GCB posts GHS 538m net profit for Q3 2023

Simultaneously, the institution’s balance sheet expanded notably, with total assets showing a substantial uptick. The value of assets swelled to GHS 25.1 billion in the third quarter of 2023, marking an impressive GHS 4.28 billion increment from the previous year’s Q3 figure, which stood at GHS 20.8 billion.

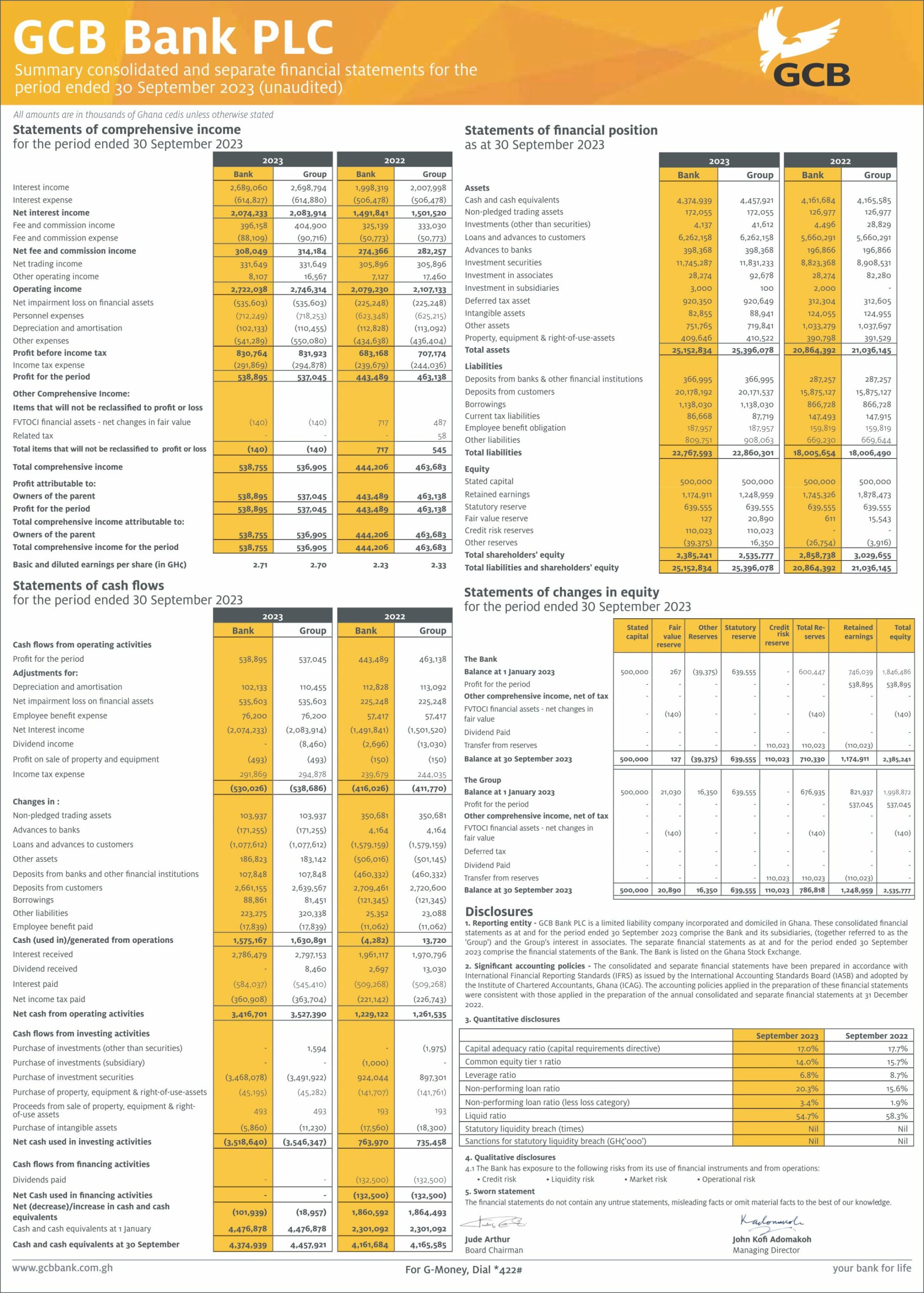

GCB in the third quarter of 2023 demonstrated a robust financial performance, marked by a noteworthy upswing in net profit. The institution’s net profit soared to GHS 538 million, a remarkable increase of GHS 95.4 million from the preceding year’s figures, which stood at GHS 443 million.

A substantial driver of this commendable profit surge was the exceptional growth in operating income, which exhibited a remarkable trajectory, surging from GHS 2.07 billion in Q3 2022 to an impressive GHS 2.72 billion in the third quarter of 2023. This bolstered the bank’s bottom line, underlining its operational prowess.

Simultaneously, the institution’s balance sheet expanded notably, with total assets showing a substantial uptick. The value of assets swelled to GHS 25.1 billion in the third quarter of 2023, marking an impressive GHS 4.28 billion increment from the previous year’s Q3 figure, which stood at GHS 20.8 billion. This impressive asset growth was underpinned by substantial increases in loans and advances to customers, investment securities, and cash and cash equivalents.

However, in a parallel trajectory, the bank’s liabilities exhibited a surge of their own. Liabilities swelled from GHS 18 billion in Q3 2022 to GHS 22.7 billion in the same period of 2023. This surge was primarily attributed to the growth in deposits from the bank’s customer base, which ascended to GHS 20.1 billion at the close of Q3 2023, compared to GHS 15.8 billion in the previous year’s Q3.

Furthermore, a matter of concern arises in the domain of the bank’s loan asset quality. The institution’s non-performing loan ratio experienced a notable deterioration, rising to 20.3% in Q3 2023, up from 15.6% in the same period of the previous year. This development necessitates heightened attention and management to mitigate potential risks.

Nonetheless, the bank exhibited robust capital adequacy, with its Capital Adequacy Ratio (CAR) standing at 17% at the close of Q3 2023, a level notably exceeding the industry standard of 14%. It is worth noting that despite a marginal decline of 0.7% in CAR compared to Q3 2022, the bank’s capital position remains resilient, assuring its capacity to weather potential adversities.

Overall, the bank’s third-quarter performance underscores a dynamic financial landscape marked by soaring profits, augmented assets, and a heightened CAR. Nevertheless, the rise in non-performing loans signals a necessity for prudent risk management in the quarters ahead.