Taxing the poor will lead to agitations; tax the rich through property rates – Prof Quartey to gov’t

“If you look at the budget statement of 2022, we are earmarking half a billion cedis to be realized from property rates. Just go through the Bank of Ghana records, go through the banks, look at how many people have borrowed and how much the value of collateral they have used in one year, it will amaze you the value of properties that we have in the country.

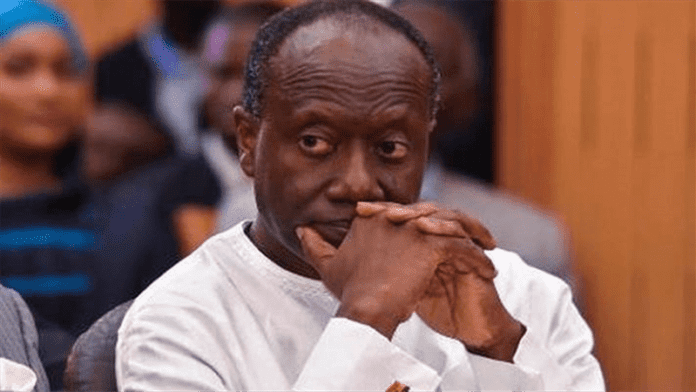

Director of the Institute of Statistical, Social and Economic Research (ISSER) of the University of Ghana, Professor Peter Quartey has told the government to focus on property ratepayments as a means of raising domestic revenue.

He said the government must scale up property rate collection, not necessarily increasing the rates, as a way of taxing the rich.

- Advertisement -

Speaking in interview with TV3’s Alfred Ocansey, Prof Quartey said “To shore up revenue, I think there are a lot of untapped areas. One has been the issue of property rate and I keep emphasizing this point.

- Advertisement -

“If you look at the budget statement of 2022, we are earmarking half a billion cedis to be realized from property rates. Just go through the Bank of Ghana records, go through the banks, look at how many people have borrowed and how much the value of collateral they have used in one year, it will amaze you the value of properties that we have in the country.

“Yet, ask yourself what percentage of this property rate that we are realizing? So I believe the low-hanging fruits will be to look at property rate and make sure, we don’t have to increase the rate, whatever rate we have in the system, just apply them and make sure people pay property rate.

“If you tax the rich, that shouldn’t be a problem but where you want to tax the poor that is where it will lead to a lot of agitations. So I think that is one clear area we can raise revenue to bridge the gap and restore confidence in the economy. Investors will have confidence in the economy, rating agencies will have confidence if we are able to raise more revenue.”

His comments come in the wake of the rejection of the E-levy proposal by Ghanaians.

For instance, Senior Advisor at the Africa Parliamentarians Network Against Corruption, Professor David Abdulai has revealed that 91 per cent of Ghanaians are not in favour of the proposed E–levy.

He said this on the Key Points on TV3 Saturday March 5.

He further raised issues against the strategy that was adopted by the Finance Ministry regarding the proposal. He said the failure of the Ministry to engage stakeholders prior to the introduction of the policy was wrong because that meant putting the cart before the horse.

In his view, the ongoing nationwide town hall meetings should have been done before the proposal was submitted to Parliament.

Speaking on the Key Points on TV3 Saturday March 5, he said “The strategy of the Finance Ministry is wrong. What they did is to put the cart before the horse. This is not the time to now go around trying to hold town hall meetings, get buy-ins from Ghanaians. They should have done that much earlier before the bill was introduced in Parliament. So the pressure on the speaker, in my opinion, is misplaced.

“I am saying strategy-wise they should have done it much earlier and then you actually engage the NDC members in Parliament before you even bring it to the floor. Good luck to them but I don’t think the pressure is fair to the Speaker.

“The speaker will do his best but I think Ghanaians have already made it very clear, 91 per cent of the populace have made it clear they are not interested in the E-levy. The Majority leader mentioned a few days ago that they never expected such resistance even though they knew.”

The Finance Minister, Ken Ofori-Atta, expressed shock at the dissenting voices in relation to the proposed E-levy.

He, however, expressed optimism that the policy will be approved but, in the event it does not go through, he said, the government will turn to the petroleum sector for revenue.

Asked what the alternative is, in the event the E-levy fails, while speaking to journalists at a function in Accra on Friday, February 18, he said “There are always many alternatives but really, you are looking at the future and you are looking at ways we can solve the issue of the increased revenue and everybody participating.

- Advertisement -

“The challenge is, for example, assuming you earn a million cedis a year and you transfer all of that through MoMo. What am I asking of you? ¢15,000. Is that what you have been fighting against? Or if you are a student and assuming your earn 100,000 cedis, which is unlikely, that means what, a 1500 cedis.

“So you then begin to ask the question, what is it that we are fighting against? And if I have also said the first hundred cedis will not be a part of it which means 3000 monthly income.

“The alternatives are many, you can go into petroleum, but is that really what you want? The mood of the country is different from the arithmetic in Parliament and that is why I have gone around.”

Mr Ofori-Atta had earlier ruled out returning to the International Monetary Fund (IMF) for support in order to deal with the challenges that the local economy is going through at the moment.

Speaking at the 3rd Townhall meeting on the E-levy on Thursday, February 10, at the Radache Hotel in Tamale in the Northern Region, he indicated that a return to the Bretton Woods institution will have dire consequences.

The government was called upon to return to the IMF for support instead of relying on the proposed E-levy for revenue.

For instance, a former Member of Parliament for New Juabeng South, Dr Mark Assibey-Yeboah believed that a return would rescue Ghana’s struggling economy.

“Without a doubt, I think we should be placing a call to Washington if we haven’t really done that. We are just not going to ask for the funds just because E-levy has been passed or not. E-levy will just bring about GH¢5 billion. We are in a deep hole in our tax revenue and facing difficulties, so going to the Fund will give us some support.

“So there is nothing wrong with going to the Fund. Ghana is a member of the IMF so what is wrong going to ask for support when we are in difficulties to go and pool resources. If I was the finance minister, I will be convincing the President that it is about time we went back,” he told Citi.

Mark Assibey Yeboah also added that the revenue expected to be accrued from the E-levy is to ensure the economic stability government is eyeing.

He further cast doubt on the government’s ability to raise the projected GH¢6.9 billion target, saying the maximum the government can raise from the controversial e-levy is GH¢5 billion.

“The GH¢6.9 billion target cannot be realized. There are a lot of exemptions so, in my estimation, the maximum amount we can get from the E-levy is GH¢5 billion, and that is less than a billion dollars, so I do not think that the E-levy is going to be a panacea to our revenues. Going to the IMF will ensure some stability and above all, we are going to get some $3 billion”.

The General Secretary of the National Democratic Congress (NDC) Johnson Asiedu Nketia also made a similar call to the government.

Asked whether President Nana Addo Dankwa Akufo-Addo should go to the IMF, while speaking on the New Day show on TV3 on Monday, February 7, he answered “I think it is something that they have to consider. if it is the only that will take us out of this problem then the earlier the better.”

But Mr Ofori-Atta who had earlier stated that the government would not go back to the IMF insisted that “I can tell you, as my colleague deputy said, we are not going back to the IMF, whatever we do we are not [going back]. The consequences are dire, we are a proud nation, we have the resources, we have that capacity, don’t let anybody tell you … we are not people of short-sighted, we need to move on,” Mr Ofori-Atta said.

By Laud Nartey|3news.com|Ghana

- Advertisement -