Does Ghana have a “Credit-Scoring” System?

If the government insists on going ahead with the idea of launching a new credit-scoring system accessible through the Citizen App, instead of just adding a simple, non-revolutionary, button in the user interface for a citizen to request their current scores from the bureau, purely as a matter of convenience, then we will have to take counsel from an old Igbo saying.

- Advertisement -

The Genesis of the Affair

A strange uproar has been rising on Ghanaian social media since the country’s Vice President announced during a speech at the country’s largest university that his government will introduce a credit scoring system for the first time next year.

The aim of this revolutionary development is to lower the perceived risk of borrowers so that Ghanaians can pick up goodies like cars with nothing more than their precious Ghana Card, the much vaunted national ID card.

Why would such a lip-smacking prospect generate any kind of furore at all? Who can be against a government policy that strips away the pointless burdens of having to prove income whenever one fancies a nice SUV, provided one is blessed to be endowed with the almighty Ghana Card?

There is one small issue: Ghana has had a credit referencing system akin to that being promised since 2010. And this is not the first time a timeline has been given for this ethereal system to surface.

Old Promise

More than a year ago, whilst speaking to an audience of bankers, the Veep promised the launch of this magnificent system by the end of March 2023.

The Citizen App that he says will provide the doorway to accessing the new credit scoring system was launched as part of the Ghana.gov project years ago. In its latest reporting to UNCTAD under the eTrade Readiness Assessment scheme, the government claimed that ~1500 state bodies and agencies have already been onboarded onto the Citizen App to provide services to the population.

Which then makes one wonder why there is a need to “introduce” the app next year to, among other services, offer credit-scoring. Perhaps, it helps knowing that the Citizen App is an important component of the Ghana Digital Acceleration Project approved for funding to the tune of $200 million by the World Bank in April 2022. When such relatively large amounts are at stake, politicians tend to get creative about spending money. In this specific case, however, something more bizarre must be going on.

The State of Ghana’s Current Credit Scoring System

As was explained at the outset, Ghana has a credit scoring system with active players trying to make the most of the situation. According to the World Bank, so do, at least, 24 other sub-Saharan African countries.

A credit scoring system is simply a statistical representation of the likelihood of a borrower to default on a loan or other form of credit. Such a score is relied upon, among other factors, by a creditor to gauge the risk of extending a particular credit facility, such as a car loan, mortgage or postpaid phone contract. Creditors use their own internal formulas, and also consult specialised entities, called “credit bureaus” or “credit referencing agencies”, that aggregate insights about borrowers at a scale that they on their own may not be able to do.

Ghana’s first credit bureau, XDS Data, was incorporated in 2003 and commenced operations in 2004.

In 2008, one year after the substantive law on credit referencing was passed, Dun & Bradstreet (D&B) joined the fray. Both companies however had to wait till 2010 when the Bank of Ghana formally issued full licenses and set up the regulatory infrastructure for full-blown credit referencing in Ghana. Following this milestone, promoters of the bureaus, like policymakers, heartily announced a new era of loans without collateral.

In March 2020, Legislative Instrument (LI) 2394 came into force to provide regulations for the conduct of credit referencing activities in Ghana. Sections 4 and 5 of these regulations impose strict obligations on data providers to update information on borrowers monthly and to ensure/assure the quality of the data provided at all times.

In essence, financial institutions are not even at liberty to provide credit in Ghana without running a search in view of sections 30 and 31 of the regulations.

Besides the credit bureaus, the Securities and Exchange Commission of Ghana (SEC) has also recently licensed the country’s first Credit Rating Agency, Beacon. Typically, rating agencies target large corporations and may rate either the corporate client itself, its securities, or other financial instruments issued by it, or both. What this means is that Ghana now has a domestic equivalent of the well-known Fitch and Moody’s.

Beacon has so far only been able to complete one rating action in the one year since it started operating, but 14 other companies are in the queue. Obviously, as should be clear from the processes as outlined below, Ghana Card will make no dent in this backlog.

So What “Credit Scoring” again?

Given these various obvious facts, the Veep’s claim that the absence of credit scoring in Ghana is what has increased the risk-perception rating of borrowers in the eyes of creditors, and thus stunted availability of credit, is very strange, especially in a country where the base interest rate hovers around 30% and many borrowers have to contend with rates exceeding the 40% mark.

