South Africa’s household wealth rose in the second quarter as an increase in the market value of their assets outstripped that of their liabilities — in part due to a strong stock market rally, the central bank said.

The ratio of net wealth to nominal disposable income rose to 393% in the three months through June, from 389% in the first quarter, data in the South African Reserve Bank’s Quarterly Bulletin published Thursday showed. That was the highest ratio since the first quarter of 2023.

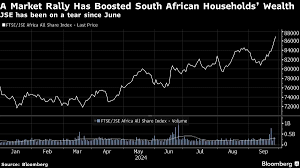

South Africa’s FTSE/JSE All-Share Index rose 6.9% in the quarter after declining 3% in the prior three months. Gains were fueled, in part, by optimism over the formation of a business-friendly governing coalition in June. The African National Congress formed the alliance after losing its outright parliamentary majority for the first time in 30 years in May elections.

The new government has committed to accelerating reforms to boost economic growth that’s remained stagnant for a decade.

Within days of the coalition agreement, ArcelorMittal SA reversed a decision to shutter two steel plants that support 80,000 jobs. Soon after, Qatar Airways bought a stake in South African airline SA Airlink Pty Ltd. A $70 million auto-parts facility to supply Toyota Motor Corp., which just three years ago said it might leave the country, has since opened and Anglo American Plc announced a $625 million iron-ore investment.

Other Highlights

- South Africa’s total external debt increased marginally to $158.3 billion at the end of March from $158.1 billion in the prior quarter.

- Foreign currency-denominated external debt rose to $91.8 billion in the first quarter from $89.4 billion in the prior three months partly due to the government’s borrowing of $1 billion from the World Bank and €500 million from the KfW Development Bank.

- Household debt as a percentage of nominal disposable income edged lower to 62.2% in the second quarter from 63% in the prior three months.

- Net flow of capital on South Africa’s financial account switched to an outflow of 18.1 billion rand in the second quarter from an inflow of 51.4 billion rand in the prior three months.

- Portfolio investment liabilities recorded a further outflow of 20.1 billion rand in the second quarter.

- Growth in labor productivity in the formal non-agricultural sector accelerated marginally to 1.7% in the first quarter from 1.6% in the prior three months.

Source:norvanreports.com