Cal Bank posts GHS 170m in net profit for Q3 2023 but assets value dip to GHS 10.2bn

A notable aspect was the Capital Adequacy Ratio (CAR), which stood at 10.7% by the end of Q3 2023, significantly below the industry’s benchmark of 14%. In Q3 2022, the bank boasted a more robust CAR of 16.3%.

- Advertisement -

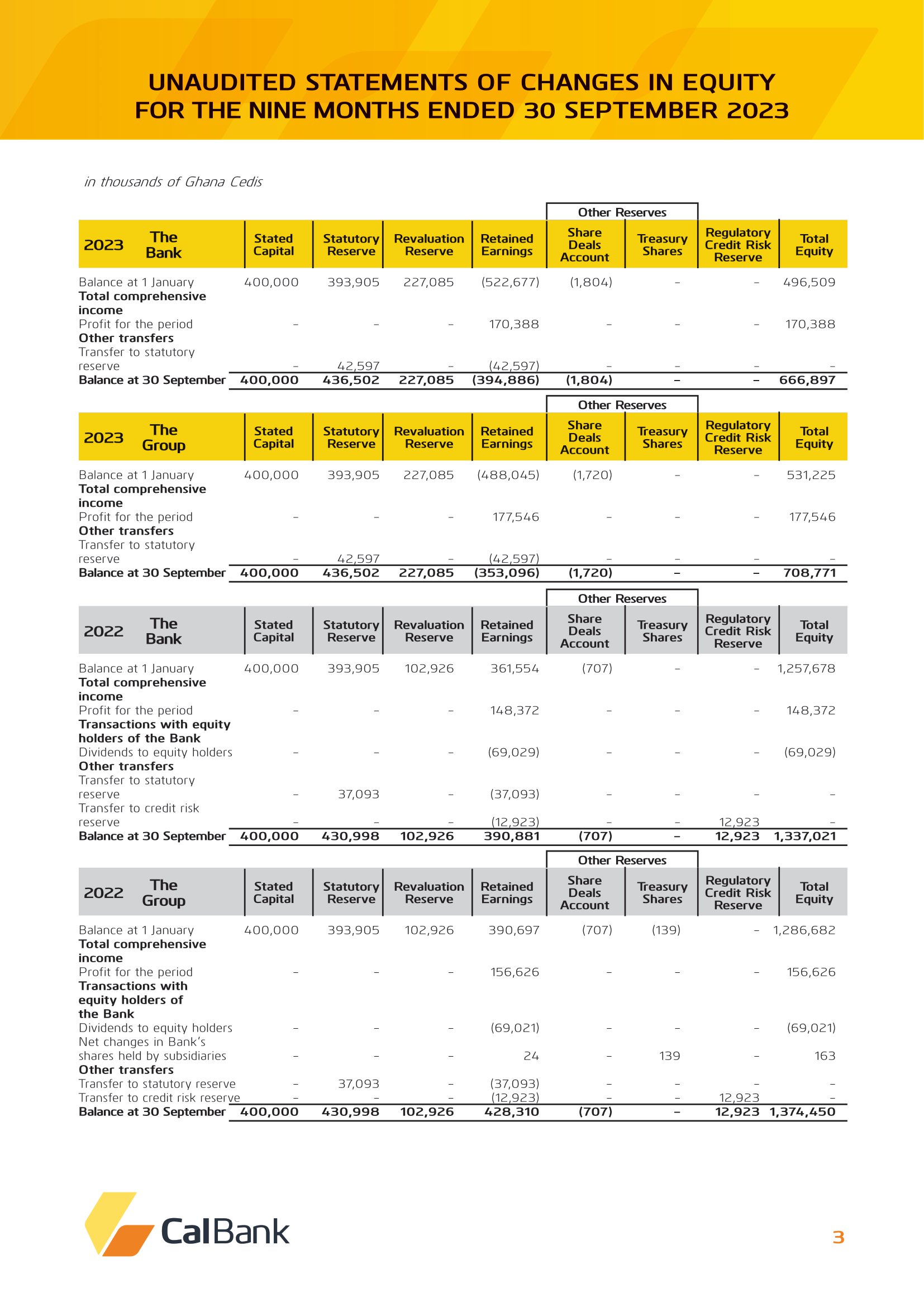

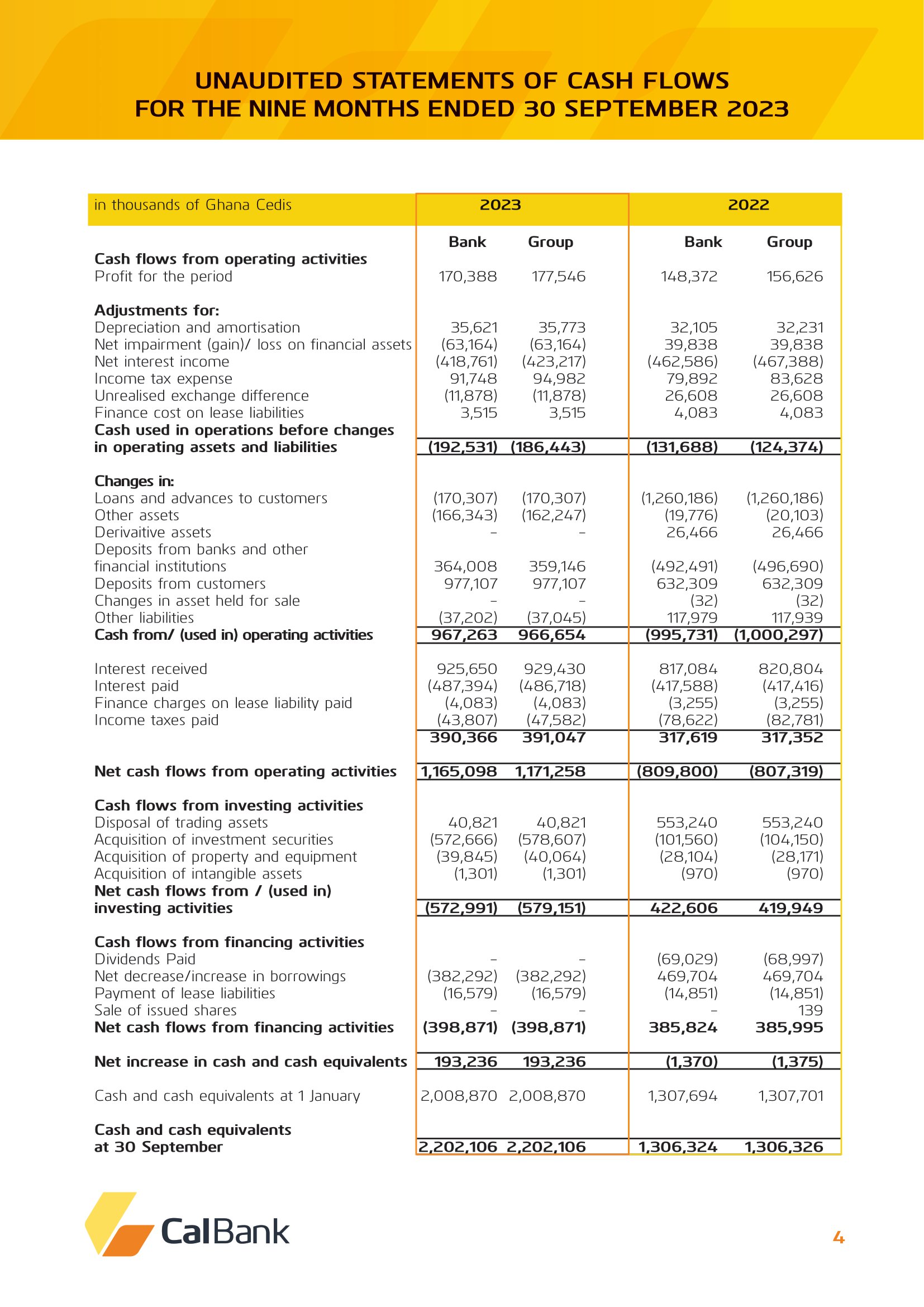

Cal Bank within the third quarter of 2023 showcased a positive performance, reporting a net profit of GHS 170.3 million. This marks a notable increase of GHS 22 million compared to the previous year’s net profit of GHS 148.3 million, underlining the bank’s resilience in the current economic landscape.

The uptick in net profit was chiefly fueled by the growth in operating income, which edged up from GHS 596 million in Q3 2022 to GHS 601 million in Q3 2023. This growth in operating income demonstrated the bank’s commitment to enhancing its operational efficiency.

Nonetheless, the bank’s total assets saw a decline during the review period, reducing to GHS 10.2 billion from the GHS 10.9 billion recorded in Q3 2022. This translates to a GHS 700 million reduction in asset value on a year-on-year basis.

