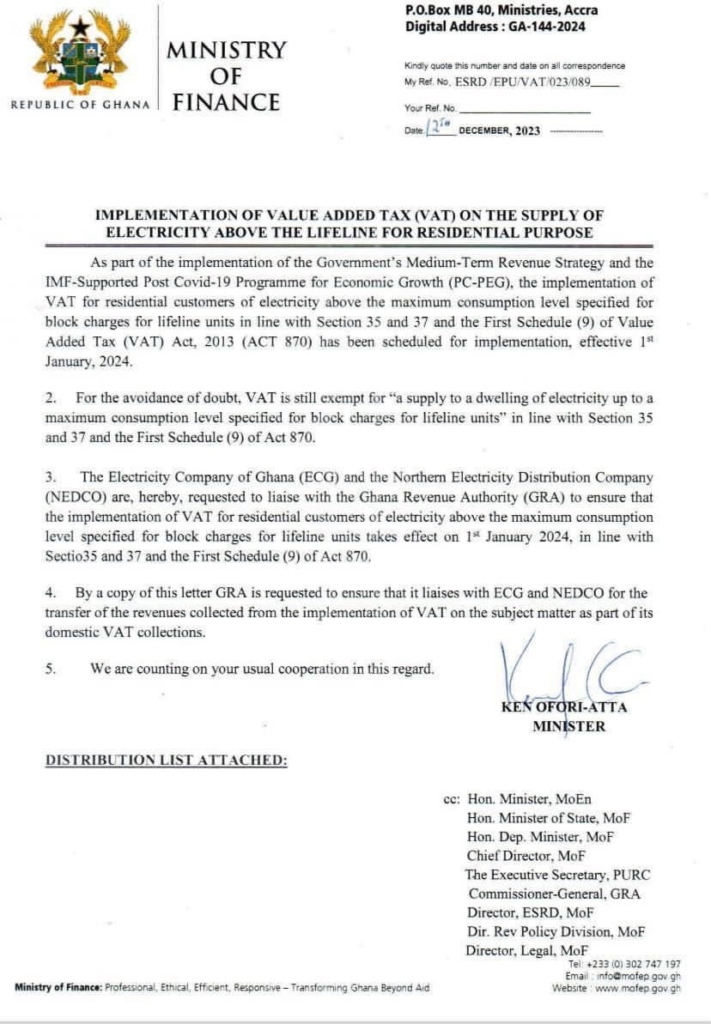

Government introduces VAT on excess electricity consumption

“By a copy of this letter, GRA is requested to ensure that it liaises with ECG and NEDCO for the transfer of the revenues collected from the implementation of VAT on the subject matter as part of its domestic VAT collections,”

- Advertisement -

In a notable fiscal policy shift, Ghana’s Finance Minister, Ken Ofori-Atta, has mandated the implementation of Value Added Tax (VAT) on households exceeding their prescribed lifeline power consumption levels, effective January 1, 2024.

In a directive that underscores the government’s drive to bolster revenue streams, the Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO) have been instructed to collaborate closely with the Ghana Revenue Authority (GRA). The objective is to ensure the seamless imposition and collection of VAT on consumers who breach the established consumption thresholds for lifeline units.

- Advertisement -

Citing the legislative underpinning for this move, the Minister invoked Sections 35 and 37, along with the First Schedule (9) of Act 870, signaling that the initiative is firmly rooted in existing legal frameworks. This regulatory clarity aims to preemptively address potential ambiguities, ensuring adherence to statutory guidelines.

- Advertisement -

This strategic fiscal adjustment emerges against a backdrop of evolving economic imperatives, as Ghana seeks to optimize its revenue collection mechanisms.

“The Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO) are, hereby, requested to liaise with the Ghana Revenue Authority (GRA) to ensure that the implementation of VAT for residential customers of electricity above the maximum consumption level specified for block charges for lifeline units takes effect on I” January 2024, in line with Section 35 and 37 and the First Schedule (9) of Act 870.

- Advertisement -

“By a copy of this letter, GRA is requested to ensure that it liaises with ECG and NEDCO for the transfer of the revenues collected from the implementation of VAT on the subject matter as part of its domestic VAT collections,” read parts of the statement.

Read details of statement below:

- Advertisement -