Central Banks shouldn’t rush to join Fed policy pivot, IMF says

“Sometimes countries prematurely declare victory and then inflation gets more entrenched and the fight becomes harder,”

- Advertisement -

Central banks around the world shouldn’t rush to relax their fight against inflation even with the Federal Reserve signaling its own policy pivot next year, the chief of the International Monetary Fund said Friday.

“Sometimes countries prematurely declare victory and then inflation gets more entrenched and the fight becomes harder,” IMF Managing Director Kristalina Georgieva told reporters in Seoul. “Don’t say hop before you jump.”

The IMF chief joins European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey in voicing caution after the Fed jolted markets Wednesday by indicating its policymakers are turning their attention to cutting borrowing costs in 2024.

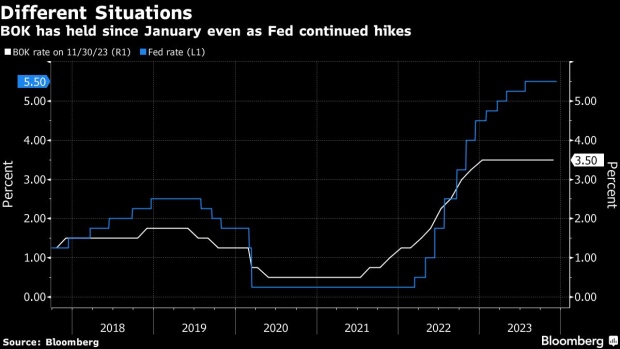

She indicated that her advice applied to the case of the Bank of Korea, after she met with Governor Rhee Chang-yong.

Georgieva said the Fed was correct to signal its pivot based on US data, but other central banks should consider their own situations. “Now that inflation is decreasing and decelerating but at different points in different countries, central banks have to calibrate their own actions according to domestic conditions,” she said.

Still, the fight against inflation is in its “very last mile,” she said, advising the BOK not to move any faster along its own policy course than data allow.

Georgieva visited Seoul this week for a joint conference with the BOK on digital money.

- Advertisement -

- Advertisement -