In response to the mounting confusion, the Technical Advisor of the Veep took to social media in a bid to shine more light.

His main arguments are as follows:

- The current credit scoring system excludes 80% of adults.

- The current system is “bank-led” and has failed to expand its data sources beyond the traditional banking system.

- The proposed system will ride on the vaunted Ghana Card system, giving it access to a broader range of demographic and other forms of data, thereby embracing more effectively the population of the country.

- The data from this new and humongous constellation will improve credit decision-making, widen the net for more people to benefit from credit, and modernise the Ghanaian economy.

- The proposed system will make it easier for individuals to access their scores by posting them online.

These positions were more or less corroborated by a political risk analyst affiliated to the same think tank as this writer, but with an interesting new twist. Whilst acknowledging the existence of a credit referencing system in Ghana, the author disputed the maturity of the system to the point where it can generate individual credit scores.

In the rest of this short essay, we shall explore why none of these arguments hold much water.

Does the Existing Credit-Scoring System exclude 80% of adults?

No, it doesn’t.

According to the Bank of Ghana’s (BoG’s) own data, nearly 8.8 million Ghanaians have credit data captured by one of the country’s credit bureaus.

Roughly half of all active companies registered in the country are also captured.

Data from the 2021 census would thus indicate an adult population coverage level of nearly 50%. Not the 20% claimed by the Technical Advisor to the Veep.

Even more importantly, users report that more than 85% of the time when they attempt to query a borrower’s credit, they get a hit, suggesting that for the vast majority of economically active citizens who actually want credit, coverage exists.

After flattening between 2016 and 2018, usage of the existing credit referencing/scoring system has increased considerably, with more than 9.3 million checks being conducted by creditors annually. As well as information on more than 15 million credit transactions covered.

Of course, a system that covers every adult, small business, and every financial transaction in the economy will be more ideal, but such a system is very hard to establish anywhere in the world.

In the United States (US), arguably the most advanced credit market in the world, research by the US government’s Consumer Finance Protection Bureau has revealed that roughly 22% of Americans are “invisible” to the credit referencing/scoring system due to having no credit score at all or information too scanty to compute a score.

Whilst it makes sense to keep looking for ways to ensure the coverage of every adult and small business, it is essential to be clear as to how that could be achieved. The suggestion that the Ghana Card is some kind of silver bullet for killing credit invisibility is wholly unsupported since it is not a lack of civil identity that restricts individuals from engaging in reportable economic activity.

At any rate, as will become obvious shortly, the issue of ensuring deep and broad reporting of economic activities is very well understood but never has the use of a particular civil ID been cited as the solution. Many of the most advanced credit markets in the world allow residents to use multiple IDs without favouring any one system.

Is the Existing System Limited to Banks?

Not at all.

As the data below from the BoG shows, the Ghanaian credit bureaus obtain their data from sources that go beyond the traditional banking system, including government agencies and retailers.

Furthermore, in 2021, the BoG, activated powers under section 13 of the LI 2394 regulations to demand that other data holders in the economy not reporting to the credit bureaus commence doing so. The directive is so informative about the state of credit referencing in Ghana that it is worthwhile publishing it in full.

The delay in reporting by some utilities, mobile network operators, fintech institutions and mobile money platforms, contrary to law, is due more to unwillingness to foot the data and data security infrastructure bill than to the absence of policy intent. Some major commercial data owners are also averse to the loss of competitive advantage if their competitors can access the same market insights that they have.

None of these problems can be fixed by introducing a new system backed by Ghana Card. What is required is effective implementation of the law, continuous sensitisation, and the encouragement of data infrastructure pooling by industry associations.

Reporting Gaps not Unique to Ghana

It bears mentioning also that everywhere in the world, some data reporters are preferred more than others by credit bureaus.

According to IFC data, banks predominate globally in the ranks of data providers simply because creditors think they are best placed to help them with information about a borrower’s payment habits.

Courts and public databases for instances are consulted by less than 30% of credit bureaus worldwide.

Likewise, 95% of credit bureaus track debt defaults but only 44% of them bother to link to tax information.

There are many practical and operational reasons why credit bureaus favour some data sources over others. None of these reasons will cease to exist because the government chooses to launch its own scheme.

