Daakye Plc posts GHS 8.7m income for Q3 2023

Daakye Plc’s financial performance during Q3 2023 highlights its current challenges. Market participants will closely scrutinize the company’s strategies to manage its current assets, address the zero value of non-current assets, and navigate the prevailing economic conditions.

- Advertisement -

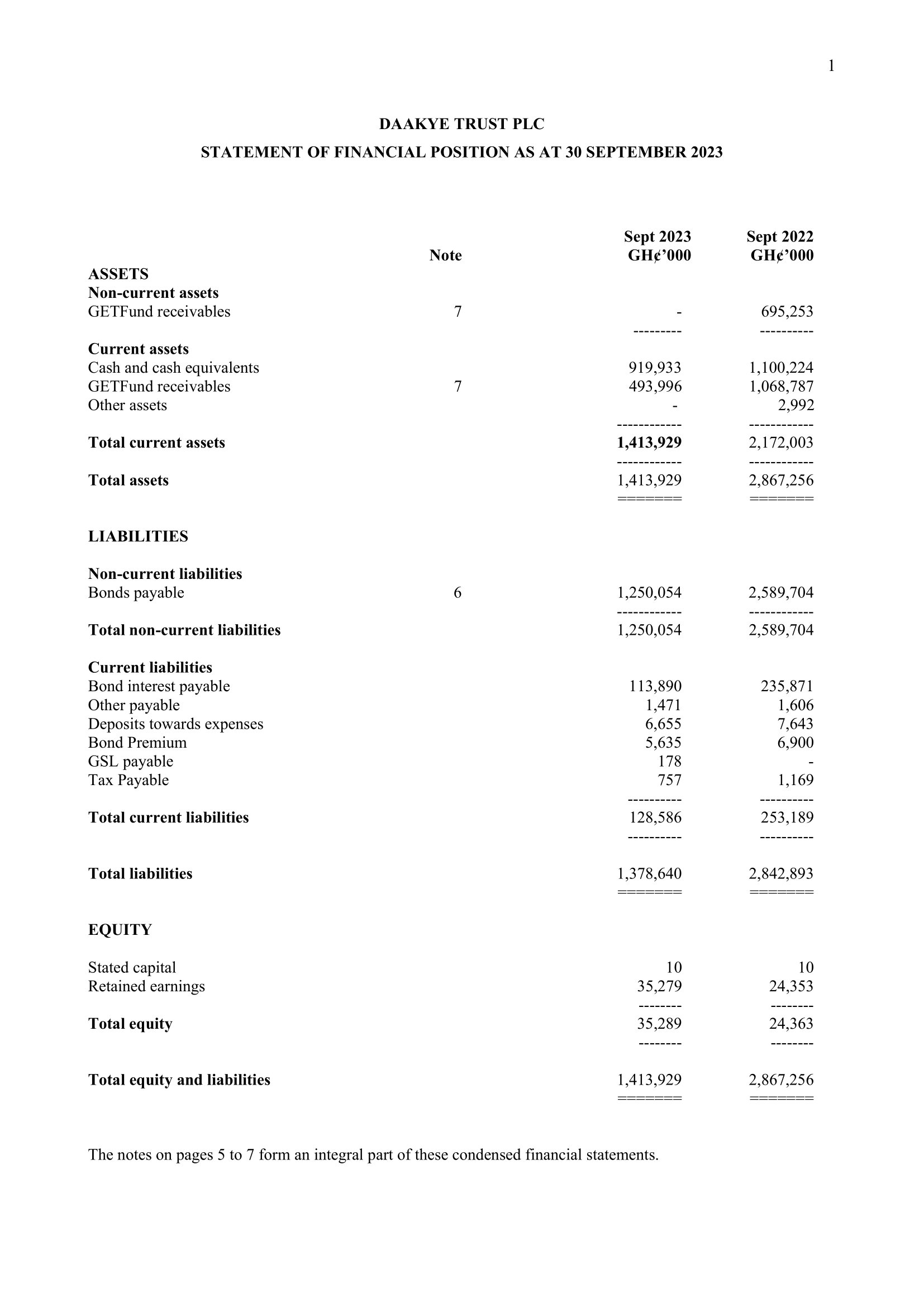

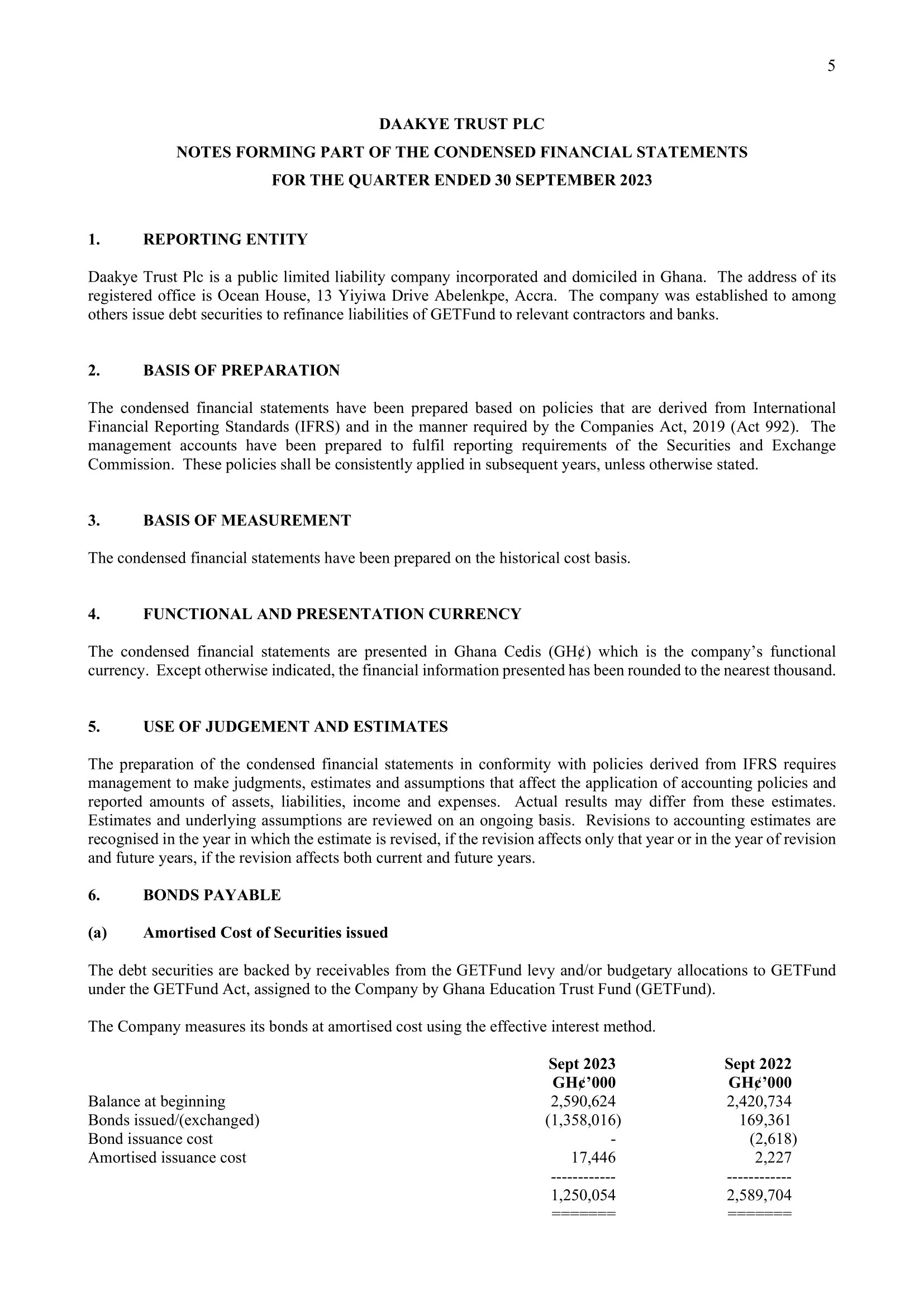

Daakye Plc has reported a challenging financial performance in Q3 2023, with total assets value experiencing a sharp decline to GHS 1.4 billion, compared to GHS 2.8 billion in the previous year.

The decline in total assets value can be attributed to a substantial decrease in current assets, which ended Q3 2023 at GHS 1.4 billion, down from GHS 2.1 billion in Q2 2022.

- Advertisement -

Additionally, Non-current assets of the company in the form of GETFund receivables was zero at end-Q3 2023 from GHS 695m at end-Q3 2022.

- Advertisement -

On the liability front, Daakye Plc recorded a remarkable reduction, with total liabilities standing at GHS 1.3 billion at the end of Q3 2023, a considerable decrease from the GHS 2.8 billion recorded in the same period last year.

Both current and non-current liabilities experienced declines, amounting to GHS 128 million and GHS 1.2 billion respectively, compared to the GHS 253 million and GHS 2.5 billion recorded in the previous year.

