IMANI Alert: New Information – How Communications Ministry raped Ghana through the Kelni-GVG sham

IMANI views the value-for-money issues it raised against the contract as unresolved. In this brief report, we shall therefore catalogue the key problems with the entire process that led to the award of the contract; and show how the chronology, the procedures adopted, the evaluation of tenders, and the final outcome all point to a SHAM

- Advertisement -

In May of this year (2018), IMANI began issuing a series of alerts and reports on the decision by the Ministry of Communications (MOC), acting in concert with its technical agency, the National Communications Authority (NCA), to award a 10-year contract worth nearly $180 million to an entity known as Kelni GVG.

In June of the same year, a Principal of IMANI, Kofi Bentil, acting as a public interest lawyer, commenced multiple lawsuits, on behalf of Maximus Amertogoh and Sara Asafu-Adjaye against the Ministry of Communications on grounds of financial maladministration and threats to privacy. A totally separate legal action was also underway by a company called, Subah, meant to injunct the take-off of the Kelni-GVG contract on the grounds that the contract infringed on Subah’s existing contract with the government which, to its mind, had been unlawfully abrogated.

IMANI supported the actions of Kofi Bentil, and was indifferent to the case of Subah since we had different perceptions about the whole approach to “telecom taxation revenue assurance” that Subah believed in. In short, IMANI does not accept this whole notion of paying millions of dollars to companies to prevent tax evasion by telecom operators because the whole technology model is questionable and the evidence over more than a decade shows that Ghana has never been able to use these systems to improve revenue collection from telcos, despite their costing millions of dollars. The whole enterprise has become a wicked gravy train that needs to be stopped.

Kofi Bentil’s lawsuits were met with a remarkable degree of resistance, evasiveness, delay tactics, and verbal aggression by the Ministry of Communications. It has become clear over the last four months, that the Ministry has absolutely no intent of behaving with the high ethical standards and decorum expected of a public office, and that pursuing this matter through the courts would likely take years.

Unfortunately, Kofi Bentil has limited pro bono capacity, and IMANI’s attempts to solicit donations from the public to minimise his costs have not been successful. In the absence of conditions favouring public interest litigation in Ghana, especially when the issue at stake involves multiple layers of bureaucratic misconduct, we were not surprised to hear from Kofi Bentil that, under the circumstances, a settlement was the most efficient end to the court proceedings. IMANI congratulates Kofi, Maximus and Sara for the remarkable success of securing concessions on privacy protection from Kelni-GVG and its enablers, the MOC.

IMANI views the value-for-money issues it raised against the contract as unresolved. In this brief report, we shall therefore catalogue the key problems with the entire process that led to the award of the contract; and show how the chronology, the procedures adopted, the evaluation of tenders, and the final outcome all point to a SHAM ARRANGEMENT DESIGNED SOLELY TO RAPE GHANA. We will then outline our strategy to compel an improvement in the value for money content of the current situation. Whilst the legal case is being settled, the ethical-financial administration case against Kelni shall continue to gather momentum until a comprehensive settlement is reached.

Here is the main chronology of events.

August 15th, 2012

- Agreement between Global Voice Group, a Seychelles-registered company, and Subah Info-solutions is executed.

- GVG assigned its rights, title and interest in a contract signed with the National Communications Authority (NCA) on March 11, 2009, for the implementation of a “Consolidated International Gateway Project Management” service.

- Through this agreement GVG assigned or “sold” the contract they had with the Republic of Ghana to Subah for $12 million.

2nd February 2015

In 2015, GRA renews the subsisting contract with Subah but NCA writes soon thereafter to GRA explaining that the necessary “legal regime is not in place” even though Subah has already commenced operations under the “new dispensation”. NCA provides a “supplementary agreement” to give “legal effect” to the engagement between Subah and NCA, thereby regularising a tripartite arrangement between Subah, GRA and NCA.