Will adding the Ghana Card to the mix make any difference?

Not in the least.

The current process has already made accommodation for the use of the Ghana Card dating back to 2012 when both the Ghana Card and credit scoring system were in their infancy. Nothing stops the banks, telecom companies, and any institution that are now required by law to collect Ghana Card information during transactions from adding the Ghana Card number to the reports they file to the credit bureaus.

The Ghana Card database has far fewer fields per subject than the reporting template used by the credit bureaus. Thus, the credit bureaus, whose template can accommodate 178 unique data fields, have richer data on many citizens than does the operator of the Ghana Card system. Below, the credit reporting format is reproduced in part to make a point.

It should be clear from the above that not only does the reporting pipeline for credit bureaus allow them to enrich the profile of a subject/citizen with multiple ID cards, including the Ghana Card, it also allows for such fascinating data sources as e-Zwich, SSNIT data, and voter records.

Once again, the challenge here is with respect to the cost of the infrastructure and the efficiency of management processes at the level of each data reporter. One cannot expect a Makola shop, however large, in today’s Ghana, to comply with the law that says that data on any credit they extend should be compiled in CSV files and submitted to credit bureaus. The reason is not because Ghana Card is not in the mix, but simply because they likely lack the capacity in terms of personnel and equipment. It is inconceivable how an entire Vice Presidential policy unit confronted with such a challenge would suggest that Ghana Card somehow “addresses the problem”.

Nor can this be considered the burden of the credit bureaus either. This is an extremely tight-margin business. One of the 3 bureaus initially licensed dropped out for sheer inability to make ends meet.

What about “tighter integration” of the ecosystem to create a “national credit platform”?

The integration idea is dangerously seductive until one delves into the details.

There must be a reason why in every serious country, competition among not just credit referencing/scoring bureaus but also among models, formulas, and approaches is the right way forward. Whilst the underlying algorithms may be similar such that in the US, for instance, all the three major credit bureaus license the FICO model from Fair Isaac (as indeed does some bureaus in Nigeria), and then flavour it their own way, the practice is nonetheless for different lenders and economic actors to explore increasingly creative ways to lend to more and more previously excluded people without worsening default risk.

No one denies that all credit data users in Ghana, especially the financial institutions, are on the lookout for better insights about their borrowers. Or that the current credit scoring system needs a lot of enhancement to meet the aspirations of its users. What is being contended is the reason for this inadequacy. It neither stems from the absence of Ghana Card from the scene nor from the lack of conceptual recognition that reporting must improve.

Forcing through more data-sharing across the government ecosystem, however, runs the risk of coming foul of privacy restrictions in the credit referencing/scoring law itself. As the regulations clearly say, consent is key except in cases of aggravated default.

The idea that the Citizen App Credit Scoring system will simply hoover data from all over the place and serve it through an online system is contrary to law as section 14 of the regulations clearly state that any provision of data to a credit bureau or agency must be by consent. The situation would not be different for a government app.

What about the suggestion to move from “referencing” to “scoring”

