Pushed to the Wall, Kenya Mulls Fresh IMF Financing Program

Kenya’s three-year IMF program for $3.6 billion is scheduled to finish in April. The lender’s board is meeting at the end of August where it’s expected to approve a disbursement under its current program, Prime Cabinet secretary Musalia Mudavadi told the same meeting.

- Advertisement -

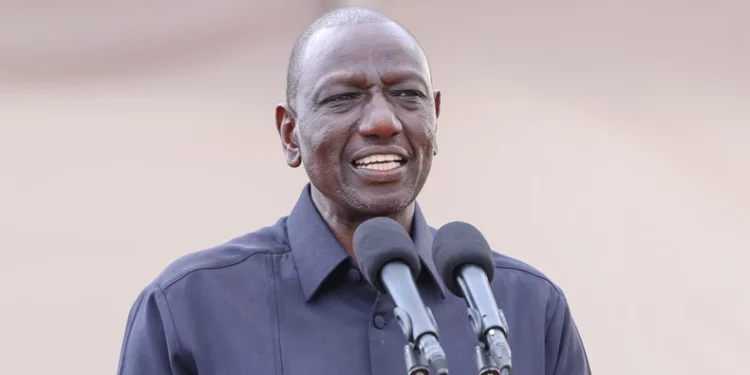

Kenya plans to seek fresh financing from the International Monetary Fund as the nation deals with the economic fallout from deadly protests that forced President William Ruto to backtrack on plans to raise more than $2 billion in new taxes.

“We are beginning to start discussions even on a new program probably with the IMF and others,” Treasury Principal Secretary Chris Kiptoo told lawmakers on Monday while presenting revised budget estimates. The state is already in discussions with the World Bank for new development policy financing, he said.

- Advertisement -

Kenya’s three-year IMF program for $3.6 billion is scheduled to finish in April. The lender’s board is meeting at the end of August where it’s expected to approve a disbursement under its current program, Prime Cabinet secretary Musalia Mudavadi told the same meeting.

- Advertisement -

The East African nation’s authorities have come under criticism for piling on debt despite spending about three quarters of tax income on repaying loans. Kenyans have been picketing since mid-June against new taxes to shore up domestic income in line with the IMF program.

“In order for us to resolve our debt challenge we have to have a program with the IMF. It cannot be otherwise,” Mudavadi said. “If anybody continues to mislead people that you can walk away from the IMF and have your way, it is not true.”

The commercial loans that Kenya holds have been biting the most, not the concessional debt from the likes of the IMF and the World Bank, according to Mudavadi, the only minister left after Ruto fired his entire cabinet nearly two weeks ago.

The nation wouldn’t default on its debt as some of the protesters have demanded, Mudavadi said. To reschedule debt, Kenya would need the good will of two, he said.

- Advertisement -

“You need to have the IMF on your side and the World Bank on your side for you to have a hearing from your creditors,” he said.

Slash Spending

To compensate for the drop in the forecast tax revenue, Kenya has had to pare back its budget and increase its planned borrowing. In a supplementary budget that lawmakers are expected to debate later this week, the National Treasury has widened the fiscal deficit to 4.2% of gross domestic product, from 3.3% that was anticipated in the initial budget presented last month.

Kenya will plug that gap through net external borrowing of 356.4 billion shillings ($2.72 billion) and net domestic borrowing of 404.6 billion shillings, Kiptoo said. The figures will likely change over the year, he said.

The revised revenue is 9% lower than the initial forecast, while spending has been reduced by about 2%. “We have cut to the bone,” Mudavadi said of the spending cuts.

Source:norvanreports.com

- Advertisement -