In the supplementary agreement, Subah was to build a common monitoring platform for the NCA and GRA using an “out of bound signal transfer point architecture”.

NCA was to bill network operators, collect monies due to government in respect of international, inbound, electronic communications traffic, and then pay a portion of the amount collected to Subah as monthly fees against invoices issued by the latter.

August 7, 2017

Letter from Ministry of Communications to the Director-General (DG) of the NCA, Joe Anokye, signed by Minister Ursula Owusu-Ekuful reminding the DG that in March 2017 a decision had been taken at a stakeholders’ consultation forum chaired by the Senior Minister to implement a common platform for NCA and GRA, but with the NCA taking the lead in the establishment of the platform because of its technical capacity. In the letter, the Minister of Communications said the participants at the meeting had agreed that the responsibility for this platform should be removed from both Afriwave and Subah. Recall that in 2015, the NDC had introduced Afriwave into the picture, thereby splitting the telecom tax assurance program into two, one administered by the GRA and operated by Subah, and the other administered by the NCA and operated by Afriwave.

11th August 2017

Joe Anokye writes to Minister Owusu-Ekuful accepting the responsibility to procure the “Common Monitoring Platform” from a vendor by a “selective tender process”. We presume “selective” here was intended to mean “restrictive” or “restricted”.

31st August 2017

NCA seeks approval from the Public Procurement Authority (PPA) to use restricted tendering for the purpose of procuring this “Common Monitoring Platform” (CMP). The use of “restricted tendering” was proposed as the only viable path forward as the CMP is a highly specialised endeavour and only a few companies in Ghana can hope to build and manage it. In the same letter to the PPA, the NCA DG claims that the Authority had conducted an extensive background search on the 4 companies it was recommending to the PPA for approval based on their track record offering similar services as those which it intends to solicit through the tender. This is a very crucial point, and the reader is asked to bear it in mind as the entirety of IMANI’s case rests substantially on it.

11th September

PPA issues approval for ONLY the 4 companies to be invited by the NCA for restricted tendering.

15th November 2017

NCA issues bidding documents to the four tendering companies, which are

- 3D TV Properties Limited/Opertech Solutions

- Aeon Logistics/SGS

- Kelni Ltd/GVG

- Atlantic Assets Limited/Telsig

Notice that the “subcontractors” of these companies are mentioned after the slash, but not as joint venture partners. We will explain why that point matters later in this report.

30th November

The four lucky companies sent the following representatives to the opening of bids at the NCA:

Rouba Habboushi – Kelni Ltd. (this representative is also associated with the Yellow Butterfly Company, which we have been investigating in relation to allied matters)

Frederick Yemoh – 3D TV Properties Limited

George Tagoe – Aeon Logistics Limited

Peter Hoyah – Atlantic Assets Limited

The NCA had constituted an entity tendering committee comprising of the following persons:

Kofi Datsa – IT Lawyer

Kofi Ntim Yeboah-Kordieh – Electronic Engineer

Roland Kudozia – Core Network Engineer

Mohamed Amin Suleman – IT Engineer

David Gyapanin – legal procurement specialist

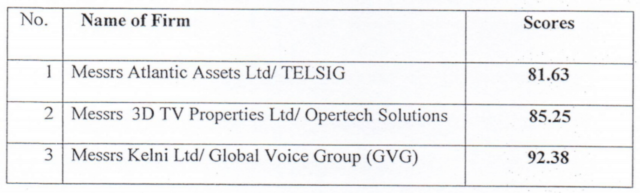

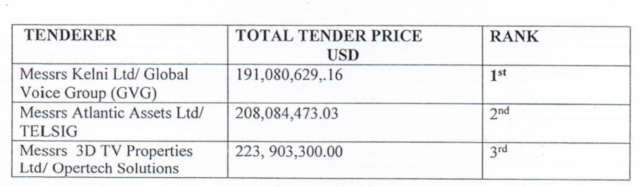

The evaluation of the bids by the committee yielded the following results:

Technical

Financial

4th December (Monday)

Following a Meeting of the Entity Tender Committee held at the NCA Boardroom, Joe Anokye and Abena Asafu Agyei, Head of Procurement at the NCA, moved to advance the process.