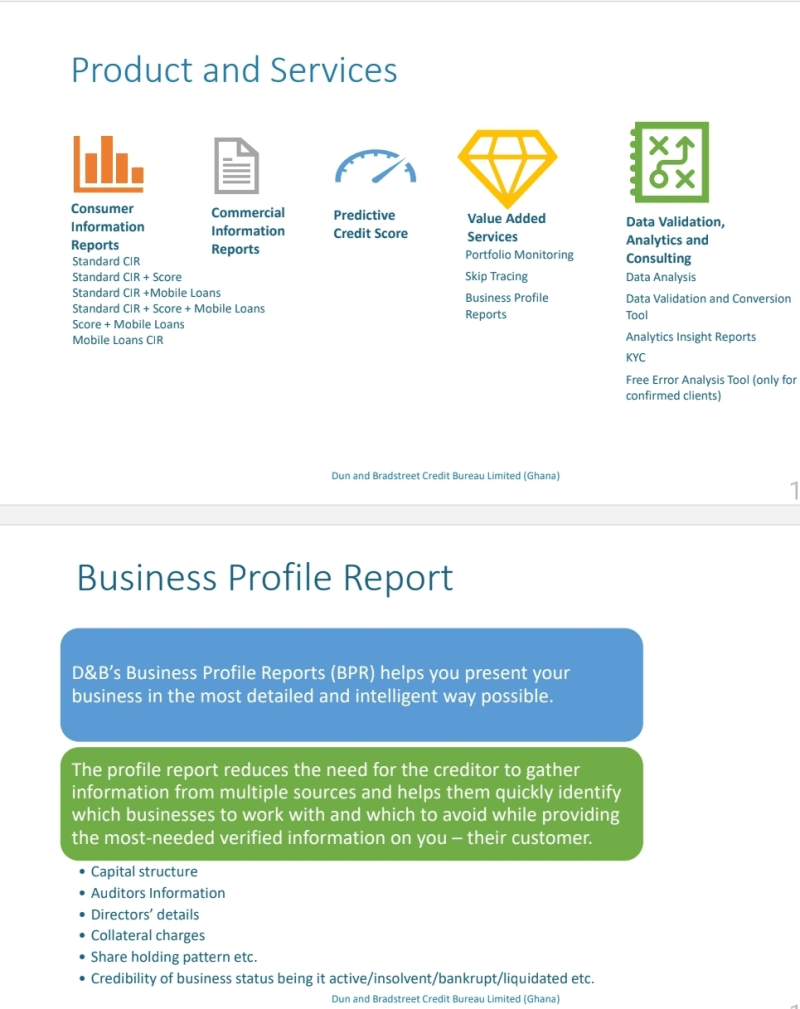

First, the current credit bureaus have the capacity to produce individualised credit scores and do issue them. Dun & Bradstreet (D&B), for instance, was founded in 1841 and has had a long time to perfect its craft. It is probably the leading credit scorer of businesses worldwide, and its proprietary Paydex system is widely known. It would make no sense for D&B to set up a subsidiary in Ghana and not provide it with scoring capacity so long as data providers make the data available. D&B regularly markets its products to financial institutions and affirm its ability to generate scores, as attested to by the brochure extract below.

The credit bureaus provide an online avenue for anyone to apply and access their reports. Nonetheless, because the law requires that they provide a free report annually to individuals, there is no business incentive in it for them to focus on “self-reporting”, with the end result that last year, only about 500 people requested for their reports and the embedded scores. In these circumstances, it is not surprising that the vast majority of Ghanaians don’t know their credit scores (bearing in mind, of course, that even in the US, some surveys show up to 61% of respondents not knowing their scores).

The bureaus focus on marketing to commercial entities who pay per use. Efforts to develop subscription products have been very challenging and credit transaction volume is still quite low, limiting the number of paid hits from which the bureaus make their money (still, the volume in Ghana is 9x that in Uganda).

It is perplexing however for some commentators to insist that there is no credit scoring per se in Ghana despite the abundance of evidence. Even lenders targeting the low-end of the market feature their stance on credit scores in their promotions.

The bureaus also attempt to educate the public on their websites.

It will be curious to know how the likes of Thomas Blankson and others at XDS who have been labouring since 2014 to enhance local credit scoring would think of this. Or how those who have to ensure the privacy and security compliance of the system, like the Isaac Benings of this world, think of this whole debate. But given the political sensitivity, public commentary is too much to expect from the bureaus themselves.

Anyway, no one can force a creditor to make a credit decision

Because technical judgement goes into the quality of a credit reporting system, competition is essential. Lenders need to be able to switch a credit scoring provider if their predictions of credit risk over time do not align with the reality as perceived by the lender.

And whilst the law says that the lender must obtain a credit report before making a decision, it cannot force the lender to rely on any one report, score or formula to determine who is likely to pay or not. At most, it can seek to prevent deliberate discrimination or other unlawful behavior. In the end, however, every institution is responsible to its shareholders for making sound credit decisions.

That is why regardless of the existence of credit bureaus, all serious lenders and businesses exposed to counterparty risk develop their own internal systems to protect their business.

The process of how MTN Ghana models the credit risk of its Qwik Loan borrowers is so interesting that it bears posting in full an extract from Vincent Guermond’s fascinating 2022 survey of the subject.

Yes, in case you missed it, dear reader, some telco operators are going to the extent of using battery power levels to improve their ability to model credit risk.

