Ghana to have the lowest tax regime in ECOWAS – Alan Kyeremanten vows

The proposed reforms, if implemented, could have a significant impact on Ghana’s economic landscape, potentially attracting more foreign investment and boosting domestic businesses.

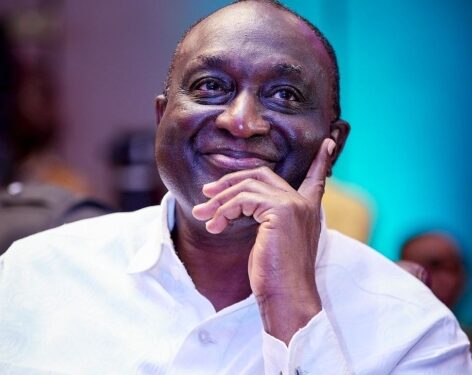

In a bold move aimed at fostering economic growth and enhancing Ghana’s competitiveness within the Economic Community of West African States (ECOWAS) bloc, Alan Kyerematen, the founder and leader of the Movement for Change and an independent presidential hopeful, has pledged to implement the lowest tax regime among ECOWAS member countries if elected in the upcoming December 7 polls.

Speaking at a meeting with the leadership of the Ghana Union of Traders Association (GUTA), Mr. Kyerematen outlined a comprehensive vision for tax reform, which includes:

- Consolidation of Levies: A significant part of the proposed reforms involves consolidating the existing National Health Insurance Levy and Ghana Education Trust Fund levies into the calculation of a new Value Added Tax (VAT) rate, aimed at simplifying the tax system and potentially reducing the overall tax burden.

- Abolition of Import Levies: Mr. Kyerematen has committed to abolishing the Special Import Levy of 2% and the COVID-19 Health Recovery Levy, which could stimulate trade and reduce costs for businesses and consumers alike.

- Support for Importers: He has also promised to eliminate the Ghana Health Service Disinfection Fee on imports and exports, abolish all taxes and charges on the importation of spare parts within two years of establishing a Government of National Unity, and review and consolidate all statutory fees on imports under a new Cash Waterfall mechanism. These measures are designed to alleviate the financial burden on importers and support the automotive and manufacturing sectors.

Mr. Kyerematen’s proposed tax reforms are aimed at streamlining the tax system, reducing the tax burden on businesses and individuals, and promoting economic growth and competitiveness. If elected, he intends to prioritize these measures to create a more conducive environment for trade and investment in Ghana.

“The trading community is a critical component of the Ghanaian economic architecture, and all efforts must be deployed to make them competitive,” Mr. Kyerematen concluded.

The proposed reforms, if implemented, could have a significant impact on Ghana’s economic landscape, potentially attracting more foreign investment and boosting domestic businesses.

As the December 7 polls approach, Mr. Kyerematen’s tax reform agenda is likely to be a key issue for voters and could shape the future direction of Ghana’s economy.

Source: Norvanreports

Via: Ghananewsonline