Kenya Exits IMF Program, Infuriating Investors

The upshot is that a planned IMF review of the state’s finances has been called off and it won’t pay out a final $850 million. The writing appears to have been on the wall for some time, though, and the authorities have been lining up other funding to plug the hole in the budget.

- Advertisement -

Kenya has fallen foul of the International Monetary Fund and investors are none too happy about it.

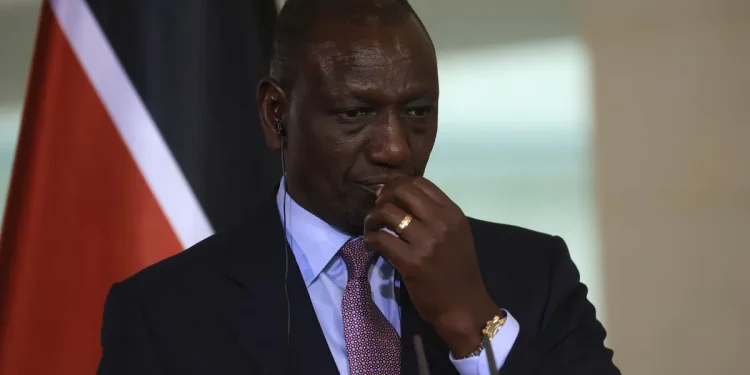

Under a $3.6 billion funding program signed in 2021, the East African nation undertook to curb spending and bolster tax collection, but the government failed to meet its obligations. President William Ruto’s administration tried to bring in new taxes last year, but backed down after deadly protests.

- Advertisement -

The upshot is that a planned IMF review of the state’s finances has been called off and it won’t pay out a final $850 million. The writing appears to have been on the wall for some time, though, and the authorities have been lining up other funding to plug the hole in the budget.

- Advertisement -

A $1.5 billion loan was negotiated with the United Arab Emirates — a facility that could potentially inflate state borrowing beyond the level agreed with the IMF and carries foreign-exchange risks.

The government has also rearranged a eurobond, pushing its maturity out by 11 years, enabling it to settle some expensive syndicated loans.

The announcement that the IMF program had been terminated sparked a selloff in Kenya’s foreign debt and the shilling. While the state is discussing an alternative arrangement with the Washington-based lender, the potential terms remain unclear.

- Advertisement -

Any funding arrangement that fails to ensure public finances are kept in check is likely to stoke further unease in the financial markets and weigh further on the country’s bonds, according to Patrick Curran, a senior economist at Tellimer.

Ruto has steeled himself against any political fallout, agreeing a power-sharing pact with his main rival Raila Odinga. That should help any budgetary measures he proposes get through parliament and bolster his changes of winning a second term come 2027 elections.

Still, he may not want to test the public’s appetite for drastic tax changes.

Source: norvanreports.com

- Advertisement -