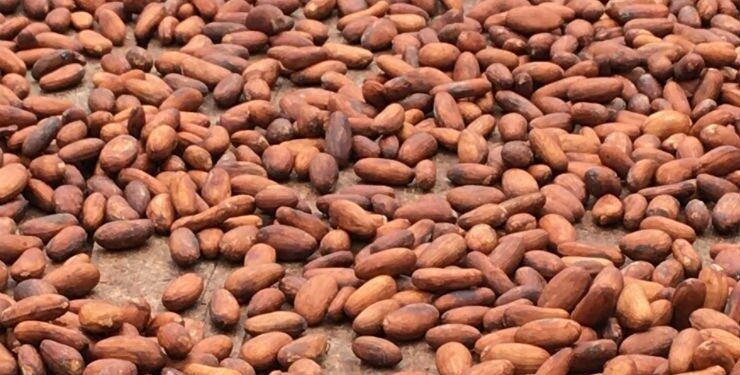

Cocoa price swings are the craziest since the 1970s

Traders will also keep a close eye on short-term weather and crop conditions in the crucial West Africa region. Rainfall in West Africa this week is expected to aid production, ADM Investor Services wrote in a note, adding that the “cocoa market is looking toppy for the first time in a long while.”

- Advertisement -

Cocoa resumed gains in New York, with prices the most volatile in almost five decades amid uncertainty over a historic crunch and as traders pull out of the market.

Futures have soared about 160% already this year as poor West African harvests leave the world desperately short of beans. But the rally has made it more expensive to maintain positions, prompting investors to close out trades, draining liquidity and making the market more vulnerable to large price swings.

- Advertisement -

Cocoa jumped as much as 5.2% to $10,985 a ton on Wednesday, snapping a 9% two-day slide. That helped push a 60-day measure of volatility to the highest since 1977.

- Advertisement -

Cocoa’s rally to a recent record above $11,000 a ton means traders — including those who’ve hedged against physical holdings — have to come up with more money to pay margin calls, which work as an insurance policy to cover potential losses. When they can’t do that, they’re forced to close out their positions. That’s pushing down open interest, the number of outstanding contracts.

There’s still much uncertainty over global supplies. Still, a shift from the El Nino weather phenomenon to La Nina will likely help global production recover next season. That weighed on prices early this week, the Hightower Report said in a note.

- Advertisement -

Traders will also keep a close eye on short-term weather and crop conditions in the crucial West Africa region. Rainfall in West Africa this week is expected to aid production, ADM Investor Services wrote in a note, adding that the “cocoa market is looking toppy for the first time in a long while.”

While there is room for some easing of prices if West African weather improves during the second half of the year, recent market moves have been mostly technical as futures met resistance when nearing the $12,000 a ton level, said Leonardo Rossetti, senior market intelligence analyst at StoneX.

“It is hard to imagine prices would slump, but there is room for some correction,” Rossetti said. “But for now, it seems to be something more technical.”

Source: Norvanreports

- Advertisement -