China Investors Expect $283 Billion of New Stimulus This Weekend

“It is the focus of the stimulus rather than the size that is important.”

- Advertisement -

Investors and analysts are expecting China to deploy as much as 2 trillion yuan ($283 billion) in fresh fiscal stimulus as Beijing seeks to shore up the world’s No. 2 economy and boost confidence.

That’s what they hope the country’s finance minister will announce at a highly anticipated briefing on Saturday, according to a majority of 23 market participants surveyed by Bloomberg. Most of the respondents expect the funding to come in the form of government bonds.

- Advertisement -

Beyond the amount of any fiscal package, the target of support will indicate where the government looks to steer its economy after years of debt-fueled expansion through investment, particularly in real estate and infrastructure.

- Advertisement -

“The stimulus should be multi-year and targeted to households and not restarting the real estate investment-led growth story,” said Pushan Dutt, professor of economics at INSEAD. “It is the focus of the stimulus rather than the size that is important.”

The weekend press conference, which the government said would introduce measures to strengthen fiscal policy, comes as investors assess how far the authorities plan to go with stimulus efforts that prompted a world-beating stock rally. Officials are also planning a briefing Monday on boosting support for enterprises.

China has already cut interest rates and ramped up support for property and stock markets in a barrage of steps announced late September. But investors have clamored for fiscal interventions economists believe are crucial to lifting confidence.

Onshore Chinese shares remained volatile throughout the week after ending a 10-day rally on Wednesday, as officials disappointed by announcing no major new stimulus following a weeklong holiday. The benchmark CSI 300 Index dropped more than 1% in early trading on Friday.

“Government agencies are now expected to feel the pulse of the market before publishing policies,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. “They should avoid letting expectations climb and crash to deal a blow to market sentiment.”

Most of the respondents, including economists, strategists and fund managers, expect new fiscal stimulus in the next six months if Finance Minister Lan Fo’an doesn’t announce it Saturday.

They forecast China will sell more government debt to expand public spending through the end of next year, with special bonds being the most likely option. Four respondents anticipate a package exceeding 3 trillion yuan.

A portion of the stimulus is expected to target consumption, which has been a weak spot in China’s post-pandemic recovery. Respondents said the measures may include:

- More subsidies for targeted groups, such as the elderly and the poor

- Consumption vouchers

- More support for families with children

- Greater social safety net

- More subsidies for buying consumer goods and cars

Boosting consumption would help rebalance the economy and reduce its reliance on exports to drive growth amid rising trade tensions, although Beijing has refrained from direct handouts on a massive scale due to concerns over what it calls “welfarism.”

- Advertisement -

China typically relied on infrastructure investment to lift the economy out of past downturns. But a saturation of infrastructure after decades of urbanization means throwing money at the sector may be less effective in spurring growth this time around.

What Bloomberg Economics Says…

“At the core of the faltering economy are the property slump and dire financial health of local governments – a toxic combination that poses unique policy challenges. The government has shown new thinking to address them. Going forward, we expect a period of exploration and experimentation with new tools applied in different areas and at different scales and pace,” — Chang Shu, David Qu and Eric Zhu. For full analysis, click here

Given the growing challenge of finding quality projects to invest in, some respondents expect the finance minister to relax curbs on the use of special local bonds and allow the funds to be used for purposes such as buying back land or buildings from developers.

China’s gross domestic product expanded at the weakest pace in five quarters in April-June. Data since then has suggested domestic demand remained subdued, with deflation showing signs of spiraling amid sluggish consumer and business confidence.

Economists have for months called on the government to ramp up public spending to pick up the slack, but mounting local debt risks and slumping revenue from land sales have been holding the authorities back.

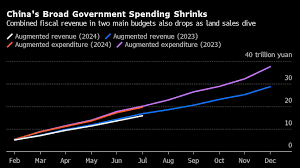

Fiscal policy so far in 2024 has been a drag on the economy, with broad budget spending shrinking nearly 3% in the first eight months from a year earlier, falling far behind a planned increase in the government’s budget report in March.

Some respondents suggest the central government will borrow more to ease fiscal strains at local levels, such as by swapping so-called “hidden” debt of China’s regions for bonds carrying lower interest costs. Beijing could also increase transfer payments to help localities meet daily spending needs such as paying civil servants.

China already planned to sell nearly 9 trillion yuan in new government bonds this year to help plug a broad government spending shortfall, according to the annual budget. Any new quota on top of that will have to be approved by the National People’s Congress or its executive body, the Standing Committee.

China’s Special Bonds, Unused Quotas Seen Funding Fresh Stimulus

Tapping unused bond allowance saved from previous years generally won’t need to go through the national legislature. The central and provincial governments have a total of about 2 trillion yuan in such unspent quotas left to use as of the end of 2023, according to official data.

Source:norvanreports.com

- Advertisement -