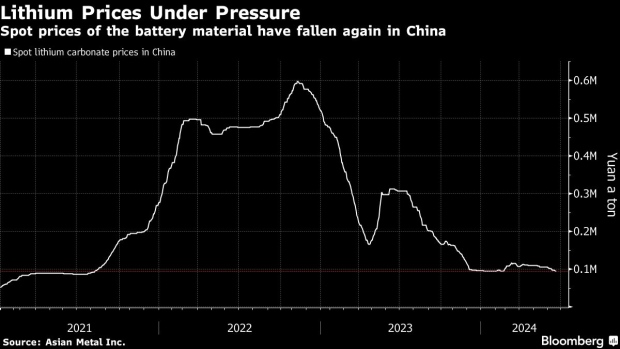

Lithium’s ongoing slump has traders searching for recovery signs

Still, some traders said they see limited downside in prices, which have already been squeezing the margins of some higher-cost producers. Contracts in Guangzhou for July are the cheapest on offer, suggesting a bottoming out during summer.

- Advertisement -

Lithium industry watchers hoping the battery metal was poised to rebound from an epic slump have been hit by the realization that prices have fallen again this month, with inventories piling up as electric vehicle demand signals stay gloomy.

Spot prices of lithium carbonate in China have slid to the lowest since August 2021 and the most-active futures on the Guangzhou exchange have lost 12% so far this month. In top producer Albemarle Corp.’s latest auction on June 19, the winning bid was down 6.9% from the previous sale on June 5.

- Advertisement -

The declines follow a plunge of more than 80% in 2023 due to a glut and slowing demand growth. Although prices stabilized earlier this year, the supply-chain is still working to clear inventories, with customers holding off purchases. The bearish sentiment has also been wreaking havoc on the stock prices of producers, including Albemarle and Piedmont Lithium Inc.

- Advertisement -

Rising lithium production and expectations of a summer lull are weighing on prices, according to Susan Zou, an analyst at researcher Rystad Energy. Despite the brief rebound earlier this year — underpinned by lower supply around China’s Lunar New Year holiday period and traders’ speculative buying — upward drivers have “mostly disappeared,” she said.

According to traders familiar with the matter, manufacturers grappling with slowing EV demand growth have been cutting orders for lithium products, in anticipation that they may soon be able to restock inventories at even lower prices.

Still, some traders said they see limited downside in prices, which have already been squeezing the margins of some higher-cost producers. Contracts in Guangzhou for July are the cheapest on offer, suggesting a bottoming out during summer.

Total lithium carbonate inventories in China have been on the rise since April, according to Citigroup Inc. Stockpiles held by downstream players — mainly cathode makers — rose 8% in the third week of June compared with the second, while those for other users including battery makers and traders soared 32%, analysts including Jack Shang said in a note on June 20.

Shares Drop

Stock prices of lithium producers have been under pressure too.

As several of the world’s largest automakers including Ford Motor Co., General Motors Co., and even Tesla Inc. dialed back EV ambitions in recent months, investor sentiment toward stocks and miners that provide raw materials for those manufacturers has soured.

- Advertisement -

Shares of Albemarle have slumped 23% so far in June, taking its year-to-date loss to 34% as of Friday’s close. Lithium Americas Corp., a prospective supplier for GM, has plunged 55% this year and its share offering in April was sold at a deep discount. Piedmont Lithium Inc., which has a supply agreement with Tesla, has tumbled 64% during 2024.

“Investors are saying ‘I’ll miss the first 30% move higher, but I’m willing to give that up if I can be put at ease that you do have customers and they are paying you, and most importantly, you’re producing material’,” said Chris Berry, president of consultancy House Mountain Partners.

Muted investor sentiment in the equities market showed “the short-term impatience of Wall Street,” according to Quentin Lamarche, co-managing director of Techmet-Mercruia, a joint venture between critical minerals investment company Techmet Ltd. and Mercuria Energy Group Ltd.

But “smart, long-term patient capital” from energy companies hasn’t been deterred by the price plunge, Lamarche added, citing they were betting speedier direct lithium extraction technologies would be developed.

Despite concerns over lithium prices, some bigger players have been busy on the deals front in recent months. Equinor ASA in May announced that it will buy a 45% share in two lithium project companies in Arkansas and Texas from Standard Lithium Ltd.

In early June, Occidental Petroleum Corp. formed a joint venture with a unit of Berkshire Hathaway Energy aimed at commercializing Occidental’s technology to extract and produce lithium compounds from brine in California.

While BloombergNEF slashed its battery-electric vehicle sales estimates in its annual Electric Vehicle Outlook by 6.7 million vehicles through 2026, it still expects overall lithium demand from batteries to reach just under 3.5 million tons in 2035, nearly three times 2024 levels.

“We’re going through an S curve and we’re living the consequences of that S curve,” said Techmet-Mercuria’s Lamarche, referring to the world’s EV-transition. “But the train has left the station.”

Source: bloomberg

- Advertisement -