Ghana positioned 7th among 10 African countries most indebted to the IMF; Egypt ranks first with $11.9bn debt

While these measures are intended to address fiscal imbalances, they can lead to social unrest and adversely affect vulnerable populations. These complications can also seep into the country’s exchange rate, making local currencies weaker than they should be.

- Advertisement -

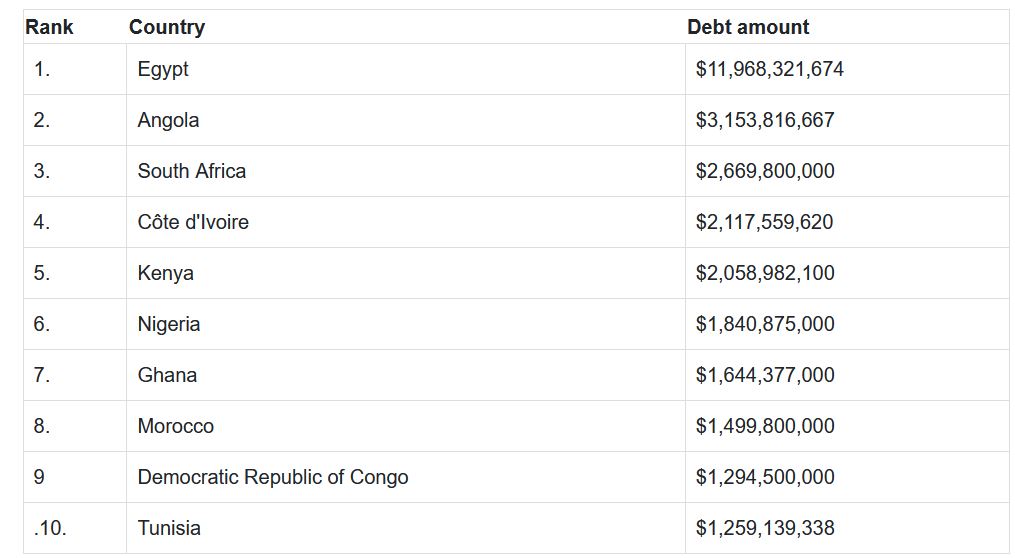

Ghana, per data on the IMF’s official website as at December 6, 2023, was ranked the seventh (7th) African country most indebted to the IMF.

This is per a list of the ten (10) most indebted African countries to the Bretton Wood Institution.

- Advertisement -

Per the data provided, Ghana owes the IMF some $1.6bn, closely behind Nigeria which owes the Fund some $1.8bn.

- Advertisement -

Egypt topped the list with some $11.9bn owed to the Fund.

The International Monetary Fund (IMF) is a key player in global finance, offering monetary assistance to governments suffering economic difficulties. However, these loans from the IMF can have deep and varied effects on their economy. These effects are felt in some parts of Africa, particularly in regions where the debt is unsustainable.

Typically as a last resort, countries often turn to the IMF in times of economic crisis to stabilize their financial systems. These loans help cushion the economic adversities said countries may be going through.

Loans from the global financier can also help buff the country’s finances until they can come up with a more sustainable solution to their economic problems. And, additionally, a loan from the IMF can boost a country’s credibility in the eyes of foreign investors. This rise in trust may result in higher foreign direct investment and better access to global capital markets.

However, these loans if not managed or utilized properly could hurt an economy. Aside from the fact that debts owed in general can cause financial stress in any economy, as it represents an expense that the country must take responsibility for, IMF loans often come with stringent conditions, including austerity measures such as reducing public spending, cutting subsidies, and implementing tax increases.

- Advertisement -

While these measures are intended to address fiscal imbalances, they can lead to social unrest and adversely affect vulnerable populations. These complications can also seep into the country’s exchange rate, making local currencies weaker than they should be.

With that said, below are the 10 African countries with the highest debts to the IMF, courtesy of the IMF’s official website.

10 African countries with the highest debts to the IMF.

With files from businessinsiderafrica.com

- Advertisement -