Mid-Year Budget Review re-scheduled to July 25 amid rising public debt and economic challenges

As part of this restructuring effort, the nation initiated a domestic debt exchange in February, offering investors an opportunity to exchange GH¢87.8 billion in obligations for new securities at reduced interest rates.

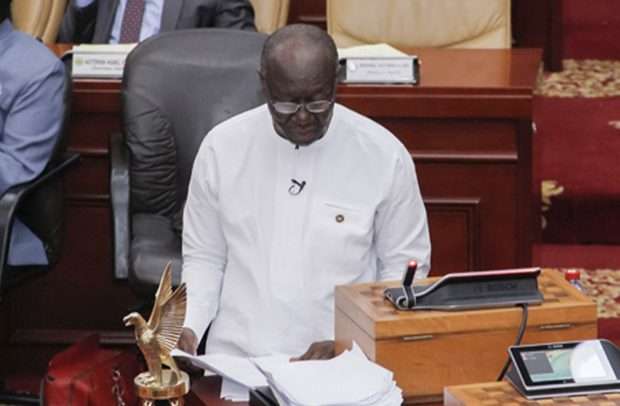

In a move aimed at unveiling the government’s fiscal roadmap amidst economic headwinds, Ghana’s eagerly awaited Mid-Year Budget Review has been rescheduled to take place on July 25, 2023, instead of the previously announced date of July 27, 2023. The event assumes critical significance as policymakers seek to address concerns over economic stability and chart a course for sustainable growth in the country.

As the West African nation grapples with mounting financial burdens, public debt has surged by a striking 20% in a mere four months. The inclusion of short-term loans from the central bank to the state has played a significant role in driving the increase. The Bank of Ghana’s website reported that public debt, excluding state-owned enterprises’ obligations, reached GH¢569.3 billion ($49.7 billion) by the end of April. This figure reflects an adjustment that incorporates the central bank’s overdraft to the government, securitized in December 2022. Notably, the debt figure at the end of December was recalibrated to GH¢473.2 billion from the earlier estimate of GH¢434.6 billion, as indicated in the central bank’s summary of economic and financial data.

Measured against the gross domestic product, obligations have seen a modest decline, with the debt-to-GDP ratio falling to 71.1% in April, down from 77.5% in December. Ghana’s endeavors to achieve fiscal sustainability amidst these mounting challenges come in the backdrop of a default on a Eurobond payment earlier in the year. Seeking financial respite, the country is actively restructuring a significant portion of its debt to ensure its viability under a $3 billion International Monetary Fund program, which secured approval in May.

As part of this restructuring effort, the nation initiated a domestic debt exchange in February, offering investors an opportunity to exchange GH¢87.8 billion in obligations for new securities at reduced interest rates. Previously averaging 19%, the new notes bore interest rates as low as 8.35%, as part of the debt overhaul strategy. Furthermore, investors are facing reduced coupons as the restructuring of $1.5 billion domestic dollar bonds and cocoa bills commenced on July 14.

With negotiations still underway with local pension funds to revamp their GH¢29 billion government bond holdings, Ghana continues to engage in discussions with bilateral and Eurobond holders to reorganize its financial obligations.

In tandem with these debt dynamics, the central bank released other macroeconomic and financial updates. Notably, external debt rose to GH¢321.4 billion at the end of April, up from GH¢240.9 billion in December. The domestic debt followed a similar trajectory, climbing to GH¢247.9 billion from GH¢232.3 billion over the same period.

Despite the challenges, there have been certain encouraging trends. Ghana’s budget deficit for the first five months of the year showed a notable improvement, shrinking to 1.8% of GDP from 4.2% during the same period the previous year. The primary balance also displayed positive progress, improving to a deficit of 0.7% of GDP from 1.2% deficit.

Furthermore, trade data indicates a widening trade surplus, reflecting positively on the country’s external sector. However, challenges in the banking sector persist, with non-performing loans rising to 18.7% in June from 14.1% a year ago, while the capital adequacy ratio dropped to 14.3% from 19.4%.

On a technology front, the burgeoning mobile money sector has recorded remarkable growth, with monthly mobile-money transactions exceeding GH¢149.4 billion in June, surpassing last year’s figure of GH¢77.4 billion.

As the much-awaited Mid-Year Budget Review approaches, stakeholders and investors alike remain keen to gauge the government’s strategic measures to address the complex economic landscape and ensure a path towards sustainable development and prosperity.

Source: Norvanreports