Nigeria hikes rate on short-term bills to lure dollar inflows

Nigeria has eased currency controls and introduced a series of reforms since last week as part of efforts to reform its foreign exchange market to ease a dollar scarcity that has created a backlog of unmet demand estimated at $2.2 billion by the central bank.

Nigeria’s central bank hiked the interest rates on short term debt obligations on Wednesday in a bid to mop up naira liquidity and attract foreign investor inflows.

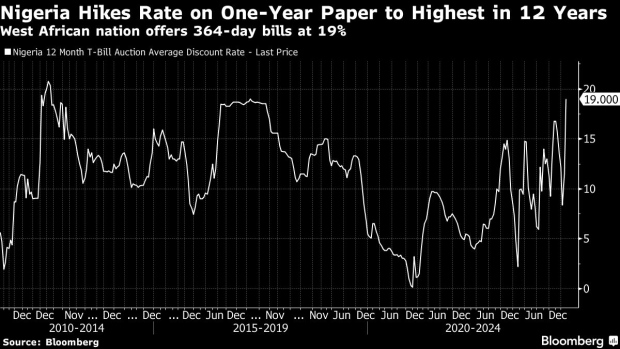

The Abuja-based Central Bank of Nigeria sold one trillion naira ($696 million) in treasury bills to both local and foreign investors at rates that were nearly twice the level of previous offers. Yields for the one-year bill rose to 19%, the highest in 12 years, from 11.5% at the previous auction on Jan. 24.

Three-months bill was sold at 17.24%, which was three times more than the January offer of 5%, while six-month notes fetched 18%.

The 19% rate on the 364-day bills takes it above the central bank’s policy rate, which currently stands at 18.75%, for the first time. It is also narrows the gap on the inflation rate, which stood at nearly a three-decade high of 28.9% in December.

The auction suggests the central bank is seeking to normalize interest rates in Africa’s most populous nation and lure foreign investors in a bid to stabilize the naira.

Nigeria has eased currency controls and introduced a series of reforms since last week as part of efforts to reform its foreign exchange market to ease a dollar scarcity that has created a backlog of unmet demand estimated at $2.2 billion by the central bank.

Source:bloomberg