KT Hammond bemoans delays in approval of 1D1F tax waivers

If we were to go by that act, the exemptions he has brought us would not pass. There is no need to give any further tax exemptions because of the burden he has brought on Ghanaians when it comes to taxation.”

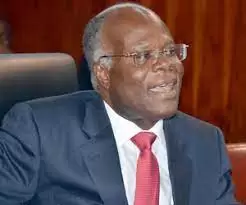

The Minister for Trade and Industry, KT Hammond, has expressed his disappointment over the delays in passing tax waivers for factories under the One District, One Factory policy.

He accused the Trade and Industry Committee of Parliament’s leadership of obstructing the approval process.

In his 2024 State of the Nation address, President Akufo-Addo appealed to Parliament to urgently consider approving outstanding tax exemptions from 2021 to send positive signals to the business community.

Speaking to Citi News, the Trade and Industry Minister alleged that the NPP leadership on the Finance Committee is conspiring with the minority caucus to sabotage the approval of the tax waivers.

“Anything that they perceive will be in the interest of the country and coming from the NPP, their natural instinct is to rise against it.But on this occasion, it is not just only the opposition, there are also some elements in the NPP, on the committee’s leadership who are really creating problems and I have been fighting them inside and outside of Parliament to have the tax waivers issue resolved.”

The Ranking Member on the Trade and Industry Committee, Yusif Sulemena, stressed that the minority caucus will not approve any tax waivers.

“When we started passing those exemptions, it got to a point where we realized they were abusing them so we passed what we call the Tax Exemptions Act, and we want him to respect that act. If we were to go by that act, the exemptions he has brought us would not pass. There is no need to give any further tax exemptions because of the burden he has brought on Ghanaians when it comes to taxation.”

Source:mypublisher24