5th December 2017 (Tuesday)

George Andah, Deputy Minister of Communications, writes to Charles Taylor of the Central Tender Review Committee (CTRC) with copies of the “Evaluation Report” of the tender held pursuant to the “concurrent approval” issued by the CTRC and solicits ratification for the process.

X December 2017

On a letter with a tampered date (our analysis show that the letter was written sometime between 4th December and 14th December) that appears to be a cross between 4th, 13th and 14th December, David Quist, Secretary to the CTRC wrote to Minister Owusu-Ekuful to inform her that an emergency meeting had been held on the 11th of December 2017 to approve the evaluation report and therefore that approval to enter into an agreement with the selected vendor was therewith issued.

CTRC asked for a Ministry of Finance approval since the contract was multi-year and also demanded to see results of negotiations with the vendor prior to final approval.

14th December 2017 (Thursday)

MOC is purported to have written a letter to the Ministry of Finance (essentially the same day that the letter from the CTRC letter is supposedly dated) asking for approval.

19th December 2017 (Tuesday)

Minister of Finance writes to grant approval. Not a single explanatory memorandum was annexed to the request for approval. One wonders how the decision was made.

20th December 2017 (Wednesday)

MOC writes to CTRC with its assurances that the Ministry of Finance had granted approval. No information whatsoever about the results of the negotiations were provided.

22nd December 2017 (Friday)

David Quist writes to inform the MOC that at a meeting of the CTRC the day before, during which the “outcome of negotiations” and the Ministry of Finance’s approval had been reviewed, the committee was disposed to issue approval. Even though a pending petition showing that the Ministry is acting illegally had also been sighted, the CTRC was nevertheless of the mind that the process needed to progress.

27th December 2017 (Wednesday)

Right after boxing day, the contract with Kelni-GVG is signed.

Abuses & Concerns

- The first thing noticeable about the chronology outlined above is the haste with which very complex evaluations of a $178 million dollar contract were supposedly conducted. In virtually all cases, no real due diligence information was available to the authority making the decision to approve or reject. For example, the Ministry of Finance received a letter on Friday asking it to consent to a multi-year contract valued at nearly $180 million, with ABSOLUTELY NO financial due diligence of the proposed EPC structure, and yet two working days later the Minister had been able to take a decision to sign. Anyone with even the barest notion of how government works in Ghana would appreciate the job queue in the average ministerial office, not to talk of the Finance Ministry of all places. Clearly, there was no intent to conduct due diligence. This problem is rampant across the chronology.

- Despite a pending petition from Subah alleging in very strong terms the illegality of the entire proceedings, the CRTC does not bother even once to invite comments on the matter even as the process is rammed through from emergency sitting to emergency sitting (note that the CRTC would normally meet once or twice a month and by law must meet at least once every three months).

- On 16th January 2018, barely three weeks (less than 14 working days) later, the Attorney General was compelled to write to Kofi Nti, Commissioner General of the GRA, regarding a petition received from Mercer & Company on behalf of Subah in respect of a purported termination of its contract and award of the same contract to a foreign company. This letter was ignored even though the Attorney General had clearly advised that the letter of termination sent on 25th April, 2017 and meant to take effect on 5th May 2017, did not satisfy the 3-month notice indicated in the contract, and that the 11-day notice was clearly in breach of the contract. The notice from the AG was very clear that should Subah decide to exercise its rights at law, financial liability to the state could not be averted. Yet, this was ignored even as the MOC, with the connivance of the CTRC, rammed through the process. Any settlement with Subah today would have financial implications for the project.

