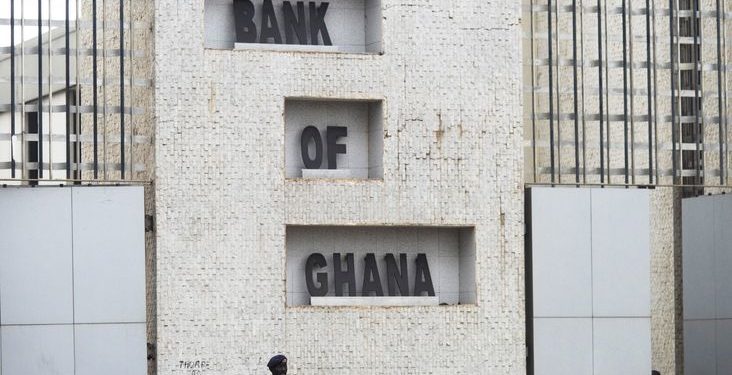

BoG announces new Cash Reserve Ratio requirements for banks

Governor Addison attributed the subdued growth in private sector credit to the escalating risk profile of international banks, compounded by a deterioration in asset quality over the recent period.

In a significant move to fortify the resilience of Ghana’s banking sector, Dr Ernest Addison, Governor of the Central Bank, announced pivotal adjustments to cash reserve ratios during the 117th Monetary Policy Committee (MPC) briefing on Monday, March 25, 2024.

Effective from April this year, banks will be mandated to adhere to the following cash reserve ratios based on their respective loan-to-deposit ratios:

Banks with a loan-to-deposit ratio exceeding 55% will be subjected to a currency Cash Reserve Ratio of 15%.

For banks maintaining loan-to-deposit ratios ranging between 40% and 55%, a Cash Reserve Ratio of 20% will be enforced.

Banks with loan-to-deposit ratios falling below 40% will face a more stringent requirement, with a Cash Reserve Ratio set at 25%.

This strategic recalibration of cash reserve ratios reflects the Central Bank’s proactive approach to reinforcing financial stability while navigating the evolving challenges and opportunities within Ghana’s banking ecosystem.

Governor Addison underscored the overall stability of Ghana’s banking landscape, highlighting sustained improvements in credit risks, liquidity, and profitability across the sector.

Encouragingly, more than half of the 23 banks in the country, he noted, have achieved full capitalization, negating the immediate necessity for recapitalization.

Notably, a majority of the banks have surpassed two-thirds of the requisite capitalisation over three years, achieving this milestone within just one year by the end of 2023.

However, amidst these positive developments, concerns persist regarding the sluggish growth of private-sector credit.

Governor Addison attributed the subdued growth in private sector credit to the escalating risk profile of international banks, compounded by a deterioration in asset quality over the recent period.

Source:mypublisher24

I was recommended this website by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my trouble. You are amazing! Thanks!