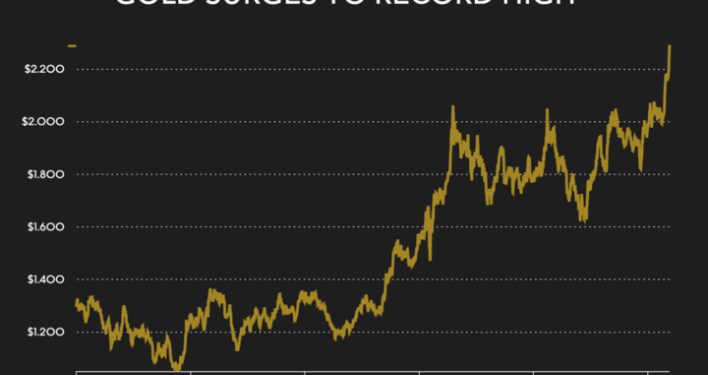

Gold price rises above $2,300 shattering all-time high

Gold, a hedge against inflation and a safe haven during times of political and economic uncertainty, has climbed over 11% so far this year, helped by strong central bank buying and safe-haven demand.

- Advertisement -

Gold rose to another record after Federal Reserve chair Jerome Powell signalled policymakers will wait for clearer signs of lower inflation before cutting interest rates.

Powell said recent inflation figures — though higher than expected — didn’t “materially change” the overall picture, according to the text of a speech at Stanford University in California.

- Advertisement -

He reiterated his expectation that it will likely be appropriate to begin lowering rates “at some point this year.”

- Advertisement -

Treasury yields and the dollar pushed lower, boosting bullion by as much as 0.6% to a new all-time high of US$2,295.25 an ounce.

US gold futures, meanwhile, crossed the US$2,300 mark, up 1.4% at US$2,313.60 per ounce.

While Powell reiterated the Fed’s wait-and-see approach before lowering borrowing costs, the US central bank’s path to cut rates is unchanged despite recent inflation figures.

That’s “very gold positive as it suggests that the Fed will cut significantly before the inflation target is reached,” said Bart Melek, global head of commodity strategy at TD Securities, in a Bloomberg note.

- Advertisement -

Investors are still expecting a first rate cut at the Fed’s June 11-12 policy meeting, even as the stronger recent economic data has sown investor doubts about that outcome.

The US jobs report for March is due to be released on Friday, with new inflation data coming next week.

A pair of Federal Reserve policymakers said on Tuesday they think it would be “reasonable” for the US central bank to cut interest rates three times this year.

“The likelihood of rate cuts is still there, but the data is still really strong. This is an election year, so I don’t think the Fed will want to be held accountable for any kind of market crash,” Daniel Pavilonis, senior market strategist at RJO Futures, told Reuters.

Gold, a hedge against inflation and a safe haven during times of political and economic uncertainty, has climbed over 11% so far this year, helped by strong central bank buying and safe-haven demand.

Despite the metal’s scorching rally, gold’s biggest producers remain somewhat muted in recent trading sessions. Newmont, for example, edged only 0.6% higher by midday Wednesday.

Source:norvanreports

- Advertisement -