StanChart reports impressive net profit of GHS 298m rebounding from Q3 2022 losses

Standard Chartered Bank’s balance sheet also highlighted loans and advances to customers totaling GHS 2.1 billion, while cash and equivalents stood at GHS 4.8 billion.

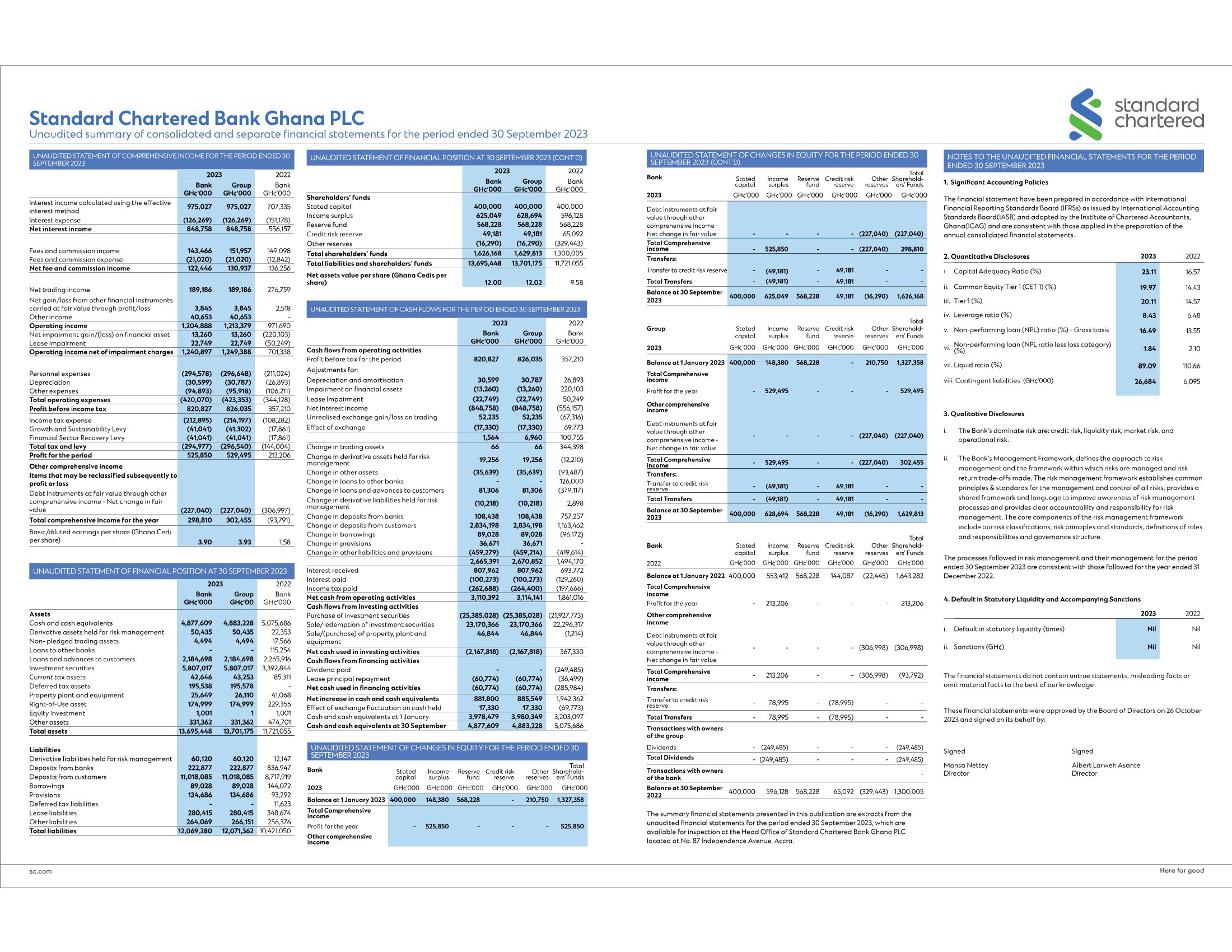

Standard Chartered Bank, in a remarkable turnaround, has reported a substantial boost in its financial performance for the third quarter of 2023.

The bank, which had previously grappled with a net loss of GHS 93.7 million in the same quarter of the previous year, posted an impressive net profit of GHS 298 million.

This noteworthy recovery can be attributed to the substantial growth in the bank’s operating income, which surged from GHS 701 million in Q3 2022 to a robust GHS 1.2 billion in Q3 2023.

A key factor underpinning this surge in profitability was the bank’s asset growth, with total assets surging from GHS 11.7 billion in Q3 2022 to GHS 13.6 billion in Q3 2023, reflecting an impressive GHS 1.9 billion increase on a year-on-year basis.

Notably, this increase in asset value was largely fueled by a substantial expansion in the bank’s investment securities portfolio, which grew from GHS 3.3 billion to a substantial GHS 5.8 billion within the review period.

Standard Chartered Bank’s balance sheet also highlighted loans and advances to customers totaling GHS 2.1 billion, while cash and equivalents stood at GHS 4.8 billion.

Meanwhile, the bank’s liabilities showed growth, with total liabilities reaching GHS 12 billion in Q3 2023, compared to GHS 10.4 billion in Q3 2022. This increase in liabilities was primarily driven by a surge in customer deposits, which grew from GHS 8.7 billion in Q3 2022 to a significant GHS 11 billion by the end of Q3 2023.

However, there is a concerning aspect in the form of the bank’s loan asset quality. The non-performing loan (NPL) ratio, a key indicator of loan quality, worsened, escalating from 13.5% in Q3 2022 to 16.4% in Q3 2023. This increase in NPL ratio could potentially raise concerns about the bank’s credit risk and asset quality.

On the bright side, the bank’s Capital Adequacy Ratio (CAR) at the close of Q3 2023 stood at a robust 23.1%, marking a significant improvement from the 15.6% CAR recorded in Q3 2022. This impressive CAR not only indicates the bank’s strong capital adequacy but also positions it significantly above the industry’s average CAR of 14%.

Standard Chartered Bank’s financial report for Q3 2023 reveals a remarkable resurgence in profitability, asset growth, and capital adequacy. However, the increase in non-performing loans serves as a potential area of concern that may require appropriate risk management.