Mahama Considers Tweaking IMF Programme in 2025 if Elected President

The Distinguished Speaker Series focuses on the future of Foreign Direct Investment (FDI) in Ghana.

- Advertisement -

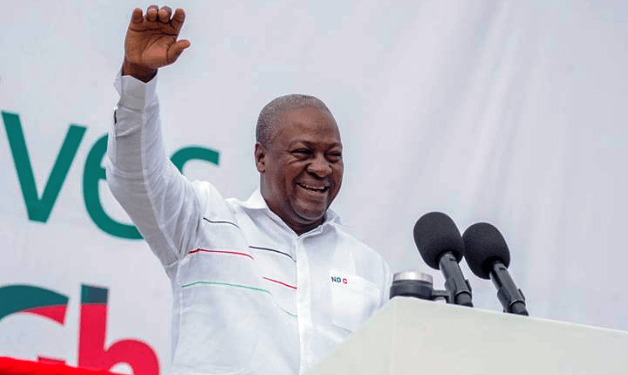

Former President and Presidential Candidate of the National Democratic Congress (NDC), John Mahama, has disclosed plans to modify Ghana’s current $3bn IMF programme if elected into office as president.

The modification of the existing IMF programme, the former president noted, will be to introduce and takeout certain policies, albeit still maintaining and working towards the objectives and targets of the Fund programme.

- Advertisement -

“We (NDC) are not going to renege on the IMF programme, but within the context of the programme we will have some things we would want to tweak, introduce or take-out, but will not affect the programme,” he quipped.

- Advertisement -

Adding that, the tweaking of the IMF programme will align with consensus reached at the pledged National Economic Dialogue set to take place within his first 120 days in office as President.

The dialogue, according to Mr Mahama will focus on creating a 4-year fiscal consolidation programme, which the former president has described as a key component of his economic strategy.

Mr Mahama made the above assertion during a fireside chat at the inaugural event of the Distinguished Speaker Series organized by the Consortium of Trade Associations on Thursday, August 29, 2024.

The Distinguished Speaker Series focuses on the future of Foreign Direct Investment (FDI) in Ghana.

The former president has pledged to abolish what he describes as “draconian taxes” within his first 100 days in office if elected in the upcoming 2024 general elections.

Among the taxes targeted for elimination are the controversial e-levy, the COVID levy, a 10% tax on betting winnings, and the emissions levy.

The abolishment of these taxes, according to some experts is likely to impact the current IMF programme which is heavily focused on domestic revenue generation mainly through tax revenue mobilisation.

- Advertisement -

Some GHS 7.7bn in government revenue is projected to be lost from the abolishment of levies such as the Covid-19 levy and the e-levy.

Total disbursements under Ghana’s current 36-month Extended Credit Facility (ECF) Arrangement approved by the IMF Board in May 2023 has reached $1.6 billion following the country’s successful second review of the Fund programme.

Following acute economic and financial pressures in 2022, the Fund-supported programme has provided a credible anchor for the government to adjust macroeconomic policies and implement reforms to restore macroeconomic stability and debt sustainability, while laying the foundations for higher and more inclusive growth.

The Distinguished Speaker Series initiative marks the beginning of a comprehensive dialogue involving various stakeholders and influential policymakers, aimed at repositioning Ghana as the premier destination for FDI in Africa.

Since 1990, foreign investors have contributed approximately $47.2 billion to the Ghanaian economy, establishing Ghana as a significant recipient of FDI in the subregion.

The Consortium of Trade Associations include the American Chamber of Commerce in Ghana, Ghana Netherlands Business & Culture Council, Spain-Ghana Chamber of Commerce, Ghana South Africa Business Chamber, Canada-Ghana Chamber of Commerce, Japan External Trade Office, and the Chamber of Commerce & Industry, France.

The consortium of trade associations is dedicated to promoting economic growth and development in Ghana through strategic partnerships and collaboration.

By facilitating dialogue between the public and private sectors, the consortium aims to enhance the investment climate and drive sustainable economic progress in the country.

Source:norvanreports.com

- Advertisement -