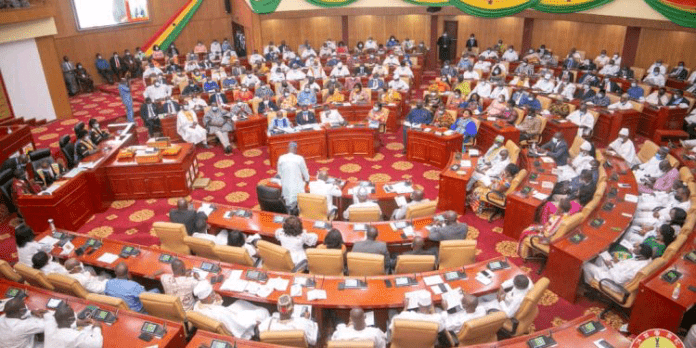

Parliament: Excise Duty Law amended to impose Taxes on Wine, Malt Drinks, Spirits and Cigarettes

The Bill also seeks to amend Act 878 to implement the ECOWAS directive on the harmonisation of excise duties on tobacco products direct that the excise duty on tobacco products must include an ad valorem duty and a specific duty.

- Advertisement -

Parliament has passed the Excise Duty (Amendment) Bill, 2022 in line with ECOWAS Protocols and to raise revenue to mitigate the harmful effects of those products on their consumers.

- Advertisement -

The object of the Excise Duty (Amendment) Bill, 2022 is to amend the Excise Duty Act, 2014 (Act 878) to revise the excise tax rates for cigarettes and other tobacco products to conform with the Economic Community of West African States (ECOWAS) Protocols and raise revenue to mitigate the harmful effects of these excisable products; increase the excise duty in respect of wine, malt drinks and spirits; and impose excise duty on sweetened beverages and electronic cigarettes and electronic liquids to increase revenue.

- Advertisement -

The Bill also seeks to amend Act 878 to implement the ECOWAS directive on the harmonisation of excise duties on tobacco products direct that the excise duty on tobacco products must include an ad valorem duty and a specific duty.

Reading the Finance Committee’s report on the Bill for adoption in Parliament, Chairman of the Finance Committee, Kwaku Kwarteng, said,

“the ad valorem rate is required to be fifty percent or more while the specific tax is required to be the minimum equivalent of zero point zero two United States Dollars (US$ 0.02) per stick in the case of cigarette, cigar and cigarillo and the cedi equivalent of twenty United States Dollars (US $20) per net kilogramme for all other tobacco products”.

Moving the motion for the second reading of the Bill, a Deputy Minister of Finance, Abena Osei-Asare, emphasized the fact that

- Advertisement -

“there has been an increase in the use of electronic cigarettes and other smoking devices over the last decade and currently, “these products do not attract excise duty.

“The amendment therefore seeks to impose excise duty on these products in line with the ECOWAS protocols as the nicotine and other chemicals used as additives are also harmful,” he noted.

Additionally, “apart from mineral waters and malt drinks, all other sweetened beverages, including processed fruit juices do not attract excise duty”.

The Bill therefore seeks to amend Act 878 to impose excise duties on these products and also increase the excise duty on mineral waters and malt drinks.

According to her, “Spirits have a higher alcohol content compared to beer. However, the excise duty on spirits is lower than that of beer. To address this, the excise duty on spirits is being raised above that of beer in accordance with good practice on the imposition of excise duties. Consequentially, the Bill proposes an increase in excise duty on spirits and wines for reviewed upwards”.

The Bill will also revises the description of the various products for ease of reference and the record to conform to the World Customs Organisation Harmonised Commodity Description and Coding System.

By Edzorna Francis Mensah

- Advertisement -