The dip in asset value was predominantly driven by a reduction in investment securities, which contracted from GHS 5.1 billion in Q3 2022 to GHS 3.1 billion in Q3 2023. However, it is worth noting that cash and cash equivalents demonstrated an increase, rising from GHS 1.3 billion to GHS 2.2 billion, while loans and advances to customers remained relatively stable at GHS 3.4 billion.

Cal Bank prudently managed its liabilities, maintaining them at GHS 9.5 billion, with no increments year-on-year. Notably, the bank’s liabilities are predominantly composed of customer deposits, which grew to GHS 7 billion by the close of Q3 2023, compared to the GHS 5.8 billion recorded in Q3 2022.

While the bank’s performance showed promise, there were mild concerns regarding the quality of its loan assets. The non-performing loan ratio inched up to 7.8% in Q3 2023 from 6.5% in the same period of the previous year, calling for diligent risk management measures.

A notable aspect was the Capital Adequacy Ratio (CAR), which stood at 10.7% by the end of Q3 2023, significantly below the industry’s benchmark of 14%. In Q3 2022, the bank boasted a more robust CAR of 16.3%.

In conclusion, Cal Bank’s Q3 2023 financial performance exhibits an improved net profit and an emphasis on operational efficiency. However, the decline in total assets, a slight deterioration in loan asset quality, and a CAR below industry standards signal the need for prudent management and strategic adjustments in the quarters ahead.

- Advertisement -

- Advertisement -