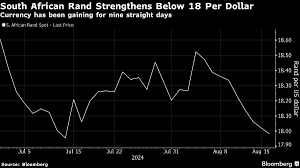

Longest Rally in 13 Years Takes South Africa Rand to Best in World

“The one-off move higher in USD/ZAR during the market rout in early August offered investors a very good entry point to buy South African assets,” Drimal said.

The ninth consecutive day of gains in the currency, often seen as a bellwether for the outlook of emerging markets, marks its longest streak since January 2011 as well as a five-week high on a closing basis. As of Friday morning, it was the best-performing currency against the dollar among the 150-or-so global currencies tracked by Bloomberg.

South African assets have won investors’ favor since a business-friendly coalition took power two months ago and the country’s economic data began improving. Inflation has fallen since February, relieving the pressure on the central bank to keep interest rates high. The expected start of Federal Reserve rate cuts next month could open the door for policymakers to follow suit, said Marek Drimal, a strategist at Societe Generale SA.

- Advertisement -

“The one-off move higher in USD/ZAR during the market rout in early August offered investors a very good entry point to buy South African assets,” Drimal said.

- Advertisement -

This gains extend beyond the currency. The government’s rand bonds have handed investors total returns of 2.7% this month, outperforming the emerging-market benchmark which has given them 1.5%.

However, with traders pricing in rate cuts in South Africa, the rand rally may face headwinds. Forward-rate agreements see at least 50 basis points of easing this year.

- Advertisement -

“It’s unlikely the rand rally has still legs,” Drimal said.

For the rand to secure long-term, fundamental-driven gains, “delivering reforms aimed at structural improvements of the South Africa economy and growth potential is crucial,” he said.

Source:norvanreports.com

- Advertisement -