also to continue with the policy of a 30 % cut in the salaries of political office holders including the President, Vice President, Ministers, Deputy Ministers, MMDCEs, and SOE appointees in 2023,” he said.

Members of the Council of State also resolved to reduce their monthly allowances by 20% until the end of the year due to the country’s economic challenges.

However, it appears that the memo did not reach the central bank.

Minority scrutiny

The central bank has been under intense scrutiny ever since it emerged that it had made the jaw-dropping loss. The Minority in Parliament has since August 2023 demanded the resignation of the Governor, Dr Ernest Addison, and his two deputies, attributing the financial hemorrhage to “mismanagement.”

“We are resolved to embark on popular action to occupy the Central Bank and drive out the team of inept, callous, and criminal mis-managers of the finances of this country and save the Bank of Ghana. The March to Ensure Accountability will begin in 21 days if the Governor of the Bank of Ghana does not do the needful and pack bag and baggage out of that sacred institution that he has so desecrated. Dr Ernest Addison Must Go! There has to be an end to impunity and it is now,” the Minority Leader, Dr Cassiel Ato Forson, said.

When the Governor and his deputies did not resign, the Minority embarked on a demonstration.

But Dr Addison reportedly told Central Banking, a foreign business website, that he would not resign. He described the protests by the Minority as “completely unnecessary.”

“The Minority in Parliament has many channels to channel their grievances in civilised societies, not through demonstrations in the streets as hooligans,” Dr Addison said.

Nonetheless, the honorary vice president of IMANI Africa, Bright Simons, has described “the scope of the mess” created by the managers of Ghana’s apex bank as “eye-popping from a historical point of view.”

- Advertisement -