South Africa Budget Leaves Investors Cold as Deficit Widens

Electricity shortages have hobbled South Africa for years, curbing production and tax revenue, while a succession of pay rises for civil servants have depleted state coffers.

- Advertisement -

South Africa’s budget update showed public finances are under increasing pressure, heightening the need for the new coalition government to lure more investment to the region’s biggest economy.

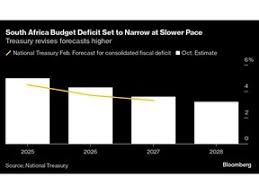

The fiscal deficit is expected to widen to 5% of gross domestic product in the year through March, the medium-term budget policy statement delivered by Finance Minister Enoch Godongwana on Wednesday shows. That’s up from 4.5% projected in February, and higher than most economists predicted.

- Advertisement -

The rand weakened and bond yields rose.

- Advertisement -

Electricity shortages have hobbled South Africa for years, curbing production and tax revenue, while a succession of pay rises for civil servants have depleted state coffers. The revised budget estimates, the first from the new 10-party administration, illustrate the extent of the challenge it faces in meeting its goals of boosting output and employment while stabilizing state finances.

“We know that our debt is unsustainable because debt-service costs have become the largest component of our spending and it is rising faster than economic growth,” Godongwana told lawmakers in Cape Town. “To deal with this problem, we have taken difficult steps to reduce the budget deficit. We have restrained spending and maintained stable tax collection.”

The rand weakened 0.1% to 17.6895 per dollar by 4:25 p.m. in Johannesburg after erasing a gain of as much as 0.7%, while yields on 2035 government bonds rose to 10.45% from a session-low of 10.33%.

Tax revenue for the current fiscal year is set to fall 22.3 billion rand ($1.27 billion) short of target, with income from value-added tax, personal income tax and fuel levies all disappointing. The ratio of debt to gross domestic product is still expected to stabilize in the 2025-26 fiscal year, but is now seen doing so at 75.5%, higher than the 75.3% expected in February.

GDP is forecast to expand an average of 1.8% over the next three years, slightly higher than previously estimated, yet still insufficient to keep pace with population growth.

“The target budget deficit is a little wider than expected, which considering South Africa’s public finances are already in precarious shape, is not the ideal outcome markets were hoping for,” said Brendan McKenna, an emerging-market economist and strategist at Wells Fargo. “We are still optimistic for fiscal consolidation over the medium-term.”

- Advertisement -

The National Treasury allocated additional funds to pay for a peacekeeping mission in the Democratic Republic of Congo and cover debts stemming from an abandoned freeway tolling project. It also set aside 11 billion rand for an early retirement plan for civil servants over the next two years, a measure that should help contain its burgeoning wage bill.

“We remain underwhelmed and disappointed by Treasury’s continued approach to tackling our deep-seated economic and governance crises, the Congress of South African Trade Unions, the country’s biggest labor federation, said in a statement. “If we are to set public debt on a sustainable path, then we need to stimulate growth, slash unemployment and rebuild the state. Simply repeating the tried-and-failed approach of painful austerity budget cuts and freezing vacancies will not resolve these.”

South Africa’s new alliance took office in late June, a month after the African National Congress lost the parliamentary majority it had held since apartheid ended in 1994. The inclusion of the centrist Democratic Alliance and other business-friendly parties sparked a rally in the nation’s currency, stocks and bonds, with investors banking on the government to tackle the energy shortfall, logistics constraints and red tape that has hindered businesses.

Some progress has been made: the country has had several months of uninterrupted electricity, working-visa rules have been overhauled and the government is opening up rail lines to private operators.

The National Treasury said the government is evaluating various options to encourage private investment in infrastructure projects, including developing a platform with a credit-guarantee facility to help alleviate risk associated with public sector projects. New financing mechanisms are also under consideration.

President Cyril Ramaphosa has pledged to turn the country into a giant construction site. He estimates that as much as 1.6 trillion rand in public-sector infrastructure investment and a further 3.2 trillion rand from the private sector will be needed for the country to achieve its infrastructure goals by 2030.

Fitch Ratings and Moody’s Ratings may review their assessment of South Africa’s debt this week following the presentation of the budget update, while S&P Global Ratings’ review is due from Nov. 15. All three companies have a sub-investment grade rating on South Africa with a stable outlook.

“It is a fool’s game to try and pre-empt rating decisions,” said Duncan Pieterse, the Treasury’s director-general. “I think that they will look kindly upon a treasury that consistently outperforms on its own targets.”

Source:norvanreports.com

- Advertisement -