The International Monetary Fund inched up its expectations for global economic growth this year, citing strength in the US and some emerging markets, while warning the outlook remains cautious amid persistent inflation and geopolitical risks.

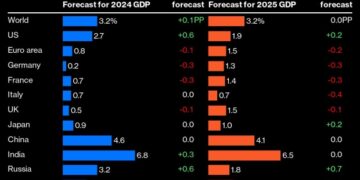

Global economic activity will expand 3.2% this year, it said Tuesday in its World Economic Outlook, up 0.1 percentage point from its January estimate. The forecast for 2025 was unchanged at 3.2%.

Bloomberg Economics pegs this year’s global expansion at 2.9% and next year at 3.1%.

Despite the upgrade, the IMF warned high borrowing costs and the withdrawal of fiscal support are weighing on short-term growth, while the medium-term outlook remains the weakest in decades due to low productivity and global trade tensions.

“Numerous challenges remain, and decisive actions are needed,” IMF chief economist Pierre-Olivier Gourinchas wrote in a note online accompanying the outlook, flagging stubborn inflation and growing global inequality.

The outlook paints a picture of a world economy that avoided the worst stagflation dangers coming out of the pandemic, but with stunted potential in the coming years.

The inflation fight for central banks is headed in the right direction, although it’s too early to declare victory by easing monetary policy. And risks to growth abound, particularly from wars in Ukraine and the Middle East.

The IMF also warned about a concerning under-performance of low-income countries compared with the rest of the world, with the fund cutting its growth estimate for the group. Those countries have experienced higher-than-expected inflation, due to the stronger US dollar, as well as the impact of high food, fuel and fertilizer costs.

“The US economy has already surged past its pre-pandemic trend,” Gourinchas wrote. “But we now estimate that there will be more scarring for low-income developing countries, many of which are still struggling to turn the page from the pandemic and cost-of-living crises.”

Amid the downside risks going forward, spillovers from the war in Ukraine or violence in the Middle East risk fueling inflation and contributing to higher interest-rate expectations, which would weigh on markets and sentiment.

French Finance Minister Bruno Le Maire, briefing reporters Monday before traveling to Washington, also warned of the costs of conflict.

“The real economic risks are geopolitical, whether it’s the events in the Red Sea, the risk of escalation in the Middle East, or the persistence of the conflict in Ukraine,” he said. “All these geopolitical events are a terrible burden for economic growth.”

The fund also flagged risks from China’s real estate woes and from worsening global economic fragmentation, mainly spurred by the strategic competition between the US and China.

China earlier on Tuesday posted data showing economic growth beat expectations in the first quarter as the industrial sector powered forward, although a tail-off in March activity signaled more support may be needed to sustain that momentum.

Among upside risks are the chance inflation may slow more than expected, letting central banks ease policy sooner.

Inflation has slowed since 2022, when it hit the fastest pace in decades, thanks to an aggressive interest-rate hiking cycle. But it hasn’t yet cooled enough to reach policy targets in several large economies, including the US. At some point in the second half of this year, however, the IMF expects major advanced economies to start cutting rates.

Average global consumer prices will probably increase 5.9% this year and 4.5% next year, in both cases 0.1 percentage point faster than the previous projection in January.

The fund boosted its 2024 growth outlook for the US to 2.7%, up from 2.1% in January. It slightly downgraded the Euro area, saying that the lagged effects of tighter monetary policy and increased energy costs in the past couple of years will hurt activity.

China, the world’s second-largest economy, will likely grow 4.6% this year and 4.1% next, unchanged from the January forecast. Its weakened real estate sector and domestic demand will weigh on activity, and the fund warned that China’s exporting of excess goods may spark trade tensions with other countries.

Russia got the biggest growth forecast boost among major economies, to 3.2% this year and 1.8% next, increases of 0.6 and 0.7 percentage points, respectively, on the strength of its oil exports to India and China as global prices climbed. India’s forecast was lifted to 6.8% for this year, from 6.5%.

In an unusually strong criticism of the US, the IMF said that while the nation’s recent economic performance is “impressive” and a major driver of global growth, it comes partly from budget policy that is “out of line with long-term fiscal sustainability.”

That strategy from the IMF’s largest shareholder raises short-term inflation risks as well as longer-term fiscal and financial stability risks for the global economy by increasing costs for other economies, the fund said.

“Something will have to give,” Gourinchas wrote.

Source: Norvanreports