Zambia to hike again to support bruised currency

“We expect the central bank to complement its recent decision to increase the statutory reserve ratio” on both local and foreign currency deposits with a hike in the policy rate, said Samantha Singh-Jami, Africa strategist at RMB.

- Advertisement -

Zambia’s central bank is poised to raise interest rates for the fifth consecutive time to contain inflation and support its bruised currency.

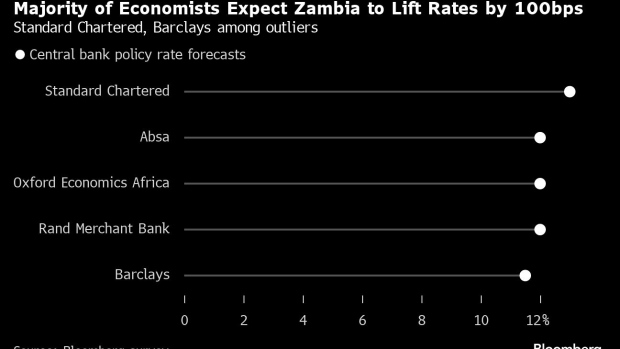

The monetary policy committee will increase the benchmark rate by 100 basis points to 12%, according to most analysts surveyed by Bloomberg, including those from Rand Merchant Bank and Oxford Economics Africa. That would be the same as at its previous meeting in November and take the rate to the highest level in seven years.

- Advertisement -

The hike will add to other measures the southern African nation has taken to tighten liquidity conditions in the hope that they will reverse a slide in the kwacha and ease inflationary pressures.

- Advertisement -

They include the introduction of new regulations on Jan. 1 requiring exporters to have accounts domiciled in Zambia to get paid for their exports and a directive by the Finance Ministry ordering commercial banks to transfer government deposits to the Treasury account at the central bank. The move could see the exit of about 12 billion kwacha from the market.

- Advertisement -

The Bank of Zambia also increased the reserve-ratio requirement for lenders to 26% from 17%, effective Feb. 5.

“We expect the central bank to complement its recent decision to increase the statutory reserve ratio” on both local and foreign currency deposits with a hike in the policy rate, said Samantha Singh-Jami, Africa strategist at RMB. “This is to abate the current inflationary pressure and ensure that it does not continue to trend away from the Bank of Zambia’s 6%-8% target band.”

The kwacha has lost 13% of its value against the dollar since the MPC’s Nov. 22 rate decision, in part due to slumping output of copper, its main foreign-exchange earner, lower metal prices and issues with debt restructuring talks. Annual headline and non-food inflation, a measure of underlying price growth, are at their highest levels since 2022.

Source:norvanreports

- Advertisement -