- Above everything else, however, is the actual conduct of the “restricted tender”. Our checks at the Registrar General confirmed our fears when we originally reviewed the documentation available on the Kelni case. None of the four companies deliberately invited to the tender had any track record in the field of telecom revenue and traffic monitoring for which reason a restricted tender was warranted. Not surprisingly, in section II 5.5(b) of the restricted tender guidelines, the NCA mischievously relaxed the requirement that the successful tenderer should have at least 3 years minimum track record. Luckily, for this country, they were unable to remove the 5.5(e) requirement that the successful tenderer shows evidence that they have 10% of the contract price in the form of liquid assets or credit facilities. Despite this requirement forming part of the evaluation criteria, as per section v (qualification information) clause 1.8 of the guidelines, no evidence was collected to confirm that any of the four obscure companies met this very clear stipulation.

- Further evidence that the purported “background research” used to justify the selection of ONLY the four companies to participate in the sham tender was completely inept came to the fore when the purported technical partner of Aeon Logistics – SGS – disclaimed any association and refused to participate in the sham proceedings. The principle here is that: in a tender evaluation of this kind, it is not purported subcontractors or alleged “partners” that matter, but rather the tendering companies whose incorporation, tax, and other identification documents/information have entitled them to participate in the bid. The informal use of the names of alleged “partners” or potential/future subcontractors to bolster the credibility of weak tenderers is heavily open to abuse and thus in contravention of all norms of public procurement. We have been exhaustive in past commentary about Kelni Ltd, so we will in this report only focus on the other three companies invited to the tender:

- Aeon Logistics was incorporated in 2014 to provide services in general logistics and ICT consultancy with paid-in capital of 5000 GHS. It says its principal place of doing business is Hse No. E249, Tumu Avenue in Kanda (picture below).

![]()

Two days after Minister Owusu-Ekuful’s letter to the NCA asking for the procurement of the CMP, the founders of Aeon Logistics sold their non-trading enterprise to Ms. Awura Adwoa Anie-Budu, a fresh law graduate and friend of Fritz Salewa, an Obafemi Awolowo grad working as a supporting paralegal at Integrated Legal Consultants, who became the second director. The total amount paid in the transaction was a grand total of 5000 GHS. That was how much the company was worth on the eve of the tender, and yet Aeon was selected as one of only four companies in Ghana suitable to bid for the project. Let that sink in. Checks at SSNIT leads us to conclude that at this time Aeon Logistics had no full-time employees, and still doesn’t. So who is it that found Aeon and decided that they needed to be invited to participate in a restricted tender for a $179 million project to monitor sophisticated telecom companies in Ghana?

- 3D TV Properties was incorporated in 1995 and is authorised to trade in the construction, general merchandise, telecoms and broadcasting sectors. It has never acquired any licenses in the telecom and broadcasting industries, a regulated sector where licenses are prerequisites of business, and has indeed been comatose for many years. Its only shareholder is Yvonne Yemoh, who contributed the 10,000 GHS share capital during the formation. The second Director is Christopher Amanortey of Akosombo Chambers. 3D TV also has no full-time employees. What is even more fascinating, it was only AFTER the PPA had approved the inclusion of the company’s name in the list of pre-qualified tenderers that, on 26th September 2017, the company modified its objects to include telecoms. Who did the research that turned up 3D TV Properties as one of the few companies in Ghana that could undertake this $179 million contract?

- Atlantic Assets Limited was represented during the tender, if you would recall, by Peter Hoyah, another paralegal at Integrated Legal Consultants, the same entity whose paralegal serves as a Director at Aeon. It was founded in 2011 with share capital of 15000 GHS by Isaac Emmil Osei Bonsu and Laura Anastasia Akuoko for the primary purpose of investing in real estate. Isaac Osei Bonsu is a well-known lawyer with Minkah-Premo, who has investments in various properties in Ghana. “Atlantic Assets Limited” nevertheless had no background whatsoever in the telecoms industry, much less in signals processing, and could not have surfaced in an objective search for companies with the capacity to deliver a $179 million project.