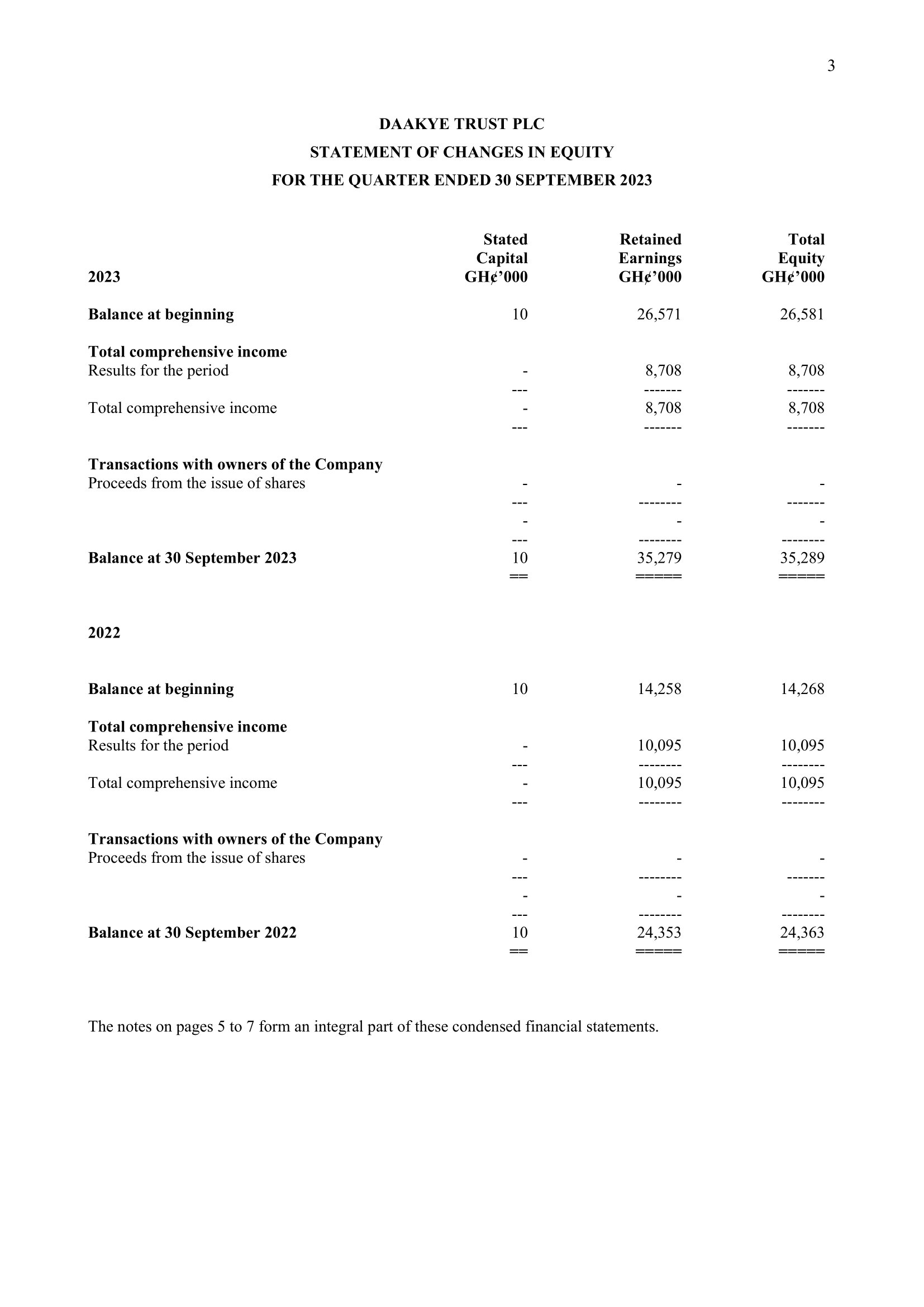

The company’s total comprehensive income faced headwinds, reporting figures of GHS 10 million and GHS 8.7 million at the end of Q3 2022 and Q3 2023 respectively.

- Advertisement -

This decrease in reported comprehensive income led to a decline in earnings per share, falling to GHS 8.7 from the previous year’s figure of GHS 10.1.

Daakye Plc’s financial performance during Q3 2023 highlights its current challenges. Market participants will closely scrutinize the company’s strategies to manage its current assets, address the zero value of non-current assets, and navigate the prevailing economic conditions.

Restoring investor confidence and enhancing financial stability will be vital for Daakye Plc to rebound and regain its financial footing.

- Advertisement -