American Express Co. is hunting for ways to make inroads in the last place on earth where cash is still king — the continent of Africa.

The credit-card behemoth is courting hoteliers, restaurants and tourism destinations across Africa to try to lure them to accept the payment giant’s cards. The moves come as Amex sees droves of US and European customers flock to the continent for leisure travel.

For years, the New York-based company has sought to entice more international retailers to accept its cards, part of its efforts to shake off the impression that Amex cardholders can’t use their cards when they travel overseas.

But its latest push might be the company’s biggest overseas challenge yet. It will have Amex looking to get a greater foothold in a region where cash remains the leading payment method at points of sale, according to a recent report by Worldpay, which said its the last region on the planet where that is the case.

In Nigeria alone, consumers still reach for cash 55% of the time at checkout, the report found.

“Given the demand that we’re seeing and the potential that exists, we believe this is the right time to plant those seeds and to build the business,” Mohammed Badi, president of global network services at American Express, said in an interview.

Amex can trace its roots on the continent back to the 1890s when it partnered with Bank of Africa on a travelers checks business. In the 1970s, it signed a deal with Nedbank Group Ltd. to have the Johannesburg-based lender issue cards that run on the America Express network.

More recently, its been inking deals with payment processors and banks around Africa that will help it gain acceptance in more countries.

In May, Amex reached an agreement with Togo-based Ecobank Transnational Inc. that will mean the firm’s cards are now accepted in 47 of the 54 countries across Africa, up from 35 previously. It’s also partnered with Flutterwave Inc., Africa’s largest payments startup, in a move that will allow online merchants in Nigeria to accept American

Express payments.

$3,000-a-Night Hotels

Amex has worked to improve customers’ perception of how widely its cards are accepted for years. After years of trying to persuade more of America’s 30 million small businesses to accept its cards as payment, the company in 2019 declared that it had reached “virtual parity” coverage with rivals Visa Inc. and Mastercard Inc. in its home country.

Now, it’s set its sights on overseas markets, where Amex has partnered with more banks to try to lure them to issue their credit and debit cards on the firm’s network.

Whenever Amex first starts trying to entice retailers to accept its cards in a new country, it draws up a list of the places its existing customers most like to shop in. Then it goes one by one to try to convince them to take its cards.

The initial goal, Badi says, is to have at least 75% of merchants in a given country accepting the firm’s products.

“That is by no means our end objective, it’s the minimum,” Badi said, noting that if customers are able to use their cards three out of every four times they pull it out then “they’ll keep pulling out the card and trying.”

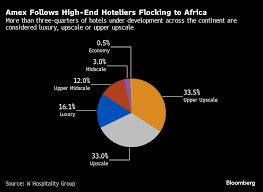

Amex’s optimism for the continent of Africa comes as major hotel chains including Marriott International Inc. and Hilton Worldwide Holdings Inc. are on track to more than double their footprint across Africa in the coming years.

Marriott, which last year opened the JW Marriott Masai Mara Lodge in Kenya with rooms averaging more than $3,000 a night, has more than 138 hotels under development in Africa, while Hilton has 72 properties in the pipeline, according to a March report by W Hospitality Group.

Source:norvanreports.com