SSNIT’s Spiralling Crisis: A closer look at management woes and the future of workers’ pensions II

The evident underinvestment in the Treasury Sub-Asset Portfolio by SSNIT endangers the robustness and dependability of Ghana’s pension system. It is imperative for SSNIT to realign with its stated investment policy, directing more funds into liquid assets to bolster its financial resilience and safeguard members’ pensions against unforeseen economic challenges

- Advertisement -

Introduction to Investment Challenges at SSNIT

The Social Security and National Insurance Trust (SSNIT) plays a pivotal role in securing the financial futures of Ghanaian workers through its pension schemes. However, a critical analysis of SSNIT’s investment strategy, particularly its allocation to the Treasury Sub-Asset Portfolio, reveals a concerning pattern of underinvestment that threatens the institution’s ability to fulfil its obligations to members both now and in the future.

- Advertisement -

Policy Framework and Investment Targets

- Advertisement -

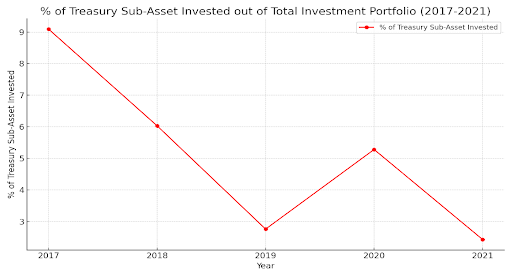

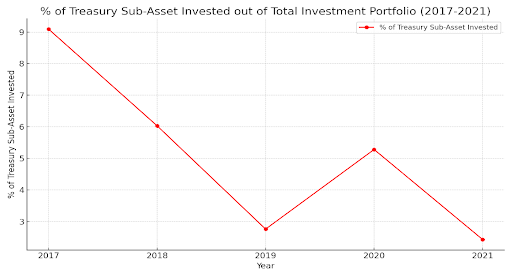

SSNIT’s Investment Policy and Guidelines, outlined in Paragraph 3.0, set forth a clear mandate: to maintain a balanced investment portfolio that ensures liquidity and long-term fund sustainability. A key component of this strategy is the Treasury Sub-Asset Portfolio, which is comprised of short-term, liquid securities such as treasury bills and fixed deposits. The policy dictates a minimum investment target of 6% in this portfolio, underscoring its importance in safeguarding the Trust’s financial health.

Falling Short of Liquidity Goals

Despite the Treasury Sub-Asset Portfolio’s vital importance in safeguarding liquidity, SSNIT’s consistent failure to achieve its 6% investment goal underscores a deeper systemic flaw in its investment strategy. This flaw is characterized by an overemphasis on illiquid assets, such as unlisted equities and real estate, which have typically underperformed. This misdirection can be significantly attributed to the undue influence of NPP government appointees in SSNIT’s decision-making processes. These appointees, often prioritizing political agendas over financial prudence, have steered the Trust away from more liquid and potentially profitable investments in the Treasury Sub-Asset Portfolio. Consequently, this deviation not only jeopardizes the Trust’s liquidity but also reflects a broader issue of politicized decision-making undermining the institution’s financial health and its capacity to fulfil its obligations to its members.

Disturbing Trend of Declining Treasury Investments

A detailed examination of SSNIT’s investment patterns over the period from 2017 to 2021 reveals a concerning downward trajectory in the allocation of funds to the Treasury Sub-Asset Portfolio. Initially, in 2017, SSNIT demonstrated a commitment to liquidity and short-term financial stability by allocating 9.09% of its total investments to this critical portfolio. However, this commitment seems to have significantly waned, with the allocation drastically falling to 2.43% by 2021. This substantial reduction is not just a deviation from SSNIT’s own established investment guidelines, which recommend a minimum target of 6%, but it also reflects a broader issue of strategic misalignment within the Trust’s investment decision-making process.

- Advertisement -

Effect of Declining Treasury Investments

The trend of declining Treasury investments within SSNIT carries profound negative implications for the institution’s operational efficacy and financial stability. By deviating from its prescribed investment targets, SSNIT compromises its liquidity position, which is paramount for meeting immediate obligations such as pension payouts and operational expenditures. This shortfall in liquidity not only risks delaying the disbursement of benefits to retirees, potentially plunging them into financial uncertainty, but also undermines the Trust’s ability to respond swiftly to economic fluctuations and external shocks. Furthermore, the diminishing focus on Treasury investments signals a misalignment of investment priorities, which can erode stakeholder confidence, deter future contributions, and ultimately jeopardize the sustainability of the pension fund. Such a trajectory, if left unchecked, could culminate in a systemic failure, affecting the livelihoods of countless Ghanaian workers who rely on SSNIT for their post-retirement security.

Recommendations for Strategic Realignment

To rectify this issue, it is crucial for SSNIT to reallocate its investment focus towards the Treasury Sub-Asset Portfolio. Increasing investments in this area is not only a matter of adhering to policy but also a strategic imperative to enhance liquidity and ensure the Trust’s financial resilience.

This situation demands the engagement of all stakeholders, including labour unions, pensioners, and ministry of finance. These entities must advocate for a realignment of SSNIT’s investment strategy to prioritize liquidity and safeguard members’ interests. Through collaborative efforts, stakeholders can pressure the Trust to adhere to its investment guidelines and fulfil its obligations to Ghanaian workers.

Conclusion and Call to Action for Labor Unions

The evident underinvestment in the Treasury Sub-Asset Portfolio by SSNIT endangers the robustness and dependability of Ghana’s pension system. It is imperative for SSNIT to realign with its stated investment policy, directing more funds into liquid assets to bolster its financial resilience and safeguard members’ pensions against unforeseen economic challenges. The urgency for SSNIT to rectify these issues cannot be overstated, and it requires the concerted effort of all stakeholders, especially labour unions, to advocate for change.

Labor unions, including the Ghana National Association of Teachers (GNAT), Ghana Trades Union Congress (TUC), and the National Association of Graduate Teachers (NAGRAT), are called upon to mobilize and demand accountability and strategic reform within SSNIT. By standing united in their call for a reevaluation of investment strategies and a cessation of politically influenced mismanagement, these unions have the power to influence pivotal changes. Their advocacy is crucial in ensuring that SSNIT upholds its duty to provide a secure and sustainable pension system, thereby protecting the financial futures of Ghana’s hardworking workforce. Now is the moment for labour unions to lead the charge in advocating for a pension system that truly serves the best interests of its members.

Source:norvanreports

- Advertisement -