Next NDC Gov’t to Focus on Rationalizing Ghana’s Current Tax Structure, Says Terkper

Income tax, encompassing both corporate and personal income taxes, forms the second pillar of the system. The third, import duties, are selectively applied to imported goods, thus protecting domestic industries from foreign competition.

- Advertisement -

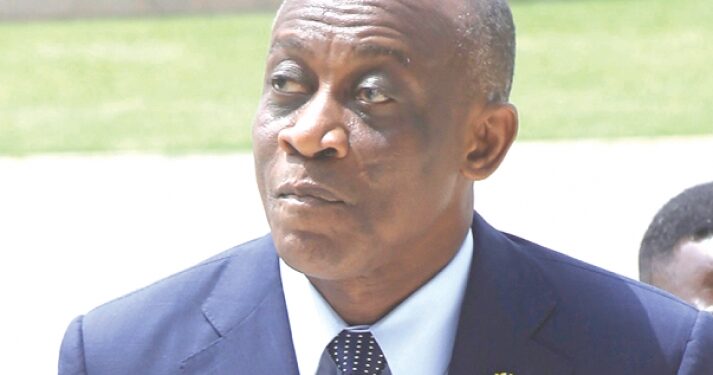

Former Finance Minister Seth Terkper, has outlined the fiscal strategy the National Democratic Congress (NDC) would pursue if returned to power, emphasizing the need to streamline the nation’s tax regime.

Mr Terkper in a recent interview on TV3’s Hot Issues, criticized the proliferation of levies that have been layered onto the tax system which he argued, are undermining the efficiency of Ghana’s revenue collection framework.

- Advertisement -

He underscored the importance of rationalizing these levies, many of which, he noted, were reintroduced after being replaced by the Value Added Tax (VAT). This, he further noted, has resulted in over 20 distinct levies, complicating the tax landscape.

- Advertisement -

He therefore stressed that a more streamlined approach would be necessary to enhance revenue generation while reducing the burden on taxpayers.

The former finance minister identified four pillars of Ghana’s revenue system: VAT, income tax, import duties, and excise taxes. VAT, which is applied to consumption, he remarked plays a crucial role in the country’s fiscal structure, particularly benefiting lower-income groups as essential goods such as food, health, and education services are exempt.

This, Mr Terkper argued, provides a more equitable tax burden, as lower-income households spend a larger share of their income on these necessities.

- Advertisement -

Income tax, encompassing both corporate and personal income taxes, forms the second pillar of the system. The third, import duties, are selectively applied to imported goods, thus protecting domestic industries from foreign competition.

Finally, excise taxes, which are levied on products such as petroleum, alcohol, and tobacco, serve as a punitive measure.

Mr Terkper in the interview affirmed that rationalizing these taxes has been successfully implemented in previous NDC administrations and remains central to their fiscal strategy.

The aim, he indicated, is to simplify the tax system, thereby enhancing its effectiveness and fairness.

Source:norvanreports.com

- Advertisement -