It would be arrogance of the worst sort for any government to believe that it can budge in and outperform frontline economic actors with skin in the game as to how to manage risk. What the government can obviously do is to improve the overall macroeconomic environment, strengthen privacy-preserving data-sharing in the ecosystem by making and enforcing the right regulations, and use its convening power and moral authority to promote innovative thinking by key decision-makers.

So, is there no way Ghana can be creative for its own needs in this area?

There are indeed scholars, analysts, and visionaries who have questioned the traditional credit referencing approach given the peculiar nature of the African economy.

For example, Management Professor Marc Epstein and then Opportunity International CEO, Christopher Crane after field research in Ghana wrote a paper in 2005 (later added to the compilation, “Business Solutions for the Global Poor”), containing some ideas of how credit risk management needs modification to better suit contexts such as Ghana’s. This foundation was built upon in 2013 by Nigerian academics into a framework that has yet to be translated in the real world.

Building novel credit scoring systems that adapt well to the African terrain would likely be the product of entrepreneurial thinking among competing credit scoring providers than something that emanates from government fiat. It would require even greater objectivity and impartiality on the part of the government to enforce regulations that level the playing field so that the best ideas can emerge. The government picking and choosing winners in such a fraught and complex domain will likely lead to technical obsolescence and the lost of trust in the reliability of the system.

For example, the government has made its policy intent clear that it wants to promote more credit to consumers regardless of station. The truth however is that for businesses the aim is to find profitable customers, not just any customers. If the sense grows that the government is motivated by electoral outcomes in boosting credit regardless of ability to afford credit, businesses will simply disregard the state-controlled credit-scoring system and rely even more on their internal systems, defeating the purpose of removing information asymmetries in order to lower the risk perception and thus the cost of credit.

What is the fear or harm though?

So, maybe an extra credit scoring mechanism would be redundant, so what? Ungrounded overenthusiasm on the part of politicians is an inalienable part of the political system, why should people fret too much? This author was rattled by the announcement to launch a credit scoring system anchored on the Ghana Card and accessible through the Citizen App because it follows a worrying pattern.

Because the Ghana Card system is extremely expensive and dominated by the private half of the putative Public-Private Partnership model, a lot of decisions of how, where and why to use it for what and which purposes tend to be driven by whether it will lead to more people opting to pay the hefty fees to acquire cards on a premium basis.

The private investor, who has been assured of hundreds of millions of dollars in financial return (with government exposure to the partner in the next few years alone topping $100 million besides the government’s own costs of personnel and vehicles etc. for the enrollment aspect) constantly scans the economy for opportunities that they can muscle in using the Ghana Card as mere pretext.

That is the only way to explain why and how the Ghana Card gets injected into scenarios where it is either redundant or useless all the time in recent times. Sometimes, real damage can result.

Last year, Ghana’s already beleaguered football league nearly suffered a fit when, totally inexplicably, a decision was taken that footballers and their clubs will be denied registration if they did not enroll onto the Ghana Card. Similar wooly-headed interferences by the Ghana Card, where it adds no clear value, are distracting from serious stuff.

The country is in the middle of transitioning from a model where people own their own liquefied petroleum gas (LPG) cylinders and fill them at various dispensing points to one where the cylinders are picked up from a few select points and returned empty for a full or partially full one. The whole model has been fraught with stakeholder disquiet and operational confusion.

Yet, rather than concentrate on fixing the incoherence of banning the filling of self-owned cylinders at retail points whilst promoting the pickup of cylinders at circulation depots, where there will still have to be instant filling to allow for different volumes to be sold, the downstream gas operator is instead insisting that gas will not be sold to citizens without Ghana Cards. Knowing very well that millions of Ghanaians do not have the card and can only get one within a reasonable timeframe if they pay through the nose at a so-called “premium center“.

As should be clear from the above, the Ghana Card has no exceptional role to play in enhancing Ghana’s credit scoring system. This is so painfully obvious as to be mind-numbing.

If the government insists on going ahead with the idea of launching a new credit-scoring system accessible through the Citizen App, instead of just adding a simple, non-revolutionary, button in the user interface for a citizen to request their current scores from the bureau, purely as a matter of convenience, then we will have to take counsel from an old Igbo saying. It is said that when you see a toad in broad daylight, you must focus on what must be pursuing it.

- Advertisement -

- Advertisement -

- Advertisement -