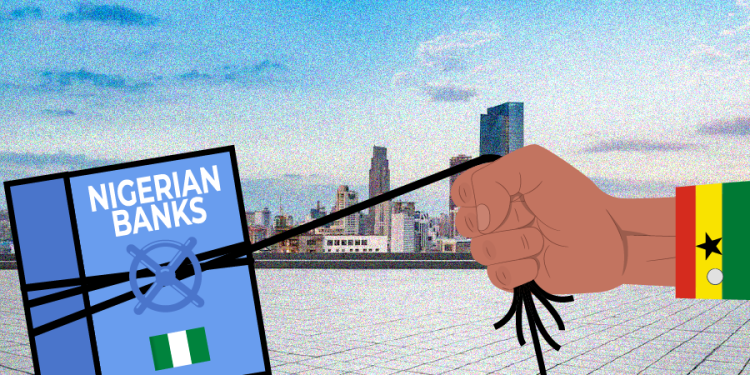

Nigerian banks report widespread losses on Ghanaian bonds default

The West African nation has faced a debt crisis driven mostly by lower commodity prices that have reduced the country’s fiscal revenue buffers. This economic crisis facing the country has also resulted in a surge in inflation, increasing discount rates and rapid exchange rate devaluation. At the end of December 2022, inflation stood at 54% and the exchange rate had weakened against the US dollar.

Nigerian banks recorded massive losses on their investments in Ghanaian Bonds resulting in some of the delays we have seen in releasing their audited accounts. Some banks like Access Bank, FBN Holdings and Fidelity Bank have yet to release their audited results.

The West African nation has faced a debt crisis driven mostly by lower commodity prices that have reduced the country’s fiscal revenue buffers. This economic crisis facing the country has also resulted in a surge in inflation, increasing discount rates and rapid exchange rate devaluation. At the end of December 2022, inflation stood at 54% and the exchange rate had weakened against the US dollar.

- Advertisement -

In response, the Government of Ghana announced a debt exchange programme aimed at restoring sound public finance and sustainable debt levels. This resulted in a suspension of coupon payments for Ghana loans forcing bondholders to take a haircut (loss of bond value). Ghana also undertook the audacious step of buying oil with gold as it struggled to find forex to pay for critical imports.

- Advertisement -

The country is currently discussing with the IMF to seek concessionary funding. The IMF in its latest economic outlook revised Ghana’s economic growth to just 1.6% as it continues to expect the country to experience economic headwinds.

Nairametrics conducted a cursory review of the results of some of the banks confirming a spate of losses incurred over the decision of the West African country to dish out a haircut on the country’s sovereign debt.

Based on our analysis Nigerian banks have recorded a total of N181 billion without including potential losses from the likes of Access Bank, FBNH and Fidelity Bank.

Ghanaian debt crisis

The recent adverse global events placed pressure on the Ghanaian economy, resulting in a surge in inflation, an increase in discount rates, rapid exchange rate devaluation and growing national debt. At the end of December 2022, the Ghanaian inflation rate stood at 54% and the exchange rate had weakened against the US dollar.

Faced with these multiple financial and economic challenges, the Ghanaian government announced a Domestic Debt Exchange Program (DDEP) in December 2022, aimed at restoring sound public finance and sustainable debt levels. The debt program was also intended to partly fulfil the conditions set by the IMF for a US$3 billion bailout.

The debt restructuring has added to several pressure points on these Nigerian banks, alongside the impacts of the devaluation of the Nigerian Naira, rising domestic impaired loans, and rapid credit and balance sheet growth.

Due to that, Nigerian banks have had to set aside billions of Naira for impairment losses. Ecobank, GTCO, UBA and Zenith Bank have made provisions to account for their impairment losses.

Analysis of the losses incurred

An analysis of 2022 full-year financial statements showed that four of the banks that have released their audited accounts incurred an impairment loss of about N207 billion in 2022 due to Ghana’s debt restructuring.

Nigeria’s largest bank by profitability and gross earnings, Zenith Bank reported it incurred a net impairment loss of N58.7 billion from its Ghanaian operations for the year 2022.

- Advertisement -

- “On February 14, 2023, the Group exchanged N123.6 bln (GHS2,675,754,659) of its existing Government of Ghana bonds for a series of new bonds with maturity dates commencing from 2027 to 2038 under the Ghana Domestic Debt Exchange Program. The new bonds were successfully settled on the 21st of February 2023 and have been allotted in the Central Securities Depository. The effect of the exchange on impairment of the existing bonds on 31 December 2022 was duly recognized in the consolidated financial statements.”

UBA, Nigeria’s largest bank by branch network across Africa also reported impairment losses from its investments in Ghana. The bank said it has lost about N17.2 billion from the restructuring of the Ghanaian bonds. UBA Ghana specifically incurred about N14.2 billion of the losses.

In a statement, the bank explained that the Group’s exposure to the Ghana debt market was through the investment activities of UBA Ghana, UBA UK and the New York Branch. While UBA Ghana currently maintains investments in the Ghana Domestic and Eurobond market, UBA UK and the New York Branch of the Bank were primarily in the Ghana Eurobond segment.

- “Included in the N17.979 billion impairment charge on investment securities was N17.280 billion impairment loss attributable to Group’s exposure in the Ghana investment market, which significantly lost its value due to the Domestic Debt Exchange Programme (DDEP) launched by the Government of Ghana on December 5, 2022. DDEP was launched in response to the Government of Ghana’s defaulting in servicing its debts when it suspended payments on most of its external debts and to ensure debt sustainability aimed at securing $3b IMF economic support.”

Ecobank International also reported losses from its investment in Ghana’s sovereign bonds. According to the Pan-African bank, it incurred losses of up to $162 million (N69.2 billion using its stated exchange rate).

- “Net impairment charges on loans were $15 million compared with $40 million in 2021. The comparatively lower impairment charge for 2022 reflected a decrease in gross impairment charges due to a decline in nonperforming loans. Impairment charges on other financial assets were $167 million compared with $0.2 million in 2021. Of these $167 million, $162 million were the impairment losses Ecobank Ghana incurred on its GoG domestic bonds and Eurobonds.”

GTCO is not left out in the impairment saga. According to data obtained from the bank’s 2022 financial statements, the total investment portfolio exposure by the group was about N167 billion. It however incurred a loss of about N35.6 billion on Ghanaian Bonds. The losses include exposure to Treasury Bills, Local bonds and Eurobonds issued by Ghana.

What this means for financial markets

The Ghanaian debt crisis highlights the challenges facing emerging market economies, particularly those reliant on commodity exports. It underscores the importance of sound fiscal management and debt sustainability to avoid potential contagion effects on neighbouring countries and their financial systems.

For future investments in Ghana and other emerging markets, investors should carefully assess the risks involved, including the macroeconomic and political environment, as well as the creditworthiness and debt sustainability of the issuing country.

In terms of financial market stability, regulators and policymakers like the CBN need to ensure that banks and other financial institutions have adequate risk management systems in place to mitigate potential losses from exposure to external shocks.

The Ghanaian debt crisis and its impact on Nigerian banks can also be seen as a microcosm of the challenges facing globalization. As economies become increasingly interconnected, shocks in one part of the world can have ripple effects on other regions and countries. This highlights the importance of sound fiscal and monetary policies, as well as effective regulation and risk management practices, to ensure the stability of financial systems and mitigate the risks of contagion.

Source: norvanreports.com

- Advertisement -