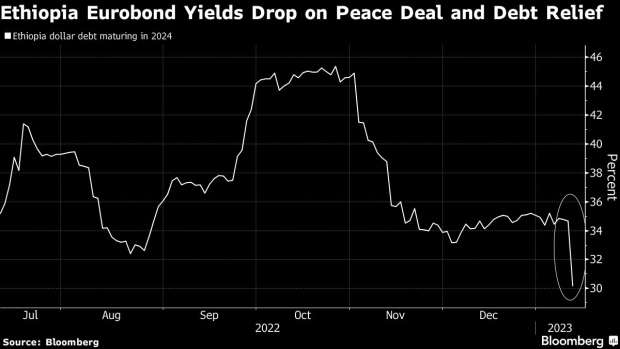

Ethiopian eurobonds rallied after dissident Tigrayan fighters this week agreed to hand over heavy weapons, firming up a peace deal that may bring an end to the country’s civil war, and after China agreed to cancel some of its bilateral debt.

“Ethiopia probably compressed on peace progress more than China headlines,” said Maciej Woznica, fixed-income portfolio manager at Coeli Frontier Markets AB. French and German foreign ministers also met with Ethiopian officials in the capital, Addis Ababa, in support of the peace agreement.

The yield on Ethiopia’s $1 billion bond due in 2024 fell 535 basis points on Thursday.

The disarmament was part of an accord forged in South Africa in November. Thousands of people died and hundreds of thousands were displaced in a two-year conflict between federal troops and rebels from the Horn of Africa nation’s northern Tigray region.

Ethiopia, one of the countries seeking debt relief under the G-20’s Common Framework, has an external debt of $26.9 billion as of end-September, according to government data. The government didn’t provide details of the pact with China to forgive some liabilities.