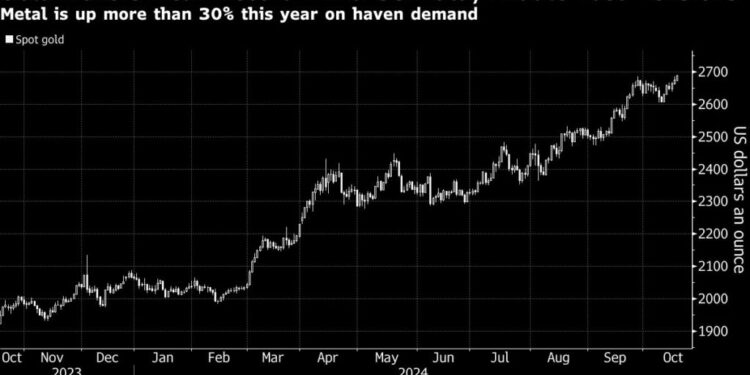

Gold Price Sets New Record High on US Election Uncertainty, Monetary Easing

On top of the concerns in the Middle East, you are also nearing the US election, which is looking like a very closely contested election.

- Advertisement -

Gold set a record high on Thursday as uncertainty surrounding the US election and rising Middle East tensions prompted higher demand for safe-haven assets, while easing monetary policy environment also kept prices elevated.

Spot gold hit an all-time high of $2,696.62 per ounce earlier before pulling back to $2,686.52 at noon ET for a 0.5% intraday gain. US gold futures saw a similar increase, trading at $2,704.80 per ounce in New York.

- Advertisement -

Bullion has now risen by more than 30% this year, setting multiple record levels along the way, with the precious metal driven by prospects of further Federal Reserve rate cuts and ongoing geopolitical risks.

- Advertisement -

“On top of the concerns in the Middle East, you are also nearing the US election, which is looking like a very closely contested election. And that generates a whole host of uncertainty, and gold often is the place to go in times of uncertainty,” said Nitesh Shah, commodity strategist at WisdomTree, in a Reuters note.

Prices are expected to rise even further to as high as $2,941 an ounce over the next 12 months, delegates to the London Bullion Market Association’s annual gathering predicted earlier this week.

- Advertisement -

“The LBMA poll that came out from Miami earlier in the week, where the base look for gold prices was to rally near $3,000 in the next year and silver doing even better, I think that potential is also just attracting a bit of attention,” commented Ole Hansen, head of commodity strategy at Saxo Bank.

Earlier in the session, prices had backed off from record highs after data showed US retail sales increased slightly more than expected in September, while a Labor Department report said unemployment unexpectedly fell last week.

The data points added to a slew of mixed economic readings recently, reinforcing gold traders’ expectations that the US central bank will continue its rate-cutting path for the rest of the year.

“These were good data points,” noted Bob Haberkorn, senior market strategist at RJO Futures. “I think the Fed wants to get rates lower and they probably have another quarter point coming here at the very least before the end of the year, which is rates get lower, gold should get stronger.”

Source:norvanreports.com

- Advertisement -