VAT on Electricity: Ghanaians are tired of taxes from NPP govt – Kofi Kapito

“This year alone, from the first of the year, there have been more than 20 taxes introduced. Cars now, if you register a vehicle, you’re forced to pay a 100 cedis for what? Insurance has gone up.”

- Advertisement -

The Consumer Protection Agency (CPA) has raised strong concerns about the Ghanaian government’s recent tax increases, calling them excessive and burdensome for citizens.

According to the Agency, over 20 new taxes have been introduced just this year alone, creating a growing sense of “tax fatigue” among Ghanaians.

- Advertisement -

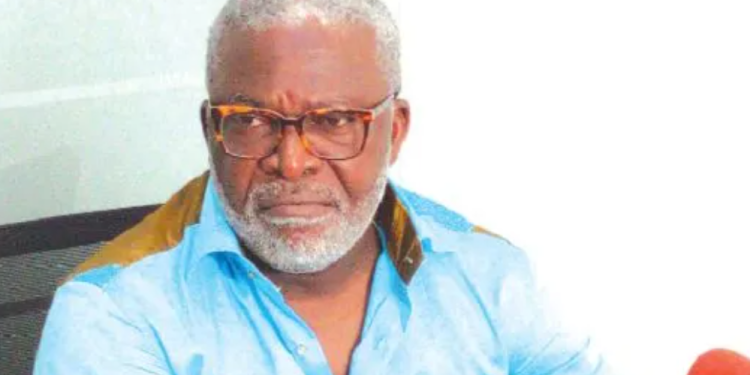

In an interview on Citi Breakfast Show, CPA CEO Kofi Kapito voiced his displeasure with the government’s tax policy.

- Advertisement -

He highlighted the recent Value Added Tax (VAT) applied to residential electricity consumption as a prime example of the growing tax burden.

“The consumer is tired,” Mr. Kapito stated. “This year alone, from the first of the year, there have been more than 20 taxes introduced. Cars now, if you register a vehicle, you’re forced to pay a 100 cedis for what? Insurance has gone up.”

The government on January 1, 2024, announced the imposition of a Value Added Tax (VAT) on a specific section of electricity consumers in the country.

- Advertisement -

A letter addressed to the Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO), and signed by the Minister for Finance, Ken Ofori-Atta stated that the VAT will apply to residential electricity customers above the maximum consumption level specified for block charges for lifeline units.

This move is part of the government’s Covid-19 recovery program and took effect from January 1, 2024.

According to the letter, the implementation of VAT for residential customers of electricity is in line with Section 35 and 37 and the First Schedule (9) of the Value Added Tax (VAT) Act, 2013 (ACT 870).

The government aims to generate revenue through this initiative and support the country’s Medium-Term Revenue Strategy and the IMF-Supported Post-COVID-19 Program for Economic Growth (PC-PEG).

Source:citinewsroom

- Advertisement -