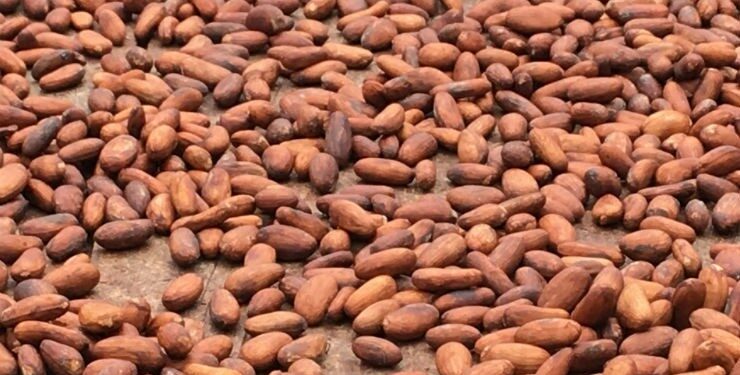

Cocoa slumps as farmer pay hikes boost supply outlook

Boosting farm income in the the two largest cocoa-producing nations is expected to encourage growers to deliver more beans and lift investment in their operations.

Cocoa extended its longest slump so far this year after a record-breaking rally that saw prices more than double in a matter of months on acute supply concerns.

Futures in New York were down as much as 3.9% in Thursday trade, falling for a third straight day. The number of outstanding contracts continued to decline following recent cuts in money-manager bets that drained aggregate open interest to the lowest since 2020.

- Advertisement -

Prospects of higher pay for farmers are raising hopes of a supply boost in West Africa. Top grower Ivory Coast increased farm-gate prices by 50% for mid-crop beans, while neighboring Ghana is considering a similar move, Bloomberg reported on Wednesday.

- Advertisement -

Boosting farm income in the the two largest cocoa-producing nations is expected to encourage growers to deliver more beans and lift investment in their operations.

- Advertisement -

The rapid pace of price gains in the second half of March — from $8,000 a ton to $10,000 — suggests that momentum rather than a fresh fundamental shift was the driver, according to a group of Citigroup Inc. analysts that includes Aakash Doshi. The next two months “could represent a turning point in the cocoa bull cycle.”

A team of JPMorgan Chase & Co. analysts including Tracey Allen estimated cocoa prices prices will come down slightly over the medium term while still remaining historically high, tracking around the $6,000 mark.

Source:norvanreports

- Advertisement -