Broke Nigeria courts Ghana’s debt crisis on pay raise plan

“Consequential allowance salaries will be increased by 40 percent for civil servants from level 1 to level 17 starting from April, but I am not sure if the President has signed it yet,”

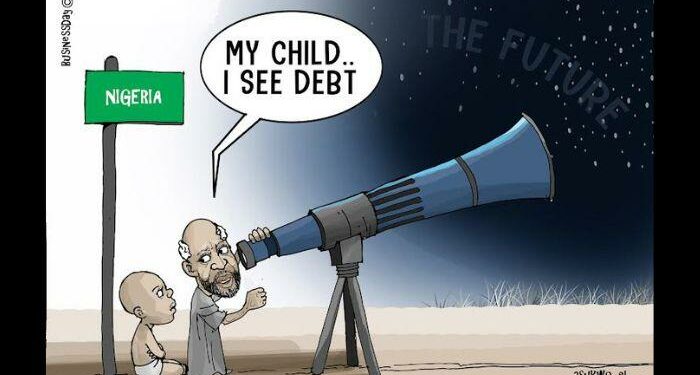

The proposed 40 percent pay raise for civil servants is seen putting Africa’s biggest economy at risk of a crisis similar to that of Ghana, a neighbouring country battling its worst economic turmoil in decades.

Despite Nigeria’s ailing finances, the federal government is planning a fresh pay increase, tagged ‘consequential allowance’, to help government workers to cushion the effects of rising inflation and the looming removal of petrol subsidy.

“Consequential allowance salaries will be increased by 40 percent for civil servants from level 1 to level 17 starting from April, but I am not sure if the President has signed it yet,” Olajide Oshundun, director of press and public relations at the ministry of labour and employment, said on April 18.

The financial burden of a 40 percent increase in civil servants’ salaries is fueling confusion among some economists and business leaders who are at a loss on why a supposedly cash-strapped government is increasing its wage bill at a time the government is spending 96.3 percent of revenue on debt servicing.

“The country is broke; Nigeria is certainly living above its means with the decision to increase wages by 40 percent, a pattern that is similar to how Ghana ended in economic turmoil,” a Lagos-based asset manager who does not have authorisation to speak on the matter said on condition of anonymity.

Nigeria is already faced with the risk of recording the biggest budget deficit in history this year if actual revenues continue at the run rate of the past 12 years, BusinessDay’s analysis of budget implementation data shows.

The country has recorded a budget deficit every year since 2009 averaging about N1.1 trillion in the five years before the President Muhammadu Buhari administration came into power in 2015. However, since 2015, budget deficits have averaged N4 trillion.

“With debt service at historic highs, how will the government fund a 40 percent salary increase when Nigeria’s oil revenues are struggling,” Ola Alokolaro, partner, energy and infrastructure at Advocaat Law Practice, said.

BusinessDay findings showed Nigeria’s actual oil revenue was down by around 72.9 percent to N395 billion, compared to a target of N2.1 trillion as of August 2022.

“Although almost all the key revenue lines underperformed relative to the budget, one of the primary sources of the revenue shortfall was the FGN’s independent revenue,” economists at FBNQuest Capital said in a note sent to BusinessDay.

“Nigeria has ignored its revenue challenge by going on a borrowing spree. Yet, this has not impacted the economy, which has been stuck in a low growth path despite higher debt levels,” Alokolaro said.

In 2022, Nigeria’s debt service-to-revenue ratio was at 80.6 percent — a figure far above World Bank’s suggested 22.5 percent for low-income countries like Nigeria.

The International Monetary Fund (IMF) had said Nigeria may spend almost 100 percent of its revenue on debt servicing by 2026.

Ernest Bosha, an Abuja-based economist, said it’s the economy that will pay the ultimate price for lower-than-planned government revenues.

“It means reduced public spending on badly-needed infrastructure; Nigeria is a step shy away from Ghana’s economic chaos,” Bosha said.

What happened in Ghana

Ghana, a country once described as Africa’s shining star by the World Bank, is facing one of its worst economic crises in decades after defaulting on its debts and reaching a preliminary agreement on a $3 billion IMF bailout last December.

Analysts say not much progress has occurred since Ghana announced it was returning to the IMF to secure a bailout and restore some level of confidence in the economy.

Ghana’s economic successes were in the limelight when the new government of President Nana Akufo-Addo took power in January 2017 and brought down inflation significantly.

According to a World Bank report, Ghana’s GDP per capita grew by an average of 3 percent per year over the past two decades, putting Ghana in the top 10 fastest-growing countries in Sub-Saharan Africa.

“The growth that we experienced around 2017 to 2019 was actually coming from the oil sector,” Daniel Anim Amarteye, an economist with the Accra-based Policy Initiative for Economic Development, told Al Jazeera.

“We were so excited that the economy was growing, but we couldn’t devise strategies to ensure that the growth reflects in the other sectors of the economy,” he said.

Experts say the government took certain political and economic decisions that would have eventually exposed the weaknesses in the system even without those external factors like the coronavirus pandemic or the Russia-Ukraine War.

“High recurrent expenditure levels and expanding finance costs with subpar revenues have resulted in huge deficits, particularly following the COVID pandemic,” said Sarpong Capital, an independent investment banking and capital markets firm based in Accra.

For instance, to fulfill one of Akufo-Addo’s most expensive campaign pledges, his government launched a free education programme in public high schools nine months after he took office. It also provided free meals to students at primary and secondary levels.

Also, in 2017, the governing New Patriotic Party scrapped what it called 15 “nuisance taxes”. These included the 17.5 percent value-added tax on financial services, real estate and selected imported medicines. They also reduced import duties on spare car parts, abolished the 1 percent special import levy and the 17.5 percent VAT on domestic airline tickets.

“This brought a massive reduction in government revenue,” Williams Kwasi Peprah, a Ghanaian associate professor of finance at Andrews University in Michigan, told Al Jazeera.

“To make up for the revenue shortfall, the government adopted borrowing. This increased Ghana’s bond market activities domestically and externally and, as a result, a high debt-to-GDP exposure, leading to the current debt unsustainability levels,” he added.

From August 2017 to December 2018, findings showed Akufo-Addo’s government spent more than $2.1 billion on what it called the “banking sector cleanup”.

Ghana’s central bank said some banks were insolvent and were operating on life support, putting the interests of depositors at risk. The cleanup saw a reduction in the number of banks from 33 to 23 while more than 340 other financial institutions, such as savings and loans companies, had their licences revoked.

The government aimed to restore confidence and reposition the banking sector to support economic growth.

“The financial sector cleanup also cost the country more than anticipated in attaining a robust financial sector before 2022,” Peprah said.

He said the discovery of two more oilfields in 2019 led to the anticipation of more revenues.

The government responded by issuing more domestic and external bonds, increasing its debt and raising spending on interest payments, social programmes and employment.

In 2017, the government also restored allowances for trainee nurses and teachers. President John Mahama lost to Akufo-Addo in the 2016 election partly for suspending those allowances two years earlier. They put a huge strain on the public purse. For the nurses’ allowances alone, the government paid more than $2.5 million annually.

“That was a poor political and economic decision the Akufo-Addo government made at that time because the country was faced with revenue challenges,” said Kwasi Yirenkyi, a financial analyst with Accra-based Data Crunchers. “The government was spending more than it was receiving, and at the same time, it failed to widen the tax net. We were slowly heading for disaster.”

Source: norvanreports

- Advertisement -