- None of the GRA officials purported to have been part of the evaluation panel actually participated. This was strange indeed considering that the CMP was justified as a means to unify GRA and NCA revenue assurance processes and practices.

- Mohamed Amin Suleman, a former employee of Global Voice Group, continued to participate as an evaluator in these proceedings when he should have had the professional sense to recuse himself. The question is: why was he empanelled in the first place by the NCA?

- The technical proposal from Kelni Ltd, which was adjudged as most superior by the compromised entity tender committee was replete with sheer technical skulduggery. Multi-protocol packet analysers were deliberately obfuscated and renamed as multiple, separate, hardware and software packages in order to bamboozle and confuse, thereby justifying millions of dollars for capital investment that simply cannot survive even the most rudimentary of technical audits. Some of the most egregious entries include:

CNMP Probes Simon Series 2000

USSD Filtering & Monitoring Engine

SMS Classification & Monitoring Engine

CAMEL/DIAMETER Filtering & Monitoring Engine

SigTran Monitoring Engine

These redundant, mis-specified, facilities were listed as costing over $700,000 for each site.

- As IMANI has demonstrated severally in the past through our written and oral commentary, the proposed infrastructure plan for the SS7 and sigtran monitoring, which undergirds the whole CMP effort, was bloated and inflated by several millions of dollars, as was the operational and management plan. This was done with the full connivance of the Entity Tendering Committee, which is why it produced no technical report to justify any of the planned expenditure given the task at hand. Not a single technical opinion was written to show any effort at all to review the proposed architectural design and topology. Ghana’s money was just poured down the drain.

- At the CRTC level, unconscionable failures compounded the farce. The restricted tender awarded to Kelni Ltd was not published in the Public Procurement Bulletin contrary to section 39(2) of the Public Procurement Act (the electronic version of the PPB is available for anyone to check: https://www.ppaghana.org/rt-contracts_results.asp?Agency=%25&ppb_date=356&Submit=Search&offset=50). None of the serious questions that should have been asked were asked. And nearly $180 million of the country’s precious resources were allowed to sink down the drain of ineptitude.

IMANI has decided, therefore, to refer this whole matter to CHRAJ.

Given the challenges with the court system we outlined at the beginning of this report, going to CHRAJ is the most cost-effective route in these circumstances.

Our primary complaint is that a “restricted tendering” process presupposes extensive due diligence before the public tenderer can conclude that only the companies being invited possess the rare combination of capacity and experience to undertake a particular assignment. Without that safeguard, the process is heavily open to abuse.

We insist, based on our research, a part of which we have summarised in this report, that the decision to restrict such a major tender, valued at such a huge sum, and one that had no restrictions on the nationality of tendering entities, to four companies with no track record managing operations of similar technical complexity as the assignment in view was part of a deliberate effort to conduct sham proceedings just to favour preferred vendors.

This conduct amounts to abuse of office and administrative malfeasance. We do not believe that any objective assessment of the obscure companies invited to tender was conducted. Their selection was a ruse meant to facilitate a preconceived conclusion.

It is very important to bear in mind the wording of the law on this issue. A restricted tender is only justified under the following conditions:

(a) if goods, works or services are available only from a limited number of suppliers or contractors; or

(b) if the time and cost required to examine and evaluate a large number of ten

A CHRAJ investigation is thus warranted.

If, however the MOC, NCA and Kelni-GVG are open to further negotiations with a view to improving the value for money situation, the remedy we intend to seek from CHRAJ can be obtainable from a comprehensive settlement now that Kofi Bentil has made progress on the privacy front. The whole point of sound public procurement, after all, is to arrive at the best value for money decision.

We shall update the public in due course.

- Advertisement -

- Advertisement -

- Advertisement -